-

Plus, Karbon launches smart tax organizers and binders with Stanford Tax; and other accounting tech news and updates.

December 5 -

By any other name; a different kind of clearing house; dodgy digital; and other highlights of recent tax cases.

December 5 -

The release coincides with a $6.25 billion donation from Michael Dell and his wife to kickstart the savings program.

December 4 -

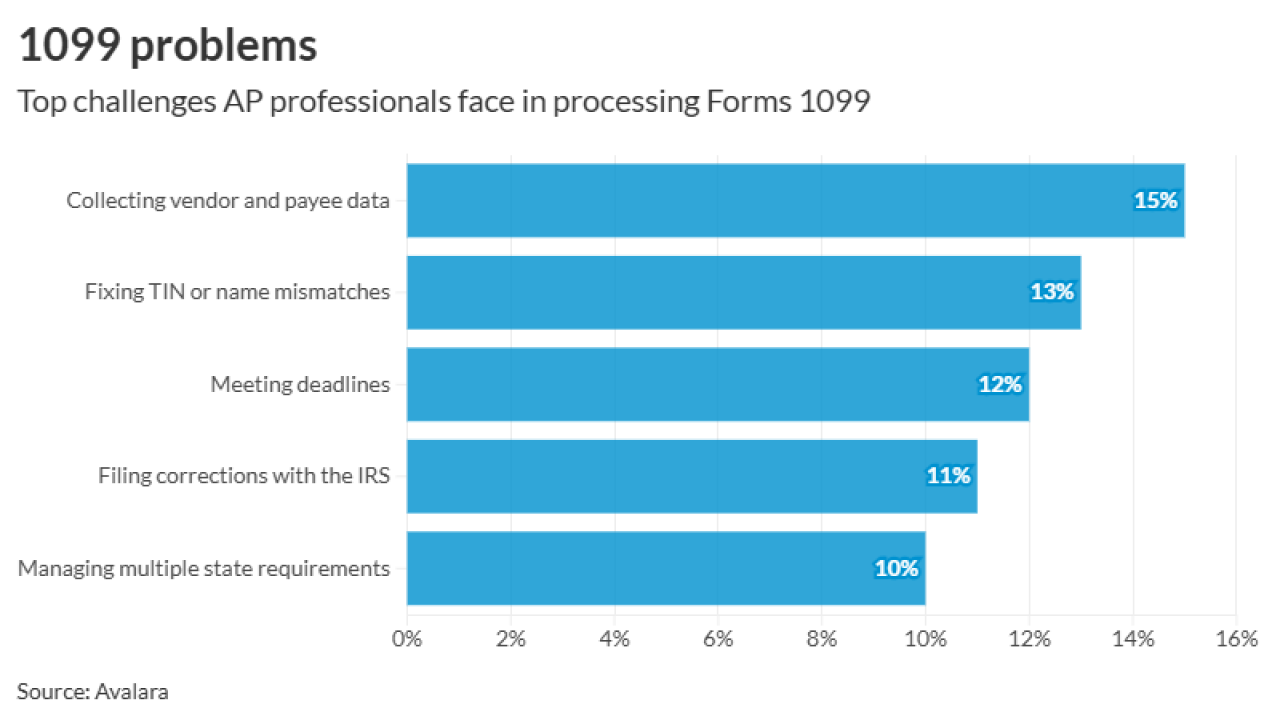

Approximately three-quarters of businesses haven't yet automated their 1099 information reporting for their taxes, according to a new report from Avalara.

December 4 -

Trump's aides are discussing making the Treasury chief the top White House economic advisor, in addition to his current job, plus acting IRS commissioner.

December 4 -

Planning around SSI COLAs; holiday business deductions; complex decisions of inheritance; and other highlights from our favorite tax bloggers.

December 3

-

Identity theft, fictitious applicants and other forms of fraud continue with the advance premium tax credit for buying health insurance.

December 3 -

The House approved two pieces of legislation to keep IRS agents from levying fines and penalties without supervisory approval, and to strengthen taxpayer rights in proceedings before the Tax Court.

December 3 -

The initiative from the president's tax law has drawn support from corporate and financial leaders.

December 3 -

Just in time for Giving Tuesday, there's some good news for charities, thanks to the One Big Beautiful Bill Act, but also some new caps and limits.

December 2