Forms galore

If you want to come across as though you know what you’re doing, then you need to memorize each of the eight forms below the basic purposes of each one. Once you know the primary SEC filings, you can confidently make your way through learning SEC reporting.

The 10-Q

The 10-Q contains traditional financial statements and footnotes, but it also contains management discussion and analysis. The MD&A describes the income statement and statement of cash flows fluctuations.

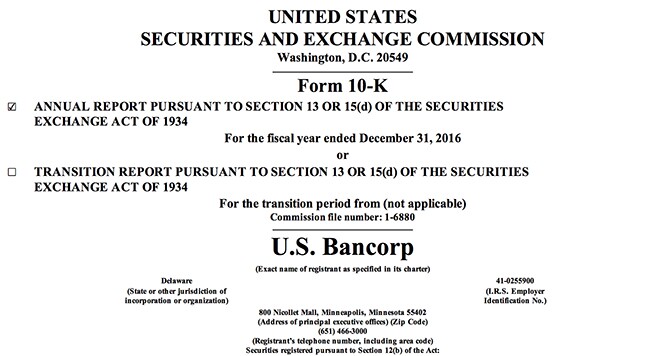

The 10-K

The 8-K

Another very common 8-K is for any salary or stock option adjustments that the company grants to “Section 16 Officers” of the company. (See No. 4 for more on Section 16 Officers.)

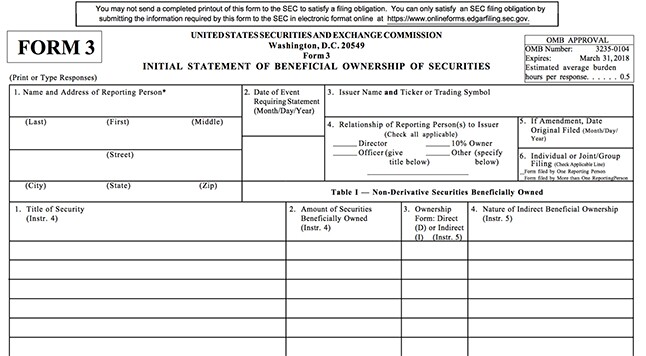

Forms 3, 4 and 5

The Form 3 is used for the very first stock transactions that the Section 16 individual has in the company’s stock.

The Form 4 is used for subsequent company stock transactions.

The Form 5 is used for any transactions that the Section 16 officer failed to report earlier on a form 3 or form 4.

The Proxy Statement

The proxy statement is a form used to prepare the shareholders for a vote at the company’s annual meeting.

The primary sections of the proxy statement contain information about the following:

--The structure and pay of the board of directors;

--The items that will be voted on at the annual meeting; and,

--The compensation for the executives

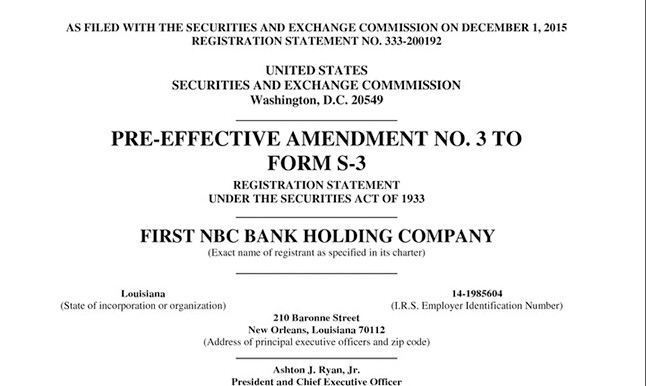

The S-3

The S-1

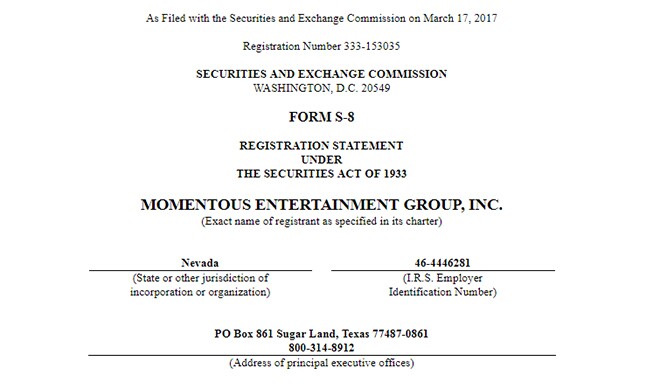

The S-8

Most publicly traded companies will offer stock options or restricted stock units to its employees and board of directors. In order for the recipients of these options or units to be able to sell the underlying shares upon exercise, the shares must be registered.