-

The Trump administration's interim guidance on clean energy tax credits offered some relief to the industry by laying out a manageable path for new projects.

February 17 -

The IRS can broaden the audit, and, in the wrong fact pattern, frame the issue as deliberate concealment rather than poor recordkeeping.

February 16 The Tax Law Offices of David W. Klasing

The Tax Law Offices of David W. Klasing -

Halfpricesoft, an accounting and payroll solutions provider, updated its ezW2Correction software to assist with file corrections for 2015 to 2025 tax forms.

February 16 -

The Institute is asking the Treasury and the Internal Revenue Service to simplify the "determine and document" requirement for taxes charged to CFCs.

February 16 -

The Joint Chiefs of Global Tax Enforcement issued a pair of advisories on how OTC crypto trading desks and payment processors can hide criminal activity.

February 16 -

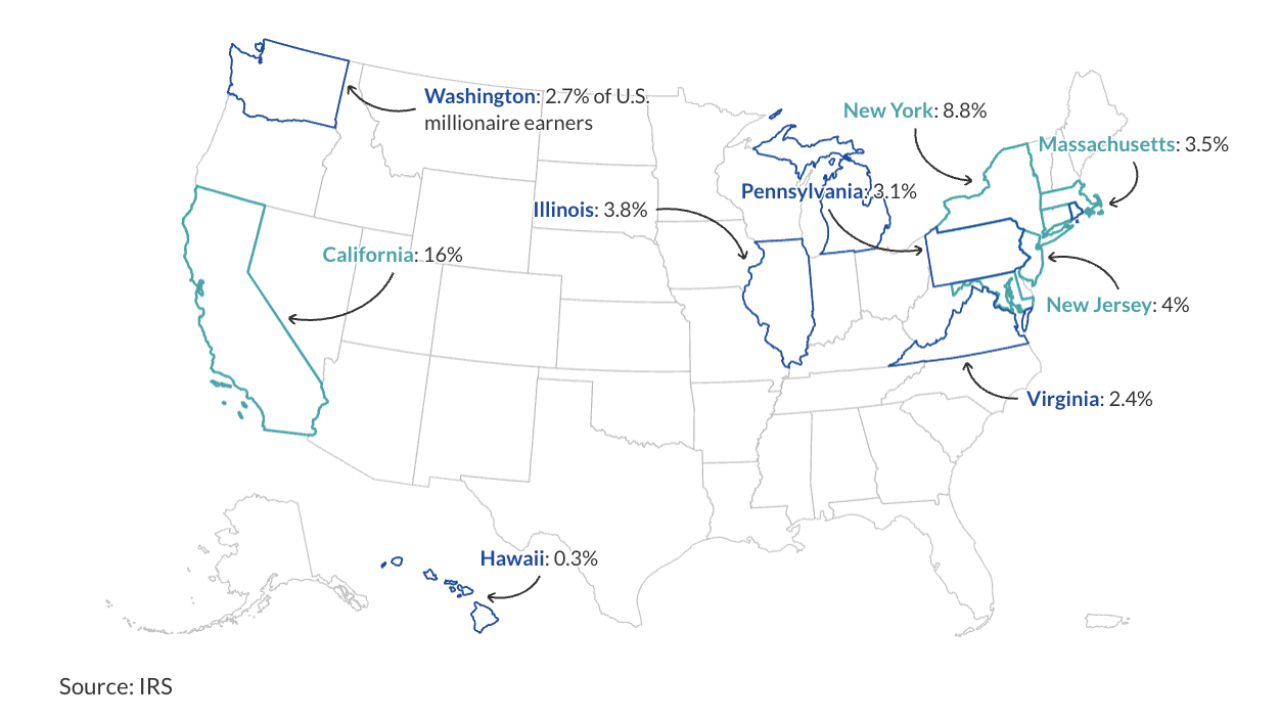

New proposals in seven states could soon subject over half of all U.S. millionaires to targeted high-earner tax rates.

February 13 -

Two of our longtime cherished colleagues at Accounting Today have passed away: Roger Russell and Jeff Stimpson.

February 13 -

Some auditors have taken on exceptionally high listing workloads alongside existing mandates.

February 13 -

The Trump administration issued new guidance on the use of foreign materials and components in U.S. clean energy projects.

February 13 -

Don't bet on it; COVID come-uppance; mine the gap; and other highlights of recent tax cases.

February 12