In late 2016, I wrote about

Bitcoin is the best-known cryptocurrency built upon the blockchain, but there are many others, like Ethereum. These cryptocurrencies are token-based and exchanged on Coinbase.com. There are those (knowledgeable people) who believe the success of blockchain is directly impacted by the convergence of a related cryptocurrency, whether it is Bitcoin, Ethereum or another cryptocurrency. When you couple the blockchain with cryptocurrency, artificial intelligence (cognitive), the Internet of Things (networks and sensors), smart contracts, and robotics (automated processes), the possibilities increase exponentially. This is due to the increased focus on predictive capabilities, rather than manual business processes and the authenticity of historical transactions. Real-time, authentic data makes predictive data analytics more valuable. When the focus changes, so do the business processes forcing accountants to move up the value chain or be disintermediated. Thus, the Blockchain Plus terminology.

Therefore, firms of all sizes can start positioning themselves at the basic level by making sure their processes are digital and documented to ensure efficiency and the ability to invest in what we call the CIA — the Continuous Improvement Accelerator. According to Peter Diamandis, founder of XPrize and Singularity University, there are 6 “D”s of exponential change:

- Digital;

- Deceptive;

- Disruptive;

- Dematerialized;

- Demonetized; and,

- Democratized.

Accountants must change their mindsets, skill sets and toolsets to remain future-ready. Technology such as Apple Siri, Google Assistant, Microsoft Cortana and Amazon Alexa continue to gain capabilities to search and quickly respond to queries that previously required professional assistance, judgment and time. In just the last 18 months, the capabilities have grown to the point where these tools are producing valuable data. Couple this with artificial intelligence and it won’t be long until transactions can be recorded and coded more accurately by machine than human. Several of the leading accounting software companies are already investing in this technology (Xero, Sage, Intuit, Intacct and NetSuite). The biggest advantage I see for accountants is their serious domain expertise. This, coupled with expertise in multiple technologies and the ability to timeline convergence, is critical.

Peak to trough

There is no question that there is plenty of hype regarding all of these technologies, including blockchain. However, the accounting profession should not ignore the investments being made in these technologies and the potential disruption to all professions.

In my opinion, blockchain has moved from Gartner’s Peak of Inflated Expectations to the Trough of Disillusionment. The question becomes, how long will it take to enter the Zone of Enlightenment and Plateau of Productivity? We are now in the ninth year since Satoshi Nakamoto (the name used by the founder or founders of Bitcoin and blockchain) wrote the original white paper. As a point of reference, it took approximately 400 years to move from gold to certificates, and 50 years for credit cards to capture the world market. Some predict 20 years for blockchain. I don’t know the exact timeline, but Ray Kurzweil developed the law of accelerating returns. Kurzweil said, “Humans are linear by nature — and technology is exponential.” This statement is based on the rapid advancement over the past 50 years of processing power, storage and bandwidth. As CPAs, we are trained to think linear rather than exponential. A good example is: How much money would you have if you doubled one cent every day for one month? The answer is $10,737,418.24. The growth isn’t that significant until the last few days of the month. Most people underestimate the speed at which technology is disrupting all professions.

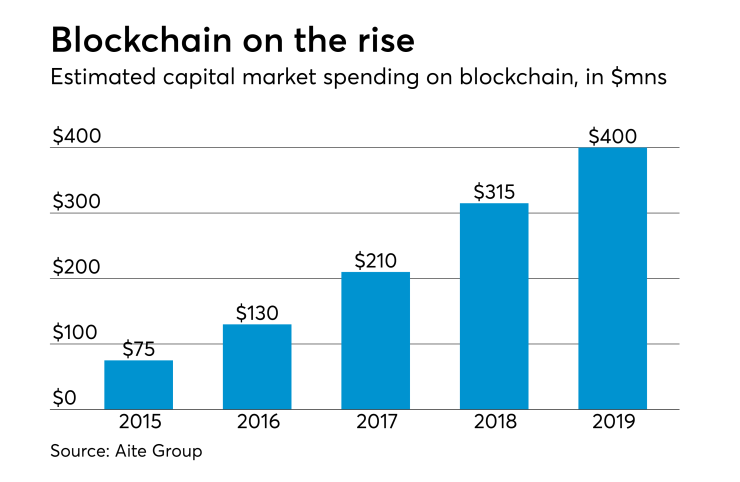

Much of the investment today in blockchain is coming from incumbents who have a vested interest and the potential of being disrupted (financial institutions, governments, medical, the Big Four globally, real estate and technology companies, to name a few). As recently as May of 2017, Congress was seeking answers from the Internal Revenue Service about Bitcoin tax investigations. The regulators want to ensure that owners of Bitcoin are properly reporting income. This demonstrates potential obstacles ahead, ranging from regulation to attempted control by incumbent intermediaries.

Uncertainty is a “big word” in economics. Some of the uncertainties the blockchain has the potential to eliminate are:

- Identity (proof, security and privacy);

- Transparency (asset tracking);

- Shared reality (nodes monitor tampering); and,

- Renege (smart contract as an escrow agent).

The blockchain is more than a distributed database with digital signature capabilities. This is where hype and misinformation enter the marketplace. CPAs, as trusted business advisors, have a great opportunity to lead rather than follow with blockchain technology. So far most of the investment and experimentation has come from outside the U.S. The blockchain is a global initiative. According to EY global technology sector leader in tax services Channing Flynn, “To date, blockchain has transformed only people’s thinking. We don’t yet even know all the questions blockchain technology will raise, much less the answers. But waiting for the technology to take hold is too late. Now is the time to start defining the questions and influencing policy that will lead to answers.”

Knowing what questions to ask is important, and currently the answers are cloudy. Here are some examples of questions to ask:

- Why own it, especially if it isn’t sustainable and profitable?

- Is blockchain part of the AI technology stack?

- Will blockchain incentivize industries or professions to open their silos?

- Is blockchain driven by FOMO (fear of missing out)?

- Is the sum of multiple technologies greater than their parts (convergence)?

- Will blockchain help with the control of copyrights and intellectual property?

These are questions that will inspire differences of opinion and perhaps debate.

On the skill-set side, accountants may need to brush up on their math and statistics. More importantly, they must not let current financial success lull them into procrastination and inaction. The profession can position itself as future-ready by investing in digitizing business processes and having the ability to filter disruptive technology for themselves and clients. This requires a collaborative team, not a rugged individual. Your action plan should include reading and learning about developments and the impact they will have on you, your profession and clients.