-

In Notice 2025-69, the IRS and the Treasury offer clarifications and examples of how to claim the One Big Beautiful Bill Act deductions.

November 24 -

Staff have begun working through the backlog of correspondence and messages, and are expected to begin reaching out to tax pros and taxpayers soon.

November 23 -

The One Big Beautiful Bill Act offers a striking example of how policy design can favor businesses over individual taxpayers, particularly young professionals.

November 21 University of Colorado Boulder

University of Colorado Boulder -

The IRS and the Treasury released interim guidance giving new tax benefits to banks that provide loans secured by rural or agricultural real property.

November 20 -

The American Institute of CPAs is urging the IRS not to merge its Office of Professional Responsibility with its Return Preparer Office to avoid confusion.

November 20 -

The issues concern the constitutional division of taxing power, the potential role of Congress in determining trade rules, and costs to businesses and households.

November 20 Friedlich Law Group

Friedlich Law Group -

The president's comments come as Senate Republicans prepare to hold a vote on extending the tax credits, which are slated to expire at the end of this year.

November 20 -

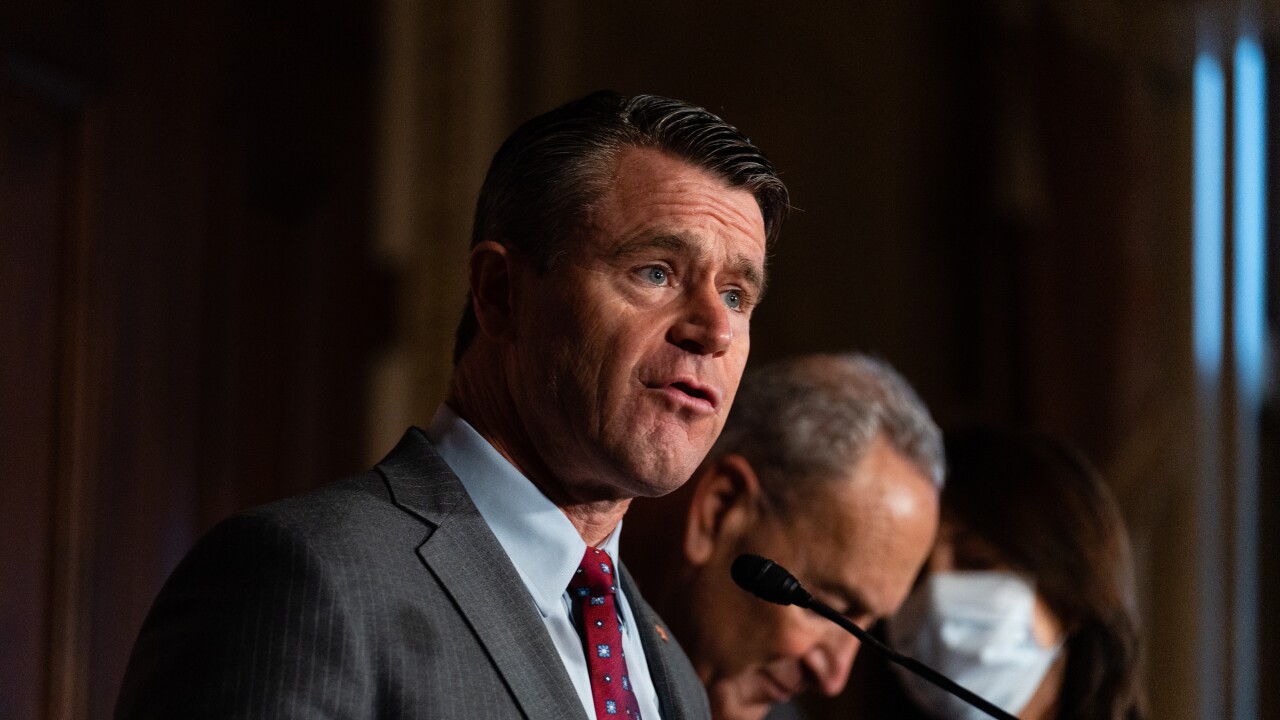

Senator Todd Young is urging the IRS to reconsider guidelines on the tax treatment of rewards crypto owners collect for locking assets on a blockchain network.

November 19 -

A group of former Internal Revenue Service leaders discussed the state of the IRS at an AICPA tax conference after a wave of departures and layoffs.

November 18 -

Quant firm Dimensional Fund Advisors has received formal approval to adopt a fund structure that for two decades has been used exclusively by Vanguard.

November 18