Trust [people] and they will be true to you: Treat them greatly and they will show themselves great. — Ralph Waldo Emerson

Talent is the lifeblood of any company. In the current competitive environment, CPA firms face plenty of challenges to not only attain the status of an “employer of choice” but, more importantly, to sustain that designation.

How do the best get better and what should organizations focus on to attract and retain quality talent? The strategic advantage occurs when they prioritize five crucial areas.

LEADERSHIP

Becoming an employer of choice starts with leadership. This quality is so important that without it, success in any of the other focus areas will be difficult if not impossible to achieve. Without great leadership, employers tend to fail in talent development, technology, processes and growth.

Leaders must have a compelling vision and consistently communicate it. People want to be their best. They want to buy into an idea, be inspired and feel like they are contributing to something bigger than themselves.

Some firms fail to differentiate between management and leadership, but there are major differences. Management is task-based and mechanical, focused on assigning work and evaluating it. Managers can use the proverbial carrot and stick to motivate people for a while, but eventually, if employees don’t care about the mission and their leader, they will become disenchanted. Managers chase goals, while leaders chase a vision. Organizations need both, but the differentiator is the vision. Many managers are promoted to leadership roles based on seniority or the ability to effectively manage client service but are ill-equipped to provide real leadership. Those with the potential for leadership should be identified early, receive training for the required skills and be rewarded for contributions to the firm, rather than personal production. Connecting compensation to performance is an important challenge. Seniority doesn’t guarantee performance.

TALENT DEVELOPMENT

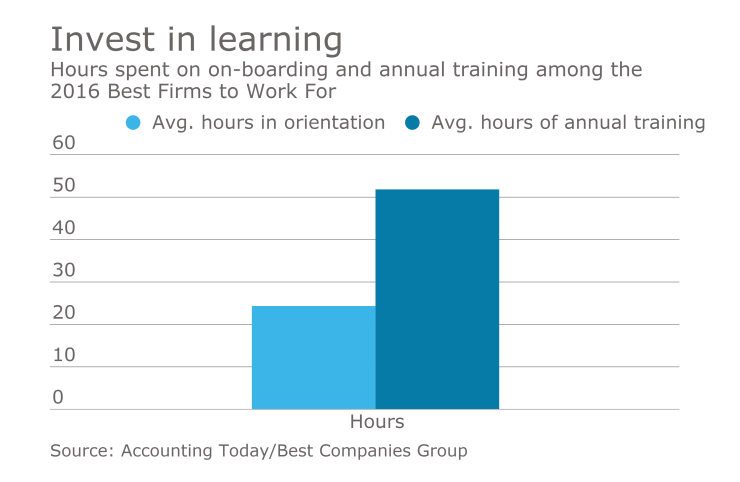

Many firms claim that people are their No. 1 asset, but one look at their training budget tells a different story. If you want your employees to stay with your firm for the rest of their career, you need to offer them a career. That means providing a clear path to promotions, regular and fair evaluations, training for new skills, and mentorship.

Each employee should receive an annual personal development plan and have access to education and development opportunities applicable to their plan. Strategic learning and development do not happen by accident. It needs to be a process within your firm, and one that is highly visible. The most sought-after candidates will expect to see evidence of a firm’s investment in learning and training initiatives before they join the firm.

When you continually invest in the development of talent, you no longer have to worry about retention and attraction. The best and brightest employees are naturally drawn to an organization that invests in their future.

TECHNOLOGY

People who have chosen public accounting as a career understand the challenges of their jobs. They know the job requires a significant time investment, and they are willing to do the work. However, they also know that technology exists today that will allow them to be mobile and able to work from anywhere at any time. They want technology and flexible work arrangements that let them decide when and where the work gets done.

Successful flexible work arrangements require software integration and workflow. When client data is spread across multiple databases and folders throughout the firm, access to all of the firm’s resources and data are limited and professionals cannot work effectively away from the office. An employer of choice adopts workflows that draw from integrated databases holding complete and accurate client information. Employees can access that data securely from anywhere.

Technology media company TechTarget defines business capability as “the expression or articulation of the capacity, materials and expertise an organization needs in order to perform core functions.” As more areas of the business are automated, the business capability model becomes even more important. Technology continues to reduce the amount of time spent performing data entry, coding transactions, and performing reconciliations. The business capability model can help define requirements, priorities, integration and applications.

PROCESSES

Disruptive technology makes many steps in existing processes redundant or unnecessary, yet many firms just patch new technology into existing processes. This results in inefficiencies, wasted time and steps that frustrate employees while providing no value for the client. Implementing processes that maximize technological capabilities helps employees feel like what they do has meaning and feel aligned toward a common goal.

Many professionals today remember working in accounting firms where training occurred via review points. After some cursory instruction on the tax preparation software, you were handed a pile of client documents and a copy of last year’s tax return and work papers. You learned how to prepare a return from round after round of review points. A difficult return could take weeks to complete as review points and responses ping-ponged between the preparer and reviewer.

Today, we know that a system of adequate training and one-way workflows can increase efficiency and profitability, as well as improve the client experience. These processes will require more time spent on training in the beginning, but will save time in the long run. Cutting down on extra loops in the process means the work gets out the door faster, making clients and employees happy.

GROWTH

One of the main reasons employees leave a business is a lack of opportunity for career progression. Creating written personal and professional short- and long-term goals and having regular check-ins to discuss progress toward those goals gets employees excited about their careers and their firm.

An employer of choice encourages employees to continue to develop their skills and careers by providing career planning and internal and external training opportunities. Growing companies also create more opportunities for their employees, providing new and interesting job assignments to help employees expand their skills or pursue a niche.

The growth of the firm is as essential to becoming an employer of choice as individual growth. Two critical components of firm growth are a focus on advisory over compliance services and working with the right clients. Many firms have too many clients that utilize only one service: individual tax compliance. These clients force workloads to be compressed into a single, untenable busy season. Revenue growth from these services is limited because technology has rendered tax preparation a commodity, where customers perceive little or no value difference between brands and will leave your firm for a lower-priced product from a competitor. Instead, growing firms need to focus on becoming trusted advisors, providing clients with strategic-based services packaged with compliance services.

The clients your firm has now may not be the clients that will see you through a shift toward advisory services. It may be necessary to terminate a small portion of your clients to free up capacity to focus on providing performance and strategic services. This will take more than a simple checklist for screening new clients. You’ll need to change your client acceptance process to bring in only clients who the firm can help grow and ones who want to grow with the firm.

If you implement these five factors in your firm, you will be well on the way to attracting and retaining the best. When you develop talent, provide technology and processes that allow your employees to feel successful in their personal and professional lives, and offer growth and opportunities, your reputation will precede you. Employees will seek your firm out as a desirable place to work.

“If you focus on results, you will never change. If you focus on change, you will get results.” — Jack Dixon