The massive remote work experiment forced upon business by the pandemic has been largely successful for two reasons — the perseverance and diligence of employees and the virtual technologies used to communicate, collaborate and automate business processes.

In the finance and accounting (F&A) function, work tools like video conferencing platforms and automated software solutions allowed for work to proceed — invoices were sent, bills were collected, revenues and expenses were recorded, and companies closed the books. This information served a crucial purpose, enabling more insightful CFO decisions, and the ability to rapidly respond to unpredictable market changes.

With the pandemic receding as the public gets vaccinated, many CFOs are heeding the lessons learned over the past 14 months and doubling down on business process automation. While this digital transformation was underway pre-COVID-19, the impact of the pandemic on how people work has accelerated CFO investments in technologies that allow F&A teams to virtually access data across enterprise systems, enhance efficiencies, optimize cash management, reduce costs, and provide clearer visibility into business performance for decision-making.

The findings of three recent surveys suggest renewed CFO urgency surrounding digital transformation, with investments geared to helping the F&A function thrive in today’s “new normal” of work. Deloitte’s Q1 2021

A

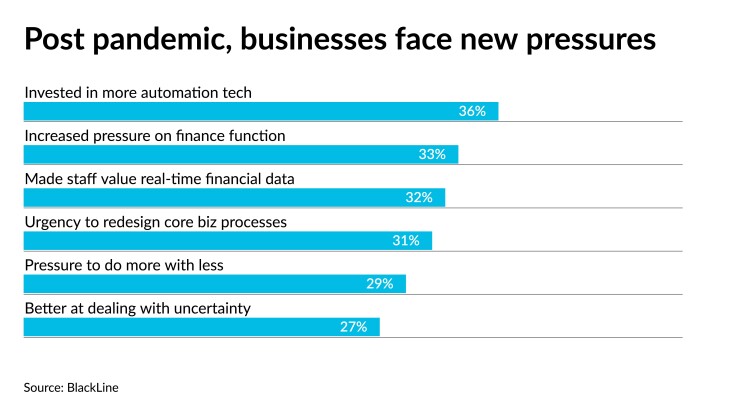

Since the pandemic reared, BlackLine’s latest annual

A pivotal juncture

The three surveys suggest that CFOs no longer view business process automation in F&A as an impractical for now “nice to have.” Rather they have mustered the resolve to invest in the function’s digital transformation. Chief among the reasons appears to be the need for CFOs to make decisions rooted in reality. Without real-time business data upon which to base their deliberations, the risks of making inferior decisions looms high.

That’s just one of the conclusions from another recent CFO

The surveys sponsored by both BlackLine and Deloitte affirm that businesses are increasingly reliant on the F&A function to provide crucial data and analysis for decision-making. One-third (33%) of the respondents to the BlackLine survey say the pandemic has increased pressure on the function “to provide an accurate picture of company performance” and 29% say they feel pressured to “do more with less.” The Deloitte survey arrived at a similar conclusion, with 54% of the CFO respondents citing “higher demands from executive and leadership teams” and 37% reporting a higher volume of work in the F&A function.

To address these pressures, all four surveys indicate that CFOs are committed to spending capital to build real-time business processing capabilities. The Accenture survey, for instance, indicates that 44% of the CFO respondents plan to have nearly all finance processes and operations in real-time in the next three years, with 33% planning to invest at least half the F&A budget in this area.

Gartner’s survey cited the types of technology investments needed to transform F&A into a “digital” function.” They run the gamut from robotic process automation and machine learning tools used for budgeting and forecasting to technologies that automate and orchestrate end-to-end finance and accounting processes, “unlocking data and insights for the business at scale.”

The various survey findings also suggest that many CFOs are looking to enhance the skills sets within the F&A function. Deloitte’s survey indicates that most CFOs would like to “bolster” their F&A teams’ talents in data analytics, forecasting, technology, digital and automation. Gartner’s survey says that CFOs are looking to fill a “growing digital skills gap” in the function to improve its ability to “exploit digital technology capabilities.”

More than half (58%) of CFOs in Accenture’s survey expressed concern about having talent within the function to perform real-time scenario planning. BlackLine’s survey indicates that more than one-third (34%) of the respondents will increase headcount to improve the F&A function’s analysis and forecasting capabilities.

If the various survey findings are correct, it will represent a sea change within the function, which has long been undermined by outdated, spreadsheet-driven manual processes, the primary reason impelling 37% of the BlackLine survey respondents to digitally transform the function. While CFOs have allocated capital through the years to automate profit centers like sales and marketing, they have been disinclined to invest money in a function they lead, perceiving it as more of a cost center.

In 2020, this mindset became as antiquated as yesteryear’s F&A processes. As the four surveys suggest, modernizing the function is a competitive imperative.