The upcoming presidential election presents an important crossroads for tax policy. The outcome has the potential to shape the Tax Code for both businesses and individuals for years to come.

The Tax Cuts and Jobs Act of 2017 remains one of President Donald Trump’s signature legislative achievements, but its future is still in doubt. Republicans chose to sunset nearly all the individual provisions in the bill by 2026 in order to comply with procedural hurdles that allowed the Senate to pass it with fewer than 60 votes. The outlook for extending the individual changes is uncertain, and efforts to repeal parts of the bill before then will be fierce.

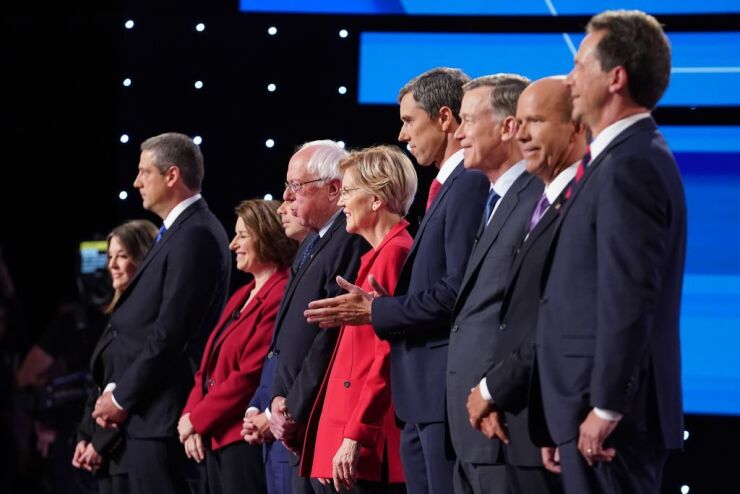

The ultimate outcome for tax policy rests not only on who wins the election, but also on the tax platform each side settles on. Democratic candidates for the presidency have offered a variety of different ideas, but have appeared to coalesce around common concepts. They have broadly pledged to repeal parts of the TCJA, and there is widespread support for ideas such as raising the corporate rate, increasing taxes on investment income, creating a wealth tax, increasing estate taxes, taxing financial transactions, and using taxes to combat climate change. Many of the most significant proposals are discussed below, and the accompanying slideshows from Grant Thornton provide details on each candidate’s positions on

Increase the corporate rate

Nearly every Democrat running for president has pledged to undo the steep corporate rate cut enacted by the TCJA. On the moderate end, Sen. Amy Klobuchar and former Massachusetts Governor Deval Patrick have proposed raising the corporate rate to 25 president, while former Vice President Joe Biden, Michael Bloomberg and Sen. Michael Bennet support an increase to 28 percent. Sen. Bernie Sanders and Mayor Pete Buttigieg have called for restoring the pre-TCJA rate of 35 percent. Sen. Elizabeth Warren’s “real corporate profits tax” plan calls for keeping the current 21 percent rate, but imposes what amounts to a corporate Alternative Minimum Tax of 7 percent on every dollar over $100 million reported to investors as “profit.”

Increasing the top corporate rate is likely to be at the center of any Democratic president’s tax reform efforts. Democrats have been extremely critical of the TCJA’s corporate rate cut, arguing that it hasn’t increased business investment and wages as intended, but has led to stock buybacks. Raising the rate and spending the money elsewhere will almost certainly be a key tenet of any Democratic administration’s priorities.

Repeal some or all of the TCJA

The TCJA has been broadly attacked by Democrats as a handout to the wealthy and corporations. As such, many candidates have singled out specific provisions enacted by the bill in additional rate cuts. For example, Warren has called for an end to full expensing and bonus depreciation, and has instead proposed a depreciation system tied to a property’s actual loss in value. Bloomberg and Bennet have proposed repealing the pass-through deduction.

Raise the top individual rate

Several candidates have expressed general support for raising the top rate on individuals, which was lowered from 39.6 percent to 37 percent by the TCJA. Biden, Bloomberg and Klobuchar have all said they would restore the 39.6 percent top rate. Bloomberg has also proposed a 5 percent surtax on incomes above $5 million. Buttigieg has also indicated that he would bump up the top rate but has not specified by how much. Sanders has proposed the most significant change so far, raising rates on income above $250,000 with a top rate of 52 percent on income above $10 million.

Despite the proposals, calls to raise the top individual rate have not proven to represent the heart of Democratic platforms. Democrats have increasingly turned their attention to developing more targeted approaches to narrow the wealth and income gaps, such as wealth taxes, estate tax increases, and increased rates on capital gains taxes.

Implement a wealth tax

Most federal taxes are imposed when money or property changes hands, but a wealth tax proposes to change that, taxing assets on their very existence and underlying value. Warren, Sanders and Tom Steyer have specific wealth tax plans, and several others have indicated their approval for the concept. Both the Warren and Sanders plans only target multimillionaires and billionaires, taxing household net worth at graduated rates. Although Warren laid the groundwork for the concept with her plan, Sanders’ plan is more aggressive, imposing a 1 percent tax on household net worth above $32 million that rises gradually to 8 percent on wealth over $10 billion. Sanders also halves the wealth thresholds for single taxpayers. Warren’s wealth tax has only two thresholds, kicking in at 1 percent on household net worth over $50 million and again at 6 percent on wealth above $1 billion. Warren initially proposed a 2 percent tax on the second threshold, but raised it in order to help pay for “Medicare for All.”

The wealth tax is arguably the most contentious tax proposal among Democrats, with some candidates describing it as punitive. It may have even served as an impetus for billionaire Michael Bloomberg’s entrance into the race. However, it has become a defining proposal for Warren and Sanders, and has the support of several other candidates.

Reform treatment of capital gains

Democrats have broadly identified increased taxes on capital gains as a means of raising taxes on high-income taxpayers. To this extent, at least six of the remaining candidates have definitively backed the idea of eliminating the preferential tax rate for capital gains and instead taxing them as regular income.

Democrats have also begun exploring a more fundamental change in the way capital gains are taxed, discussing proposals that would require taxpayers to mark to market their capital assets. Under these proposals, certain investments would be taxed on any change to their fair market value at the end of each year, regardless of whether the investments are sold or exchanged. The move shares features of a wealth tax: It imposes tax without any realization event. But it is less transformative, as it still only taxes a measure of implicit income. Warren is the only candidate to explicitly propose a mark-to-market regime, but it has support among important Democrats in Congress. Senate Finance Committee ranking minority member Ron Wyden, D-Oregon, has a version in his own tax reform bill. Warren’s version would apply to the top 1 percent of households and exempt retirement accounts.

Payroll tax increases

Several candidates have targeted payroll taxes for Social Security and Medicare. Democrats have largely called for raising the wage cap on Social Security taxes, but few have offered details. Warren and Sanders propose lifting the cap once wages reach $250,000, and Warren would also increase the rate at that point to a 14.8 percent rate while applying it to net investment in income (at a $400,000 threshold if filing jointly).

Warren’s plan shares some similarities with a proposal recently introduced by House Democrats: The Social Security 2100 Act (

Overhaul the estate tax

Democrats have proposed several different ideas to reform the estate tax, including restoring it to 2009 levels, imposing higher rates on larger estates, eliminating the stepped-up basis for inherited capital assets and generally making it more equitable. Warren and Sanders both propose lowering the estate tax exemption from the $11 million enacted by the TCJA to $3.5 million. Sanders also proposes a new rate structure, with a minimum tax of 45 percent on estates up to $10 million and a top rate of 77 percent on estates of $1 billion and above. Warren also proposes to raise rates, but she has not offered specifics.

Tax financial transactions

As a purported effort to curb heavy speculation on Wall Street, several candidates have backed a financial transactions tax. The tax would be imposed on trades of stocks, bonds, and derivatives, generally at rates equal to just a fraction of 1 percent. Sanders would tax trades of the three instruments differently, at rates ranging from 0.002 percent to 0.1 percent, whereas Warren and Andrew Yang propose a single rate of 0.1 percent. Even Buttigieg has offered general support for the idea.

Use the Tax Code to combat climate change

Nearly all of the Democratic candidates support a carbon tax, but none put forward a plan or elaborated on what it would entail. Several have also come out in favor of ending subsidies and “tax breaks” for the fossil fuel industry, but again have provided little details. A number of candidates support credits and other tax benefits to encourage investment in technology and processes that can reduce carbon emissions and promote renewable energy solutions. Biden has offered several proposals in this regard, including incentives for carbon capture, use and storage technology, credits and subsidies that allow businesses to upgrade to more efficient, low-carbon equipment, credits to combat climate change in housing and a full electric vehicle credit.

Outlook

Many of the proposals would represent significant shifts in the basic foundations of tax policy. However, not everything may actually be achievable even if a Democrat wins the White House. The likelihood of any one proposal becoming law under a Democratic president would depend on both the make-up of Congress and how the proposals shift during the general election, when platforms often moderate. Some of the proposals appear to have less traction within the caucus, such as the wealth tax, while others, like increased rates on corporations and capital gains, enjoy more widespread agreement.

Either way, the outcome of the election remains critical. The scheduled expiration of much of the TCJA could give Democrats significant leverage if they maintain control over any major lever of power.