-

New OBBBA restrictions mean wealthy donors lose deductions on smaller, routine gifts. Here is how to use DAFs and donation grouping to preserve tax benefits.

January 19 -

You can check out but you can never leave; job experience; and other highlights of recent tax cases.

January 18 -

The U.S. Department of Education is delaying involuntary collections of student loan debt by garnishing wages and seizing tax refunds.

January 16 -

Statehouse skirmishes: the Gold Card; how returns get prepared; and other highlights from our favorite tax bloggers.

January 16

-

Plus, Emburse announces Invoice Tax Validation; TaxStatus releases tax prep checklist, tax return history; and other accounting tech news and updates.

January 16 -

Rhode Island Governor Dan McKee proposed a higher tax on millionaires to help fill a hole in the state's budget.

January 16 -

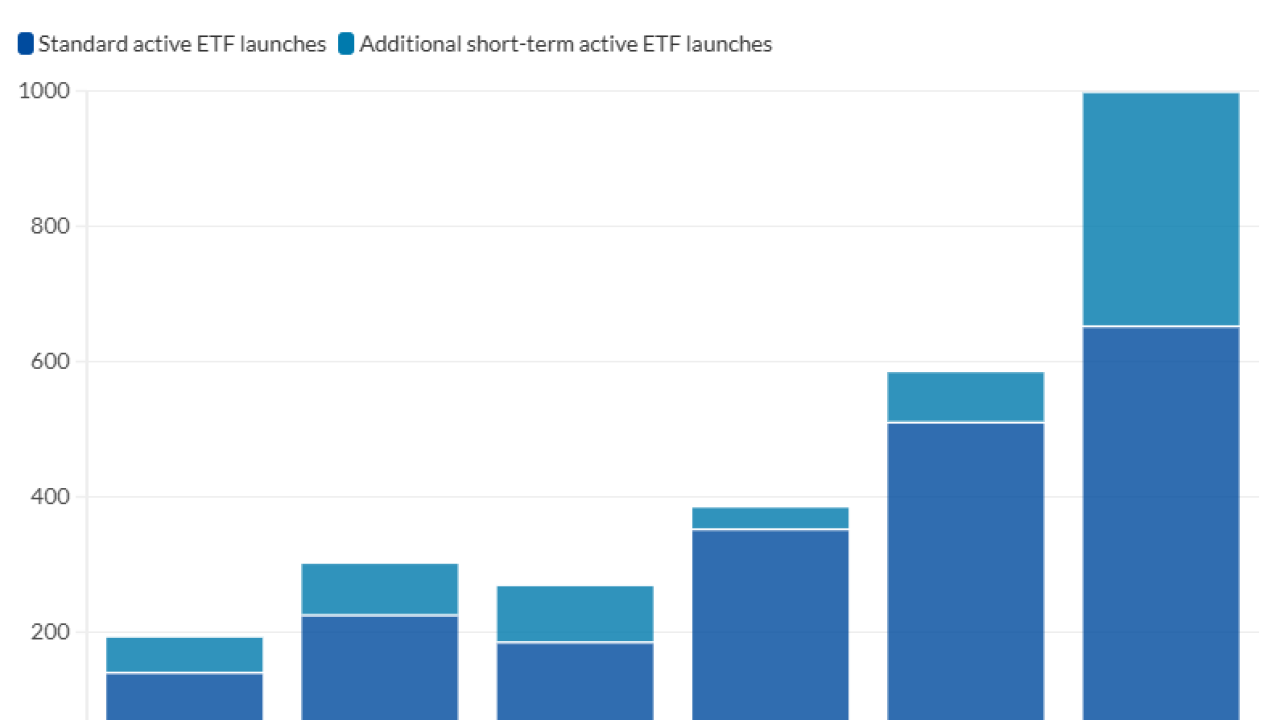

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

Notice 2026-11 from the IRS provides guidance on the permanent 100% additional first-year depreciation deduction provided by the One Big Beautiful Bill Act.

January 15 -

A proposed tax on billionaires in California has led to fear among investors and shows the difficulty of doing business in the state.

January 15 -

The House Ways and Means Committee voted unanimously to approve a bipartisan bill to accelerate processing of tax returns through use of scanning technology.

January 14