-

Whether a rich person will pay more or less in taxes largely depends on just how much income they get, and how it’s earned.

November 24 -

The Top 10 Firm's guide aims to help taxpayers and tax pros deal with the many tax changes of the past year and the ones expected to come next year.

November 23 -

The House passed a roughly $2 trillion bill incorporating the core of President Joe Biden’s economic agenda — ramping up funding for the social safety net and increasing taxes on corporations and the wealthy — sending it on to the Senate, where it’s likely to be significantly reshaped.

November 19 -

President Joe Biden’s signature plan to expand the social safety net, address climate change and rewrite tax policies passed the House Friday morning as Speaker Nancy Pelosi united fractious Democrats to send the legislation to the Senate, where its fate remains uncertain.

November 19 -

Dueling proposals would deliver large tax cuts to the wealthy while failing to do much for middle-income households, according to a new analysis from.

November 19 -

The House reconvened for the vote Friday after Republican leader Kevin McCarthy delayed action with a more than eight-hour floor speech.

November 19 -

A bipartisan group of lawmakers wants to alter who counts as brokers of crypto assets, less than a week after the current designation became law.

November 18 -

Well-off professionals in costly areas of the U.S. are set to get a windfall from competing plans to change the deduction limit for state and local taxes.

November 17 -

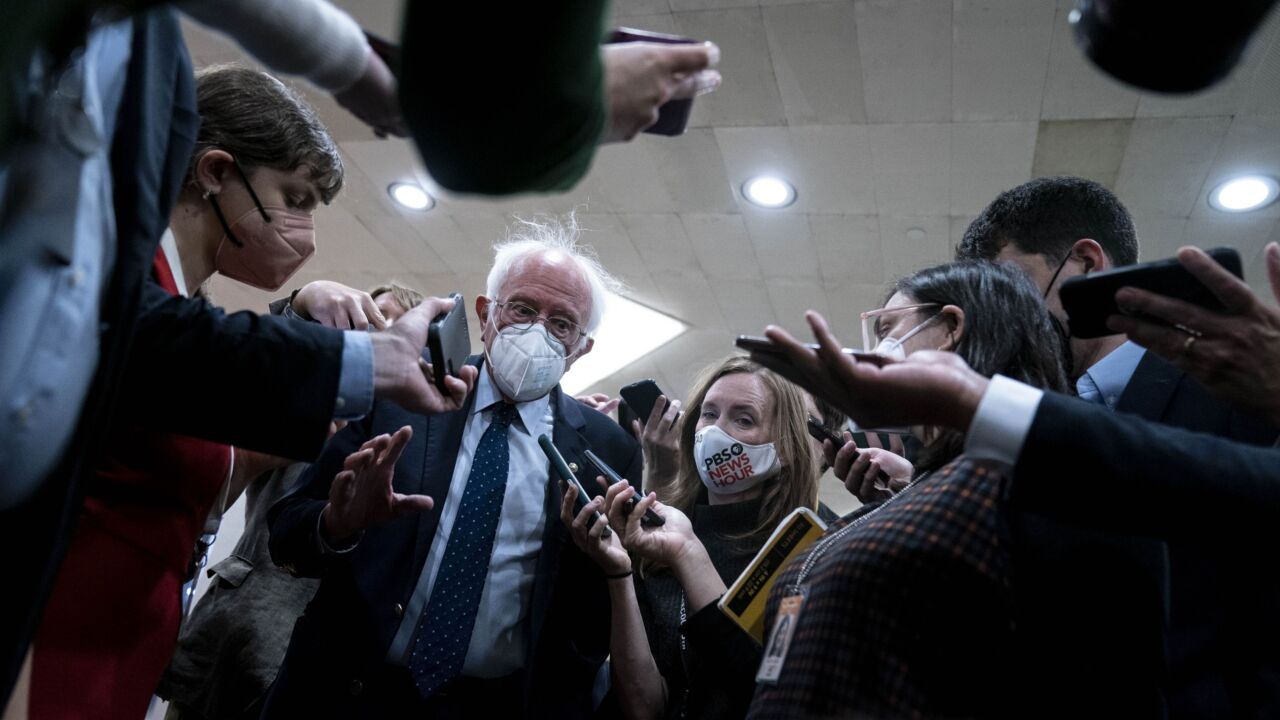

Sen. Bernie Sanders is working on a proposal to set an income threshold for an unlimited state and local tax deduction.

November 17 -

The new act impacts cryptocurrency, the Employee Retention Credit and tax deadlines.

November 16