When I graduated college, I knew I wanted to get my CPA license and that I had to pass the four sections of the CPA Exam to get it. But what does obtaining your CPA license entail? Here is some information that I have collected that you may want to know before starting the process of getting your own CPA license.

- The application takes a while the first time around. While I applied to get my first notice to schedule (NTS) in June, I did not receive it until August. It took a total of nine weeks for me to obtain it. Summer is the busiest time of the year for CPA applications, so apply early and assume the application will take at least six weeks to go through. Any other time of the year, your NTS takes around from three to six weeks to arrive. In most states, the NTS is good for six months once you receive it and you can apply for more than one section at once. When you reapply, receiving your NTS usually only takes a few days.

- Be aware of the blackout periods. Blackout periods are times when you cannot take any exam sections. The blackout periods are in March, June, September and December from the 11th to the end of each month. These blackout periods break out each testing window. For example, the first testing window is from January 1 to March 10. You cannot take the same exam section in the same testing window. If you plan a tentative schedule, you can easily avoid accidentally planning to take a section of the CPA Exam when you can’t take it.

- The NTS is only good once and fees are charged every time you schedule. If you fail an exam, you have to apply for a new NTS before you can schedule to retake it. Fees vary depending on each state; however, they are generally made up of three types: application fees, examination fees, and registration fees. The application fee is a one-time fee only charged to first-time applicants. Registration fees are only charged for reapplications, while examination fees are charged every time you apply. In the long run, it is cheaper to apply for more sections at once than one at a time. As mentioned above, the NTS expires in six months, so you do not want to apply for more sections than you believe you will be ready to take in that time.

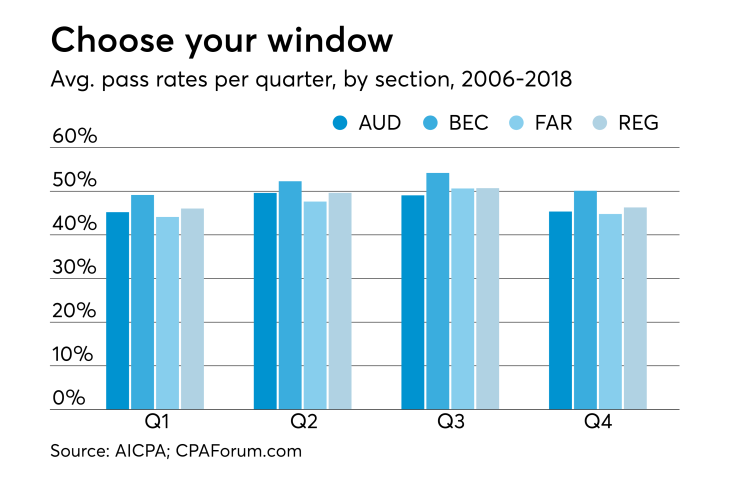

- The passing rates: Below are the average passing rates per quarter from 2006-2018 by section. Although the passing rates vary per quarter, it is not due to the exam being easier or harder to pass throughout the year. According to the American Institute of CPAs’ website, “An increase in pass rates simply means that the candidates are better prepared.” Therefore, the lower passing rates in the first and fourth quarter are likely due to busy season and the holidays taking the focus away from testing for the CPA Exam.

Obtaining your CPA license is difficult, but not impossible. Plan when you are going to take your exams, apply for multiple exams based on your schedule, and figure out how you study best. Split the cost of study material with someone if you can and use the AICPA website to practice and understand what areas to focus your studies. By following these guidelines, the CPA exam process will be a little bit smoother.