-

Anrok Inc., a startup helping software companies automate sales tax compliance, has raised $55 million in a Series C funding round.

October 21 -

Enforcement activity and Tax Court cases are at a standstill, and practitioners should expect backlogs and slowdowns.

October 21 -

Small businesses challenging the global tariffs urged the justices to affirm lower court rulings that the import levies amount to a massive tax on companies.

October 21 -

The doubling of California's film and TV tax credits to $750 million a year is showing promise in bringing production back to the state.

October 21 -

A millionaire levy in Massachusetts has generated $3 billion more in revenue than expected without forcing significant high-profile departures from the state.

October 21 -

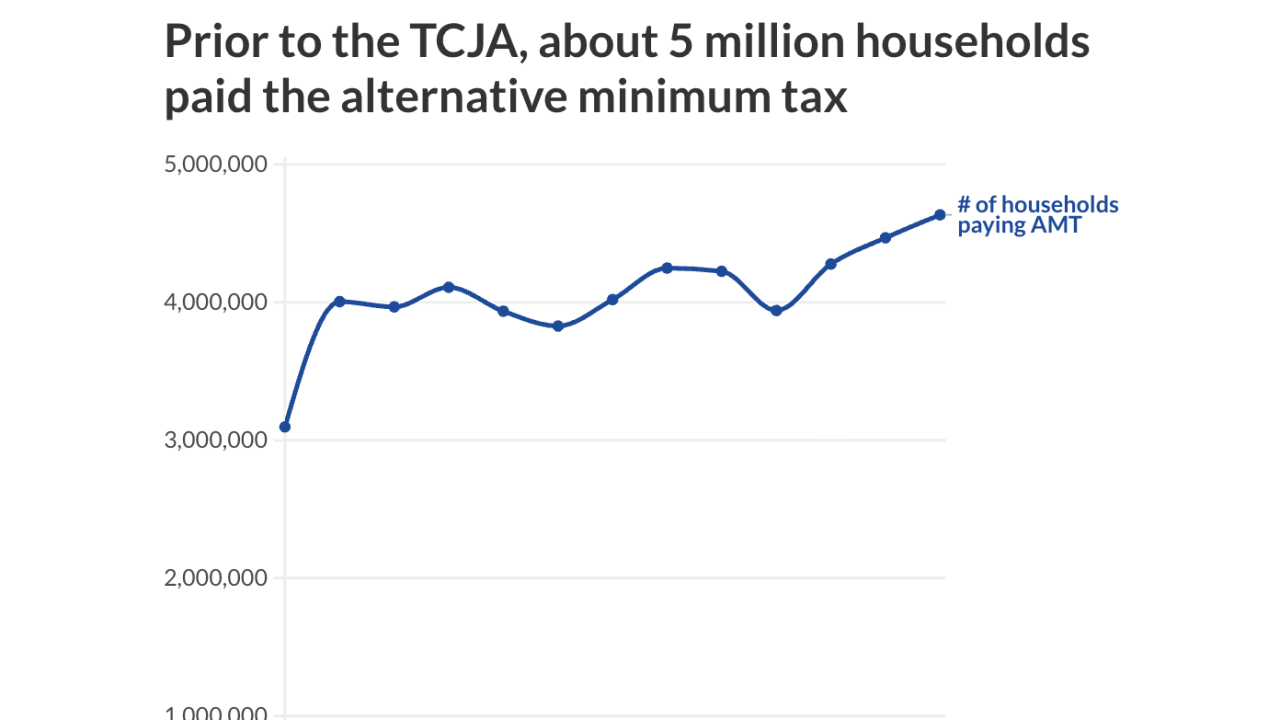

The One Big Beautiful Bill Act will boost the number of filers who must calculate their AMT. But that doesn't mean they're all going to have to pay it.

October 20 -

Tax advisors can play a significant role in alerting clients to the availability of various options and strategies for an unneeded life insurance death benefit.

October 20 The TOLI Center East

The TOLI Center East -

Influential conservative groups with deep pockets are pushing Republicans to demand steep concessions from Democrats in exchange for extending health care subsidies.

October 20 -

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

Gary Shapley and Joseph Ziegler reached settlements with the IRS and the Justice Department, and their lawsuit against Biden's attorney was dismissed by a judge.

October 17