While opinions vary on the number of jobs that can be “automated away,” it’s clear a large number of positions now handled by people, including accounting jobs, will be supplemented or replaced in some way by intelligent machines.

The utterance of the word “automation” conjures up gloomy images of job losses and people left behind by rapid technological change. While some job losses are inevitable, there is hope for optimism. What’s the reason? Simply put, the analytics at the root of those intelligent machines can provide expanded career paths for accountants and finance professionals.

We’re already seeing a displacement of jobs in the accounting industry through outsourcing and robotic process automation, among other trends, yet the role of traditional accountants is expanding well beyond simple reporting measures.

Today’s finance professionals must take into account a multitude of forces shaping financial performance: talent acquisition strategies, geopolitical forces, fluctuations in capital, emerging markets and intellectual property challenges, just to name a few. To suggest that smart and insightful accountants cannot acclimate to automation is to miss a fundamental truth about our nature: We are innovative, adaptable creatures who have been evolving and adapting to change for millions of years.

Beyond the Zero-Sum Game

Most enterprises and recruiters have struggled to redeploy jobs. A common mistake in thinking is: “Once an accountant, always an accountant.” So, what are some of the options?

At the end of 2016,

Using data from 1,120 randomly selected people with “accountant” roles in their LinkedIn profiles and employed at large U.S.-based companies, we created a way to explore options for workers whose job has become obsolete or who require additional training.

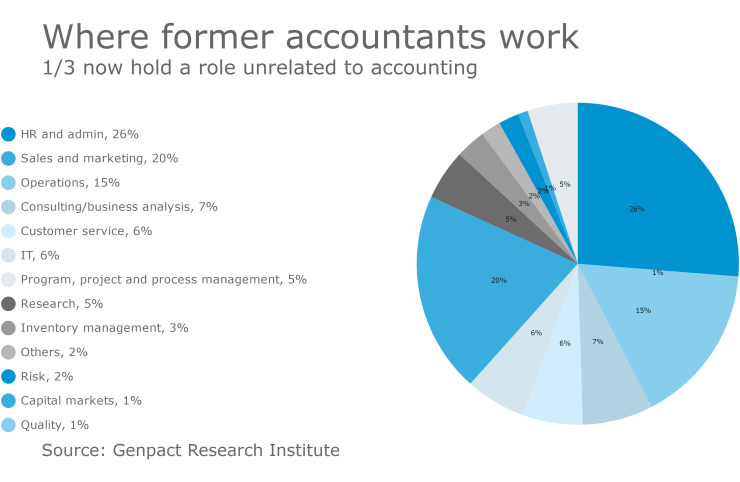

The data analyzed career histories, education and skills to identify factors that enable people to move into roles traditionally unrelated to finance and accounting (F&A). The data showed that approximately one-third of accountants have held a role unrelated to F&A during their careers. The roles were in a much wider range than expected, and certainly broader than conventional recruiting firms would encourage candidates to consider (see chart below).

Diving deeper into specifics, it is clear that numerous career paths may exist for accountants. Customer service, operations, and sales and marketing were all well-represented in this research. In addition, possible positions in research, program management, consulting and business analysis stood out. Our research findings are clear: the skills and competencies that accountants possess are applicable to many fields, both in and out of finance. Risk-focused professions, where precision capabilities are central to supporting statistical and compliance methods, are just one example. We also found that the ability of accountants to work across the organization and understand other disciplines such as sales, marketing, supply chain and human resources may enable them to channel their skills into those areas.

The role of the finance function is expanding dramatically. Taking into account such factors as supply chains and market fluctuations, as well as how intellectual property and human capital shape business performance, further expands the boundaries of traditional accounting activities and broadens career opportunities.

What’s Next?

While the deployment of automated technologies will inevitably lead to some job losses, the evolving role of the finance function and skill sets accountants possess can lead to new, expanded and rewarding careers. The American Institute of CPAs and its management accounting designation, CGMA, reinforce the value that accountants bring to the table, with skill sets that can help address a wide array of business challenges.

Big Data can also help those at risk of losing their jobs identify new roles. With deeper study, corporate management and human resources professionals will be able to draw deeper conclusions on career progression, more effectively develop reskilling programs, and create new alternative jobs paths. Such learning and development initiatives may identify jobs for many positions in risk of being eliminated through automation.

For accountants, whose professional lives will be impacted by the rapid emergence of automation, it is certainly a time of increased anxiety. But for organizations that think creatively about the skills finance professionals bring to the table and how they can apply more broadly across the enterprise, this may be an opportunity to map a more hopeful and promising path to the future.