The year 2020 has been an unexpectedly challenging one for all professions, bookkeeping included. Nonetheless, bookkeepers have been resilient, embracing the role of trusted advisor for their clients.

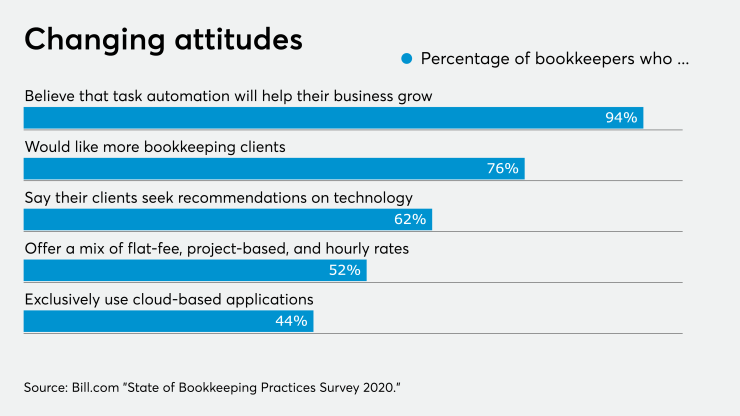

In Bill.com's recent State of Bookkeeping Practices Survey 2020, 1,644 bookkeeping and accounting firms of all sizes provided feedback on the current state of the profession, including the largest hurdles they’re currently facing. Despite the myriad challenges of the pandemic, a number of positive trends emerged.

One of the most notable is that more and more bookkeepers are embracing the role of trusted advisor to their clients. Like many things in 2020, though, being a trusted advisor doesn’t necessarily look like it did even just a year ago. From advising on technology to helping clients secure pandemic financial relief to simply offering moral support, many bookkeepers have begun offering strategic advice this year without even realizing it.

This has only led clients to trust their bookkeepers more than ever before, and the advisory services offered out of necessity this year will likely remain a core aspect of serving clients going forward.

Traditional advisory services

Not all strategic advisory services offered during the pandemic have been new or unexpected. Bookkeepers have long been offering accounts payable and accounts receivable services for their clients, but the demand for those services significantly increased this year. In fact, of the respondents surveyed, 87 percent currently offer AP services, while 77 percent offer AR services, both representing double-digit growth from the same survey taken just four years ago.

Bill pay services are also incredibly popular, with 79 percent of firms saying they now offer them. Of that group, 89 percent perform at least some cloud-based bill pay for their clients, underscoring the importance of technology. Firms similarly report an increased demand for advice on cash management, cash flow, cash forecasting, and budgeting.

While none of these services are new to the bookkeeping realm, they’re more in demand now than ever before. Firms that have offered or added these services in the past several months have gone a long way toward securing their role as trusted advisor for their clients, which can also help ensure that both the role and the services will likely continue long after we’ve emerged from the pandemic.

Technology advice

Technology and automation have been absolutely critical to surviving the demands of the pandemic for nearly every industry. Bookkeepers, though, have not only been navigating these rough technological waters for themselves. Many have also found themselves taking on the role of technology advisors for their clients — a role far beyond the realm of traditional bookkeeping services.

Whether or not providing technology advice is something you expect to do, it’s something your clients today want and need, and that will likely be the case for the foreseeable future. According to the survey, 58 percent of firms said they now offer services in technology selection, implementation, and training. In fact, even 48 percent of those firms that hadn’t adopted technology or automation as growth levers internally still recognized that their clients relied on them as trusted technology advisors. Failing to embrace and understand technology and automation in your own practice represents a tremendous missed opportunity, given that clients are now turning to you for technology advice.

Not surprisingly, one of the hallmarks of surveyed firms that were most optimistic about future growth was their enthusiastic adoption of technology. As the bookkeeping profession has continued to be reshaped by technological advances, successful firms have recognized that bookkeeping is no longer just about balancing the books. In the era of remote work and collaboration, being a strategic business advisor necessarily involves offering technology advice to your clients. If you’re not adopting those technologies in your own practice, it’s difficult to truly be the trusted advisor your clients need.

A new era of advisory services

The bookkeeping industry has definitely seen a pandemic effect when it comes to strategic advisory services. So many companies have taken an economic hit this year, and nearly everyone has experienced new economic pressures that make it challenging to do business. Clients have turned to their bookkeepers for assistance in applying for emergency financial relief under the CARES Act and other legislation passed in the wake of the pandemic. Of the bookkeepers surveyed, 38 percent reported that they now offer services related to assisting and advising clients in relation to the Paycheck Protection Program or Economic Injury Disaster Loans.

Perhaps most unexpectedly, bookkeepers have been lending their clients moral support as they weather ongoing uncertainty. In the process, they’ve strengthened the client relationships that are critical to running a successful firm. Survey respondents identified a range of unusual support and services they’ve offered to their clients in the past nine months:

- “I’m the psychiatrist for my clients; they tell me things they won’t tell their own spouse or doctor.”

- “I offer profitable services, but I also have services that are not profitable and volunteer to help mothers who are unable to work by doing small projects for them that help them help themselves and their families.”

- “We do anything our clients need. From arranging funerals for loved ones to IT support, websites, to shopping and buying vehicles for them!”

These examples are just the tip of the iceberg. Simply put, bookkeepers are going the extra mile to help their clients with services that fall far outside the traditional scope of what bookkeeping firms do. As their clients succeed and emerge from the pandemic as thriving businesses, that dedication will be rewarded. The relationships being forged and strengthened today will continue long after the uncertainty dies down.

The future of advisory services

While there’s no question that bookkeepers have had to offer unusual client services as a result of the pandemic, this newfound level of service won’t likely go away in the future. Whether it’s increasing your bill pay services, advising on technology, or going even further outside the box, strategic advice has become a part of the bookkeeper’s business, whether intended or not. Adding these services into your business and pricing model is a key next step to building it into your future relationships.

As clients come to trust and rely on their bookkeepers for both traditional and nontraditional services, they’ll want those deeper relationships to continue even after things are “back to normal,” and they’ll be looking for more insights and more proactive advice to help guide their business decisions. Going above and beyond today will only make your clients trust you more tomorrow.