Technology is disrupting accounting firms and their clients at an exponential pace. It is also providing significant opportunities to increase revenue and reduce costs. Developing a technology roadmap that integrates with a firm’s vision and strategic plan is becoming more valuable as well as challenging. Global vendors have entered the market, converging multiple technologies like artificial intelligence, networks and sensors, robotics and blockchain. Mobile, remote access, security and privacy are also part of the technology ecosystem.

To simplify, technology is automating the entire accounting firm — front office and back office. We can say the same of firm clients.

Let’s start by looking at how technology decisions have been made in the past and why the process should change to remain competitive and leverage the opportunities. Historically, firms had four primary selection criteria and influencers when it came to technology decisions. Also, they tended to focus on each service area, rather than taking an enterprise approach. Thus, many firms have redundancy in data and duplication of efforts. The four criteria are:

- Cost;

- Firm leadership (technology is either a strategic asset or overhead — this is the biggest differentiator among firms);

- Core vendors (CCH-Wolters Kluwer, Thomson Reuters and Intuit); and,

- Peers (the herd).

Today, the criteria and influencers have expanded to include: the cloud; client requirements; talent pool; integration; workflow; collaborative teams; mobile; global resources; innovation; and cost.

This presents several interesting differences when developing technology strategies for your firm and clients. First, you will notice that cost has moved significantly down the list of criteria. Client requirements, workflow, integration and talent have moved up the list significantly. Another interesting fact is the American Institute of CPAs and CPA.com have taken an active role in influencing technology decisions. They have primarily focused on the cloud and vendors other than the core application vendors.

These facts are only part of the story. Most accounting firms are similar to any small and midsized business, as they are now automating all facets of the business. Automation goes far beyond compliance and financial applications. Mindsets, skill sets and toolsets must change rapidly to sustain success and remain relevant as a profession.

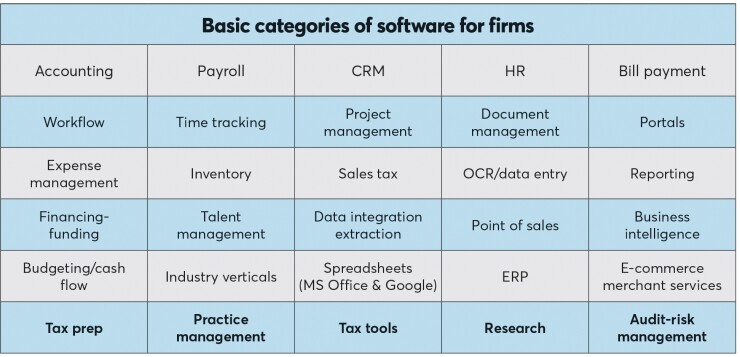

To put this challenge in perspective, most small businesses have at least 30 categories they are rapidly automating to stay competitive, improve the customer experience, and remain relevant. It is no different for a CPA firm. A quick table of the basic categories is below. The bolded categories in the last row show where firms are investing. The top firms are investing 5-6 percent of revenues annually on technology. Some predict this will increase to 7.5-8 percent due to the increased automation. The potential return on investment is significant for firms wanting to reduce labor costs and increase revenue per full-time equivalent.

One of the biggest challenges is not the cost of the technology or the new skills required, but rather the current pricing and business model used by the profession (hours x dollars) and poor collection policies.

It is not unusual for firms to currently have more than 100 applications on their servers and in the cloud. Managing these applications and the required infrastructure from an integration and security standpoint is difficult in a hybrid environment, but much easier and cheaper in the cloud.

Yet most firms are running hybrid systems with desktop applications, web-based applications and both local and cloud storage of data. This is primarily due to the fact that the core applications (tax preparation, practice management and accounting applications) are still only offered on the desktop or through emulation. This restricts data integration and workflow, and forces firms to put more resources toward maintenance and reconciliation, rather than innovation.

Also, new providers are entering the market with cloud-based applications that address needs beyond the core applications. Some of the more robust and priority applications are in the expense management, bill payment, project management, workflow, data analytics, HR, sales tax and talent management (performance and development) categories.

Anticipating the future

What is your firm’s vision? Do you have a current strategic plan and an integrated technology roadmap? If not, the good news is it can be done effectively and in a timely fashion if firm leadership deems it a priority. It will probably require external consulting, planning time and access to some skills that the firm currently may not employ. Consulting, peer communities and training will improve your firm as well as provide a path for many of your clients resulting in expanded revenue opportunities. The challenge for many firms is to change how technology strategy is developed within the firm. It requires a more collaborative and enterprise approach. Technology decisions for firms and their clients have become increasingly complex.

For firms to break through the ceiling of complexity, they must think differently and simplify their approach. By thinking differently, I mean moving from a local and incremental to an exponential and global mindset.

Many refer to this as “10x versus 10 percent thinking.” A quote from Dan Burrus is appropriate for both clients and their firms with regard to tech and service offerings: “Clients today don’t know what they want, because the things they most want are things they don’t yet know are possible. Give your clients the ability to do what they can’t currently do, but would want to if they only knew it was possible.”

Burrus further promotes the anticipatory versus reactive organization. There is less risk in thinking big and anticipating based on hard trends (trends we know are happening). From a technology perspective, bandwidth, computing power and storage capability are increasing exponentially while costs are declining. These are hard trends.

The anticipatory strategy requires more than change. It requires a transformation of mindsets, skill sets and toolsets. Most CPAs have not been trained to think exponentially and spend time in visioning and planning sessions. Traditionally, they are focused on historical data. A change in mindset can quickly provide new opportunities and revenues.

Six objectives can transform your thinking about technology and the future. Planning, people and processes determine your future. Technology is the accelerator. Those objectives are:

- Integration: Data must flow systematically through your processes and workflow.

- Consolidation: The system should serve the enterprise and eliminate redundant data and reconciliation.

- Automation: Processes should and will be automated.

- Elimination: Processes that do not add value should be eliminated.

- Speed: Think real-time rather than historical and after-the-fact.

- Accuracy: Eliminate errors through automation and AI tools.

The skill sets required have also expanded beyond accounting and technology to project management, data analytics, marketing, sales, workflow and processes. Some may believe they have invested in these skills, but today it requires access to professional skills and tools that address these areas. The day of a partner or manager addressing these issues after completing their charge hours is over. The current trend is to hire professionals with these skills and integrate them into a collaborative team.

Finally, most accountants believe that their workflow and processes should drive the technology. Today, the technology is driving workflow and processes. Here are seven questions you should ask your firm’s leadership.

1. What is our vision and does our technology roadmap support the vision?

2. Do we wish to manage technology as a strategic asset or as overhead?

3. Who is leading this strategic initiative? Do they have the time and are they qualified?

4. What areas can we automate to increase revenues, reduce costs, and improve the client experience?

5. What are the firm’s priorities?

6. What are the budget requirements?

7. What is the timeline?

Leadership is the key differentiator between companies that have great technology and those that are resisting change and future investment.

Think, plan and grow!