-

The proposed regulations relate to the new deduction for interest paid on vehicle loans incurred after Dec. 31, 2024, to purchase new made-in-America vehicles for personal use.

December 31 -

Just dropping that tax return off at your local post office may no longer be proof that you met the deadline.

December 31 -

Whether crypto tax legislation is coming; don't miss QSBS savings; Bears on the move; and other highlights from our favorite tax bloggers.

December 30

-

Provisions from the OBBBA required new answers to questions about the Premium Tax Credit.

December 30 -

The updated framework under the OBBBA has created new opportunities for the sports and entertainment industries in rural areas and low-income urban areas.

December 30Holthouse Carlin & Van Trigt LLP -

Major tax legislation, IRS staffing issues, and plenty of client confusion promise a challenging tax season.

December 30 -

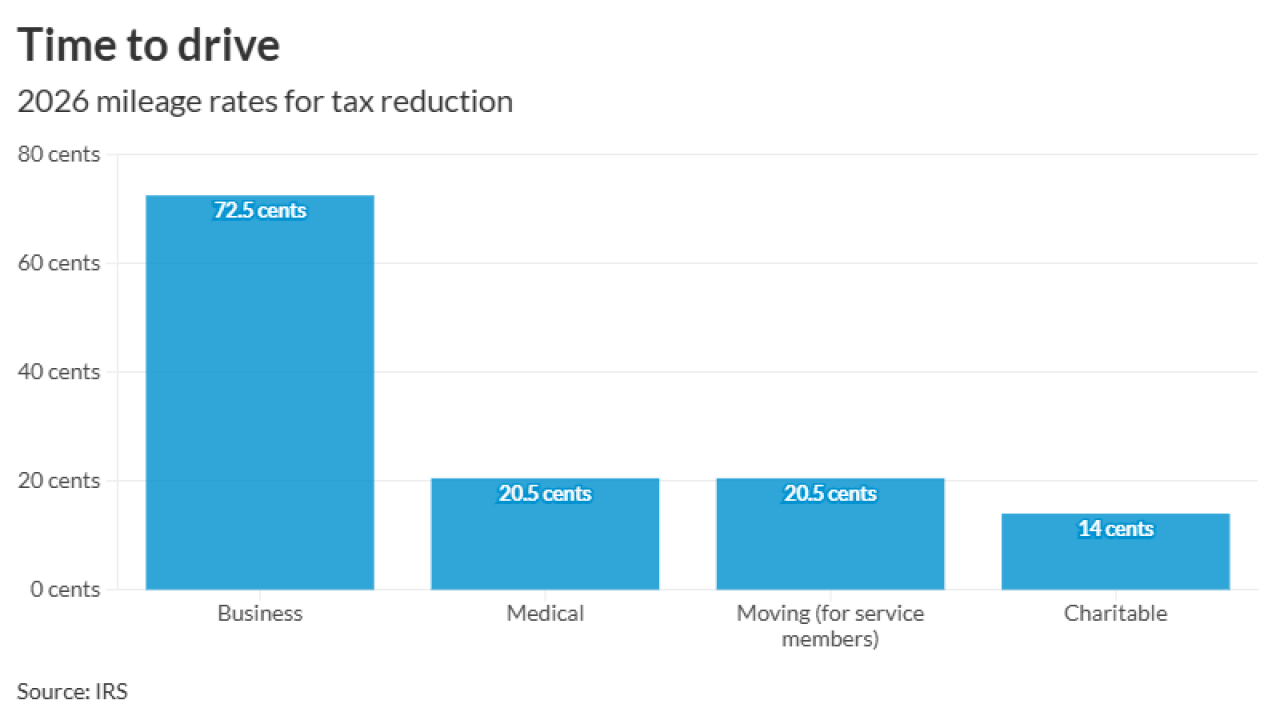

According to IRS Notice 2026-10, however, some other mileage rates will go down.

December 29 -

Financial advisors and their clients have a range of options to consider for traditional IRA holdings — but also a finite deadline.

December 29 -

Agents with the Internal Revenue Service's Criminal Investigation unit reportedly helped track down the shooter who terrorized Brown University and MIT.

December 29 -

Britney Spears is disputing a $600,000 tax claim from the Internal Revenue Service.

December 29