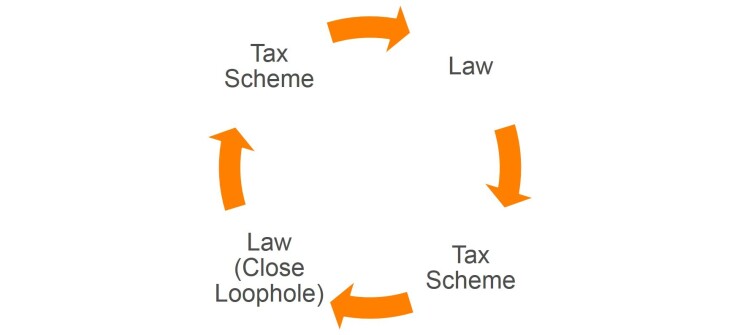

Have you discovered the latest and greatest tax planning strategy? Before suggesting it to clients, consider the ever-persistent loophole cycle.

The steps are relatively straightforward: (1) Congress passes a law; (2) taxpayers and practitioners find ways to avoid tax while still technically complying with the law; (3) Congress or the IRS closes the loophole through additional legislation or regulations; and (4) the process is repeated. It’s possible that today’s most popular tax planning move will soon fall victim to the loophole cycle.

Take, for instance, the “crack and pack” strategy promoted by practitioners to maximize an individual’s qualified business income (QBI) deduction under Section 199A. Its primary goal is to sidetrack the specified service trade or business (SSTB) phase-out rules for high income taxpayers. The approach is simple—divide a trade or business into separate legal entities. One provides services in an SSTB, and the others lease property or provide administrative services to the SSTB. Income generated by the SSTB won’t qualify for the deduction; however, income from the other entities would be treated as QBI.

Here’s where the loophole cycle complicates things. The IRS has delivered on its promise to shut down the crack and pack strategy. Under regulations recently proposed by the agency, an SSTB includes any trade or business with 50 percent or more common ownership that provides 80 percent or more of its property or services to an SSTB. This leaves the door open to other planning strategies to keep common ownership below the 50 percent threshold. However, this may be difficult under ownership attribution rules included in the proposed regulations.

The crack and pack strategy shows us that Congress, practitioners and the IRS are the main players in the loophole cycle. However, thanks to a controversial provision of the Tax Cuts and Jobs Act, state legislatures also have entered the arena. Starting this year, the itemized deduction for state and local taxes is limited to $10,000 per year ($5,000 for married taxpayers filing separately). As expected, residents of high-tax states (think New York and New Jersey) are not too happy. To ease the sting, some states have enacted legislation that allows taxpayers to make transfers to state-established charitable funds in exchange for credits against their state and local taxes. The idea here is to avoid the $10,000 limit by substituting an increased charitable contribution deduction for a disallowed state and local tax deduction.

These creative state laws have triggered the loophole cycle. Back in May, the IRS announced it would propose regulations to shut down these workaround programs. Taxpayers were warned that federal tax principles, including the highly effective substance over form doctrine, would be used to properly characterize payments to charitable funds. True to its word, the IRS issued proposed regulations that require taxpayers to reduce their otherwise deductible charitable contributions by the amount of state or local tax credits received or expected to be received. Thankfully, the rules don’t apply to dollar-for-dollar state tax deductions or state tax credits that don’t exceed 15 percent of the taxpayer’s contribution.

But the controversy doesn’t end there. New York, Connecticut, Maryland and New Jersey have filed a complaint with the U.S. District Court for the Southern District of New York seeking declaratory and injunctive relief to invalidate the $10,000 cap. The complaint argues that the cap violates the U.S. constitution by interfering with the states’ sovereign authority to decide whether and how much to invest in their residents, businesses and infrastructure. It’s highly likely the proposed regulations will be challenged as well. If the IRS’s interpretation of the law is ultimately upheld, keep your eyes open for revised state programs that seek to avoid the $10,000 cap.

The bottom line is that the TCJA has set the loophole cycle in motion for numerous tax law provisions, not just the QBI deduction and the state and local tax deduction limit. No matter how clear and concise the statutory language is, the cycle will continue. The key is recognizing the planning strategies susceptible to the cycle before recommending them to clients. What seems like a good idea today might turn out to be a problem tomorrow.