-

The Internal Revenue Service provided initial guidance to aid employers in establishing pension-linked emergency savings accounts, an outgrowth of the wide-ranging SECURE 2.0 Act of 2022.

January 15 -

It was an eventful 12 months for practitioners, with new legislation, regulations, court decisions and IRS pronouncements all impacting the tax landscape.

January 15 -

Lawmakers are trying to drum up support to allow a debate on raising the state and local tax deduction cap as bipartisan tax package negotiations leave out those proposals.

January 12 -

The failure of the leaders of the Ivy League universities to condemn antisemitism could affect their tax-exempt status, the chairman of the House Ways and Means Committee said.

January 11 -

Negotiators are nearing a bipartisan deal in time for many voters to receive the benefits during the current election year.

January 11 -

What you don't know can hurt you as it pertains to your clients as well as your own life insurance portfolio.

January 10 The TOLI Center East

The TOLI Center East -

The New York governor called for a new tax break to promote affordable housing and increase support for fighting crime in New York City.

January 10 -

The global 15% minimum tax will reshape the landscape for global companies that shift profits around the world.

January 10 -

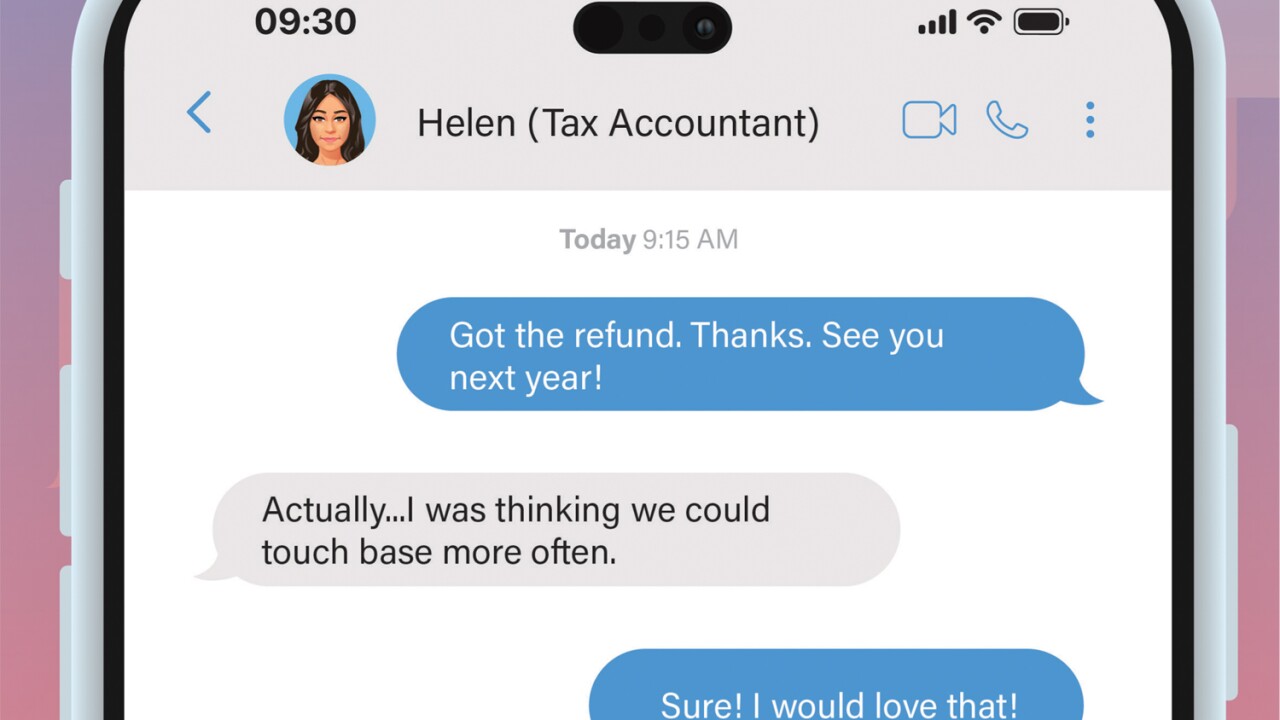

From estate, gift and trust work to Social Security maximization and charitable planning, there are a host of offerings firms can work on once the tax return is finished.

January 9 -

Practitioners have always shared advice as part of tax prep, but the future of the field is in proactive, intentional tax advisory services.

January 8