-

Tax season is starting as a number of new provisions of the One Big Beautiful Bill Act take effect.

January 8 -

Right now, cannabis businesses operating legally under state law still can't deduct basic costs like rent, salaries or marketing.

January 7 Friedlich Law Group

Friedlich Law Group -

Under a proposed ballot initiative in California, billionaires would face a one-time 5% levy to cover funding shortages for health care, food assistance and education.

January 7 -

Rhode Island Governor Dan McKee is warming to the idea of a tax on the wealthy as one way to bolster the state's resources after a particularly turbulent year for its economy.

January 6 -

The tax deduction applies to new cars assembled in the U.S. purchased from 2025 through the end of 2028.

January 2 -

The proposed regulations relate to the new deduction for interest paid on vehicle loans incurred after Dec. 31, 2024, to purchase new made-in-America vehicles for personal use.

December 31 -

The updated framework under the OBBBA has created new opportunities for the sports and entertainment industries in rural areas and low-income urban areas.

December 30Holthouse Carlin & Van Trigt LLP -

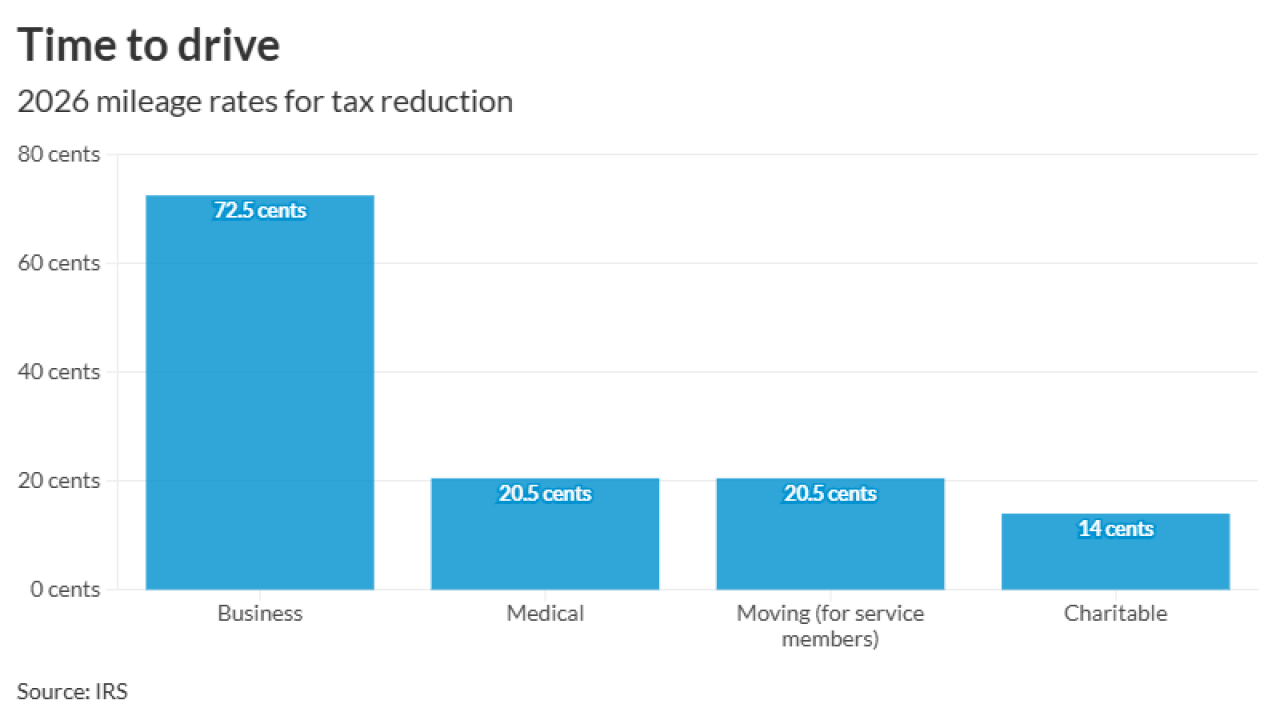

According to IRS Notice 2026-10, however, some other mileage rates will go down.

December 29 -

Unlike equity investors, who must plan around the 31-day exclusion window, cryptocurrency holders can sell and repurchase in the same session.

December 26 -

The draft, a mix of bill text and policy aims, would exempt transactions of regulated stablecoins that consistently maintain a value between $0.99 and $1.01 from capital gains.

December 22