Public debates over immigration reform often suffer from scarce and erroneous information about the tax contributions of undocumented immigrants, particularly at the state level. Legalizing 11 million undocumented immigrants would not only improve quality of life for those families living in the dark, but also benefit states seeking additional revenues to fund projects that help millions of average Americans.

The National Association of State Budget Officers has projected that state general fund spending in fiscal 2021 will decline for the first time since the Great Recession. According to a

The survey found that states will continue to face considerable uncertainty regarding their budget outlook. While most states were able to avoid extreme budget cuts through the use of rainy-day fund balances and federal intervention, challenging financial prospects lie ahead as they prepare to set their spending plans for fiscal 2022.

Given the shortfalls in revenue collections, some are wondering whether legalizing undocumented immigrants could help foster tax collection at the local and state levels.

Storm Lake, Iowa, is a recent example of how immigrants kept the town culturally and economically alive. As the mayor

We know that even temporary immigrant worker programs bring prosperity to businesses. Researchers at the Center for Growth and Opportunity at Utah University evaluated the stock market performance of agricultural and construction businesses, and found that similar grants of temporary work authorization boosted their performance above the market.

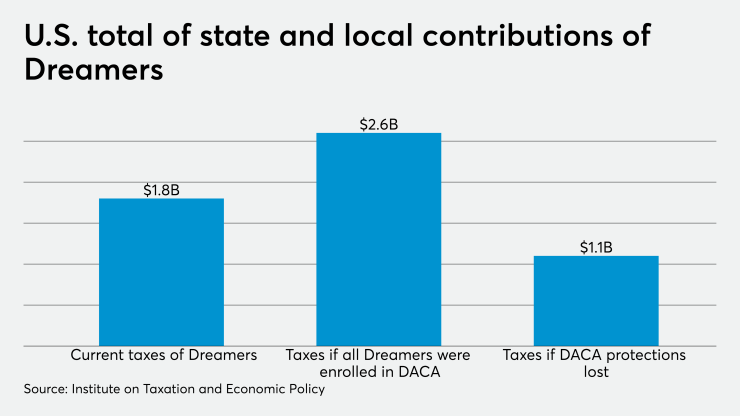

The Institute on Taxation and Economic Policy, a nonprofit, nonpartisan think tank, proposed that states and localities can significantly increase revenue collection by legalizing undocumented immigrants.

According to an

It’s worth mentioning that undocumented immigrants nationwide pay an estimated 8 percent effective tax rate (state and local), compared to the top 1 percent of taxpayers, who pay an average tax rate of just 5.4 percent nationwide.

“The state and local contributions of the undocumented immigrants who could be directly impacted by President Obama’s 2012 and 2014 executive actions would increase by an estimated $805 million a year once fully in place,” according to the report. The report also suggested a further increase in the effective tax rate of 8.6 percent from 8.1 percent.

The ITEP report highlighted that granting legal status to all illegal immigrants would boost their current state and local tax contributions by more than $2.1 billion a year. The most significant boost would come from personal income tax contributions.

The slowdown in the jobs recovery and surging coronavirus caseloads are expected to strain many states’ economies and budgets further. Even if state tax revenues begin to recover from the substantial declines induced by the pandemic, rising spending demands from an uneven economic recovery that is disproportionately affecting low-income families and individuals are expected to put added pressure on state budgets.

Various studies have suggested that undocumented immigrants have lower wages than legal immigrants, so granting legal status could lead to a boost in wages. The wage boost would in part be due to better job opportunities that would be made available to workers with legal status. Granting legal status would not only benefit 11 million undocumented immigrants, it would also benefit states seeking additional revenue to fund health and educational projects for hundreds of millions of Americans.