Want unlimited access to top ideas and insights?

Financial planning is often an afterthought, something done piecemeal while CPAs and tax professionals are servicing clients. Stimulus packages passed throughout the pandemic create opportunities for accounting and finance professionals to be more proactive in financial planning for families. Take, for instance, the American Rescue Plan Act's expanded Child Tax Credit. Financial professionals can assist families in using part of the additional funds to be received to create more income streams than Oprah.

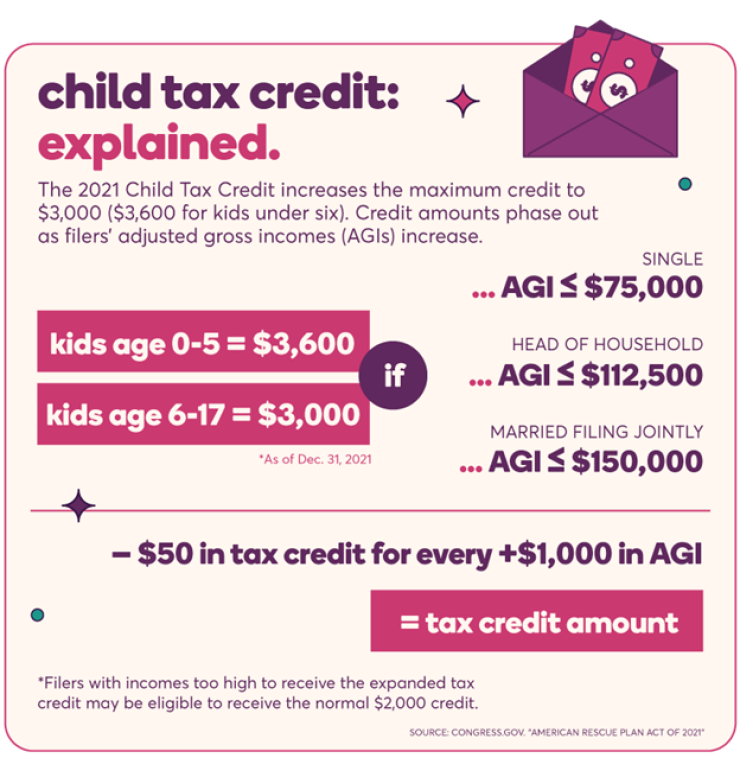

President Joe Biden's $1.9 trillion American Rescue Plan provided for the expansion of the Child Tax Credit. Parents will receive $3,600 for children under the age of six and $3,000 for children ages six to 17.

April is Financial Literacy Month. People often complain that financial education is not taught at school. News outlets and social media messages are filled with statistics and stories of wealth disparities and the lack of adequate emergency funds. Tackling financial matters without the proper information or an adequate plan can be challenging.

Financial professionals can help families by educating them on how recent changes will affect them, helping them assess their financial goals and leverage the Tax Code to meet those goals. Leveraging technology to scale this process, financial professionals can use this opportunity to upsell financial planning and to add to the financial toolbox of families within their clientele.

How can a financial professional go about this? Using the STAR method and SMART goal-setting criteria, financial professionals can get clients to gain clarity around their financial goals and help them as they devise a plan to use the extra funds that the expanded Child Tax Credit will provide for their family this tax year and next. Financial planning has to start with the financial visions that the client has; otherwise it will be yet another plan set or piece of advice given that clients will set aside and not implement.

With the STAR method and SMART goal-setting criteria, financial professionals would have clients assess their goals and then walk clients through the option to meet those goals based on current tax laws, the benefits available through work or business, and the budget that the client has set for the expanded client tax credit funds. In this instance, they’d be adapting the STAR method to a future goal, not a past accomplishment. The goal-setting would go as follows:

S - Situation: The family will be receiving a $3,600 Child Tax Credit for tax year 2021 due to the Child Tax Credit expansion in the $1.9 trillion American Rescue Plan. They want to use part of the money to start saving for their child’s education.

T - Task: The family determines that they want to save or invest $2,600 of the $3,600.

A - Action: The financial professional and the family would research to determine what type of accounts the family can save/invest in for their child.

R - Results: The family determines they want to use the $2,600 in a combination of accounts that in part provide funds that don’t affect their child’s future financial aid and that offer tax-free earnings.

S - Specific: The family wants to use $2,600 of the expanded child tax credit to open a cash value life insurance policy, health savings plan, Roth IRA, 529 plan and savings account for their child so that after the 2021 tax year, they can maximize contributions and set their child up for financial success by reducing their out of pocket college costs and providing tax-free retirement and other funds.

M - Measurable: For the 2021 tax year, half the amount of $2,600 will be received between July- December and the other half at the time they file their 2021 tax return.

A - Attainable: This goal is attainable as the family plans to create a monthly budget for the $2,600 and set up automatic debits for the accounts they will open for their child.

R - Realistic: This goal is realistic as the family is eligible to receive the funds and do not have other financial needs pending that can cause unexpected use of the funds.

T - Timely: This goal is timely because the credit has been expanded and the family is setting a plan in place to be all set before the first monthly distribution.

Taking a proactive approach to learning about personal finance by conducting research and finding financial advisors and financial gurus to retain and follow is truly priceless. Financial professionals who help families navigate tax changes in this manner will be a valuable asset to holistic financial planning and wellness for families and will be sure to stay top of mind. Using newsletters, webinars, mini-assessments and consultations, financial professionals can educate their clients and help them build wealth for their families.

Last November, I self-published a financial vision book on Amazon,