Want unlimited access to top ideas and insights?

One of the best ways to consistently and tangibly add value to client portfolios — especially in volatile markets — is using a tax-optimized investment approach. Better yet, by preparing ahead of downturns can set you up for swift and successful implementation, and help save you from the increased client outreach and longer workweeks caused by volatile markets.

Tax alpha can be obtained in three ways:

Buy-and-hold strategies are fundamentally tax efficient because they produce limited, if any, capital gains until products are liquidated. But tax-loss harvesting takes this a step further by systematically selling off assets with unrealized losses. These losses can be used to offset gains in other parts of the portfolio, as well as a portion of ordinary income.

A simple practice that can provide big returns

Simply put, tax-loss harvesting is the practice of selling positions at a loss. At a minimum, taking advantage of these losses will allow a client to delay paying taxes and attain more tax-deferred growth. Using these methods strategically can take it a step further, reducing the overall tax burden a client faces.

Most advisors approach this strategy at year end by reviewing capital gains produced over the year and looking for losses that can offset them. Although this can be effective, working it into your process throughout the year can yield greater results. Market drawdowns often create the best harvesting opportunities, and they can happen at any time.

In fact, according to a 2019 Envestnet | PMC study, effective tax management can add 1% to a portfolio annually, and potentially more in highly volatile years. Better yet, adding this strategy can extract a positive result from a downturn, demonstrating value to clients who are seeing losses mount in difficult market environments.

What’s the best approach?

Some advisors look for tax-loss harvesting opportunities on a periodic basis, such as quarterly, semiannually, or annually. No matter how often you decide to conduct reviews, there are two ways to go about it:

- Identify a list of nonqualified accounts you would like to review individually. This could be a list of the largest households or accounts that deserve special attention on a position-by-position basis.

- Look at the holdings across your business. What are the largest overall positions, and how have they performed recently? In aggregate, what are the unrealized gains or losses on a particular position?

Once positions have been identified as harvesting candidates, confirm no purchases of the security have been made in any accounts in the past 30 days, including retirement accounts. (Losses from a dividend reinvestment will be disallowed, but it may be a small amount that won’t derail the overall strategy.) Then, decide whether you want to keep the proceeds in cash or invest them in a replacement security for the next 30 days. I generally advise using a replacement security to maintain market exposure and avoid the potential pitfalls of market timing and missing out on a rebound over the next month; however, you’ll need to be aware of wash sales.

The impact of wash sales

According to the IRS, a wash sale occurs when you sell or trade securities at a loss and, within 30 days before or after the sale, do one of the following:

- Buy substantially identical securities

- Acquire substantially identical securities in a fully taxable trade

- Acquire a contract or option to buy substantially identical securities

The IRS created this rule to keep investors from reaping tax savings without materially changing their economic position. The concept is quite simple, but the implementation is far from it.

Because wash sales effectively disallow the losses generated through tax-loss harvesting, you need to be careful if you choose to use replacement securities.

The IRS is vague, leaving it up to investors to “consider all the facts and circumstances in your particular case” (IRS Publication 550) to determine if a position is substantially identical. Although everyone must ultimately interpret this based on their circumstances, there are some best practices you can follow when selecting a replacement security as a placeholder.

For example, if you sell an ETF or index fund, you can replace it with a product that tracks a different index. Replacing one S&P 500 fund with another is generally considered running afoul of the intent of the IRS. Swapping one security for a different one that holds the same 500 companies in nearly identical weighting does not put you in a different economic position, so you should seek another option. Most investors consider actively managed funds to be unique enough to be in safe territory, despite commonly overlapping positions. Identifying a security that gives the client exposure to a similar area of the market keeps the portfolio in line with its objective and can reduce opportunity costs.

Other strategies to consider

Tax-loss harvesting can be a good strategy during market turmoil, but similar approaches can provide benefits as well:

- Harvesting gains: It’s important to note that harvesting gains can be timely as well. Clients in the 10% and 12% ordinary income tax brackets are subject to a 0 percent capital gains rate. Should they find themselves in these brackets in a given year, banking the gains will effectively increase their cost basis. Unlike tax-loss harvesting, wash sale considerations do not apply to gains, and securities can be repurchased immediately.

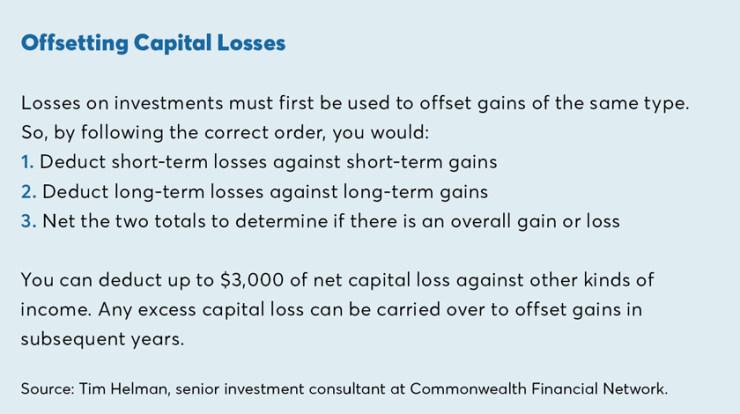

- Tax arbitrage: Because the IRS taxes different types of income at different rates, clients can utilize tax arbitrage to access lower tax rates. For example, long-term capital losses are typically used to offset long-term capital gains, allowing the investor to avoid paying long-term rates (up to 23.8%) on those capital gains. If you can delay realizing those gains, you can let long-term capital losses offset short-term capital gains and ordinary income (up to 40.8%). This strategy can add significant tax alpha because any leftover long-term capital losses can be deducted against ordinary income (up to $3,000 per year). When possible, pairing losses with short-term gains and ordinary income maximizes the value of those losses.

Although tax-loss harvesting can be a challenging process to scale at times, the ability to take advantage of down markets is unique. And the mastery of tax-loss harvesting can be another tool you can use to deliver alpha throughout all market cycles.