One of the pleasures of covering accounting is knowing that if we ask a mildly provocative question like “Is it too hard to become a CPA?” —

One of the other pleasures of covering accounting is getting to talk with leaders in the field like Illinois CPA Society president and CEO Todd Shapiro and past American Institute of CPAs chair Kimberly Ellison-Taylor (who helped spark the original question with her tongue-in-cheek comment that she’d rather give birth to her children again than re-sit the CPA exam), and I want to highlight their takes here, because they didn’t answer the question — they completely reframed it in important and very useful ways.

Essentially, they said it’s not about whether it’s too hard to become a CPA, but whether it’s worth it — or, perhaps more crucially, whether it’s perceived to be worth it.

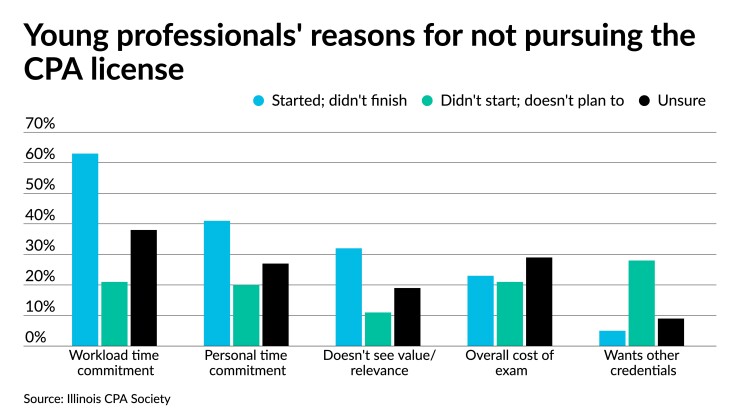

Shapiro pointed to the the ICPAS’ excellent recent report, “

But concern about time is only a symptom, he suggested: “We believe that relevancy of the credential is largely driving the decline.” When other job sectors offer more money and more interesting work, it’s easy for them to lure away potential CPAs, particularly as salaries in accounting have flattened out. “I believe that relevancy, which drives salaries and job satisfaction, is far more at fault for the decline than the 150-hour requirement.”

Ellison-Taylor, meanwhile, made it clear that it should never be easy to become a CPA: “This is the path of someone in a learned profession, and it’s all part of the journey. Would we want our medical professionals saying, ‘It’s great this was sooo easy. I’m glad I can be a heart surgeon and I didn’t have to put any real effort into it!’ So if we are a profession similar to the medical profession, why would we think that our path would be less rigorous? … We’re not going to get people who become CPAs because someone else wants them to. Generally speaking, CPAs want it for themselves. You just don’t accidentally get 150 credits, study hard and pass four exams otherwise. There are many reasons that others choose not to pursue the CPA but for those who do, it is exciting to see their joy and relief.”

But then she turned the original question completely on its head, in a way that addresses a lot of issues in the profession: “I think 150 hours and the exam are easy targets, instead of focus being placed also on other areas that warrant discussion. It’s definitely about the perception of the buyer — it wouldn’t be too hard if they thought it was worth it,” she said. “I don’t think it’s too hard to be a CPA if you believe that there is value in what you get after they become a CPA. For instance, what happens when they arrive at their hiring organization? Is it inclusive and welcoming with competitive pay and a well-communicated path to advancement? Do they believe that they can aspire to the senior positions and have a realistic chance of achieving their career goals? If they don’t think that’s possible, then it won’t be worth it and 150 hours and the exam would be among the least of their concerns. Perception is reality for many. What’s on the other side must be perceived to be worth it.”

With that in mind, accounting needn’t worry about lowering its standards, but rather do a better job of explaining and advertising why the pain of becoming a CPA is worth it: the long-term financial rewards, to be sure — but also the prestige and satisfaction of playing an important role in a profession that itself plays a critical role in the lives of its clients and the overall economy.