The title of this article may have seemed a little unusual for an accounting-themed piece, but this topic is one pulled directly from the headlines and is having an impact on nearly everyone. Barely a week goes by without a story about people falling ill — sometimes even requiring hospitalization — due to eating contaminated food. In addition to the obvious health and safety ramifications of these unfortunately common incidents, there is a bottom-line impact in every outbreak of disease or announcement of people falling ill. Apart from the reputational damage, which can be difficult to correct, all the food recalls, process retooling, additional inspections and reconstruction of sanitation procedures cause a financial and operational drag on performance.

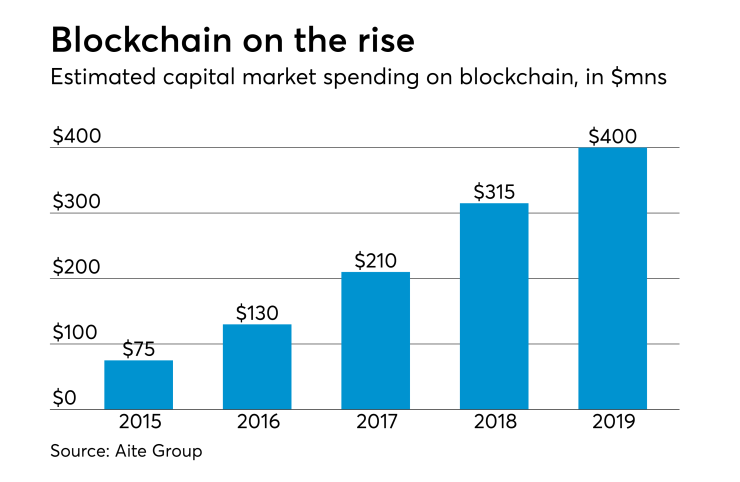

None of this is news, but accountants may be able to help address some of these serious issues. How? By leveraging technology that’s already attracting attention and investment from businesses and accounting firms: blockchain.

By this point you have no doubt seen, heard or read at least a few articles about blockchain and the potential it holds for accounting practitioners and firms. The real-time transmission of data in an encrypted format between member organizations is, at a high level, a potential paradigm shift in how supply chains operate. Even with modern technology improvements, there are still many manual processes, paperwork and time lags in between when different members of the supply chain receive information. Food safety and sanitation are basically a supply chain conversation with global scale, problems and implications.

As accountants learn about how blockchain might impact the profession and the broader business landscape, the levels of anxiety and enthusiasm linked to this technology continue to increase. Amid the buzz surrounding blockchain and its implications, many of the discussions have focused on how blockchain can improve traditional practices. What may have gone unnoticed, even as food safety concerns continue to ripple through the headlines, is how blockchain can open up nontraditional opportunities for CPAs and accounting firms. The core question is how blockchain can allow CPAs to enter new areas that connect operational issues to financial results, in addition to improving the traditional offerings.

CPAs often talk about becoming strategic partners to help drive business decisions, and food safety is a real-world problem with a real-world impact. This represents an opportunity that should be seized.

Connecting blockchain to food safety

Since accounting professionals are already investing significant amounts of time, energy and resources learning how to use and implement blockchain options, it seems logical that this same tool should be connected to tackling some of the most pressing issues facing firms today. Bridging this gap, and connecting the fundamentals of blockchain to both accounting and food safety, can seem like an abstract idea, so let’s take a look at exactly how this should occur:

1. Real-time transmission of data is a game changer. Even with the current technology, organizations are unable to pinpoint exactly where food contamination issues actually occur. This lack of transparency and accessibility is one reason to implement blockchain. Being able to pinpoint exactly where issues arise, whether they are financial in nature, or linked to food safety concerns, is something that should be communicated and leveraged.

2. Increased transparency can increase the bottom line. Improving the transparency connected to the safety and quality of the food produced by an organization can, and already is, generating quantifiable impacts on financial performance. According to a

3. This makes the CPA a true partner. Simply reporting the information that has already happened at the organization is not the path forward for generating growth, development and success. Blockchain technology, on top of the excitement and buzz that surrounds this tool, also provides CPAs the opportunity to play a strategic role in the conversation. Improving the quality of products delivered to the marketplace, helping reduce the number of people getting sick from contaminated food, and highlighting opportunities for management to increase returns represent a true opportunity to accountants to have a real impact on an organization.

Food safety — and preventing the outbreaks that seem to happen with frightening regularity — is not something that one technology, idea or process will be able to address. The same core components of blockchain that are so exciting for the accounting profession also provide practitioners with the opportunity to branch out, embrace new services and play a larger role in the decision-making process. For practitioners seeking to achieve the coveted label of strategic partner or trusted advisor, this is an opportunity not to be missed.