The accounting profession is evolving swiftly, and firms that do not keep up with that evolution may fall behind. Firms that have long focused most of their energy on offering traditional services, such as preparing tax returns and performing audits, particularly need to find ways to stay relevant and match the growing needs of their clients.

Clients are looking beyond audit and tax services, and want to partner with a trusted advisor. We need to provide services that reflect the current regulatory, tax and technology environment and help clients evolve and stay ahead of the curve. Those may include:

- State and local tax. Laws regularly change or are updated, and proactively advising clients on the best ways to navigate SALT laws can be a significant growth area for accounting firms.

- International tax. Clients need help as they expand their global footprint, sell or source products or materials from overseas.

- High-net-worth services. Many owners and shareholders can benefit from an independent view of their assets and the impacts on their personal taxes and planning, estate planning, generational-skipping of tax structures and insurance.

- Value and growth planning. Accounting firms can provide guidance for clients as they prepare for future growth and expansion.

- Succession planning. Private companies may have older founders who are looking to pass along management responsibilities or define an exit strategy.

- Emerging growth services. Growing companies are facing new challenges that come with activities like raising equity, developing new markets, expanding globally and going public. To serve those needs, accounting firms must offer more sophisticated business advisory and consulting services.

- Transactional advisory. There is a hunger in the market for mergers, acquisitions and divestitures, and most clients look for outside advice when this issue arises.

- Technology services. As client technology becomes more sophisticated, accounting firms have opportunities to help them with issues surrounding enterprise resource-planning systems, customer relationship-management systems, data analytics, business intelligence and cybersecurity.

- Industry-specific services. Accounting firms need to understand their client’s business, which means understanding their industry. They can provide an added perspective by offering industry-specific services and experts.

Upgrading practitioner skills

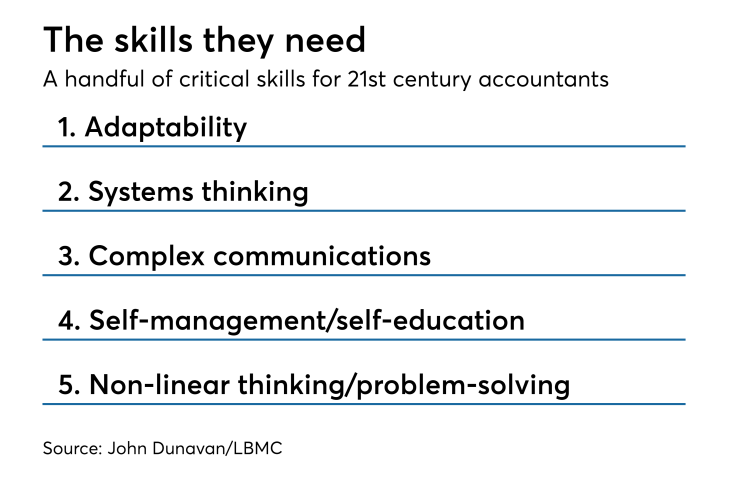

Traditional accounting and tax skills remain important, but as client systems and technology evolve, there is more emphasis on specialized skillsets. In the past, we recruited staff with a four-year accounting degree and we taught them how to audit and prepare tax returns. Now we recruit people with specialized technology and industry skills in areas like data science, engineering, business intelligence, data collection and data analysis.

Attracting higher-level talent with these skills may be preferable, but it can be difficult if they are established where they are and you are asking them to build a new practice. You may have more success with building a practice organically with the people you have and then building a case for specialized people to join later. You may also consider hiring industry-experienced people that may not be from traditional accounting backgrounds to serve as consultants and expand your internal network of advisors.

Client expectations

As new clients come on board and as clients upgrade their technology, accounting firms need to recalibrate how those clients are seen. Newer, younger companies tend to have less infrastructure, less history and are managed by younger entrepreneurs, who surround themselves with people who have a skillset that relates to where they are. There is a faster pace and an expectation of quicker answers and more immediate demonstration of value. That may not be the approach used for longer-standing clients, but aligning with expectations builds solid relationships and sets clear expectations.

Moving into the future

As traditional compliance activities become more commoditized, accounting firms are moving into a more consultative role. We now are expected to provide future-oriented services, providing insights on what clients’ current status is as it relates to future options. We should be providing more real-time analysis and relating that to what it means for the client’s future.

Technology is driving much of the change in the profession. Artificial intelligence, machine learning and robotics are already beginning to displace many of the hours our people spent on audits and tax compliance. Technology is expected to eliminate or automate up to 40 percent of basic client accounting work by 2020, so now is the time to redefine our roles in order to keep growing.

Key takeaways

1. Take a proactive approach to stay relevant to your clients.

2. Redefine your services to align with clients’ current and future needs.

3. Add the most strategic and value-add consultative services for your clients.

4. Develop and deepen industry expertise.

5. Hire the right people to match your firm’s goals and vision.