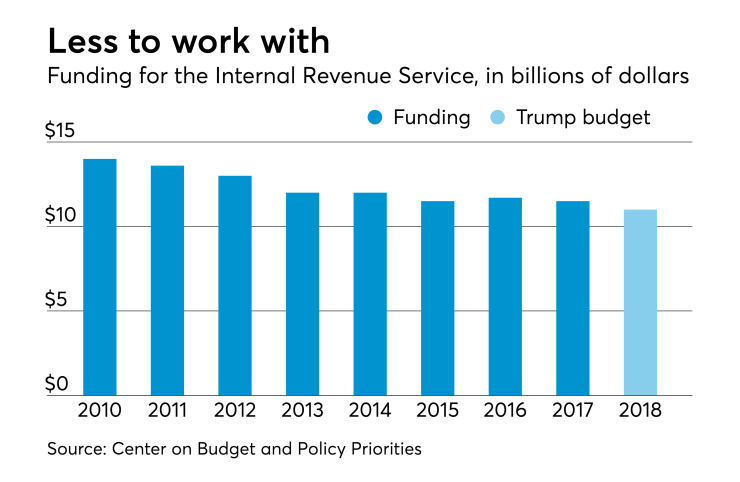

Now that tax reform has passed, it’s not just tax professionals and taxpayers that have to deal with it. The Internal Revenue Service, already constrained by budget woes, faces the most sweeping changes in tax law in more than a generation. This means designing new forms, promulgating guidance, and training their own personnel at a time when reduced funding since 2010 has impacted their ability to perform the basic functions of administering the tax system.

Taxpayer Advocate Nina Olson voiced her concern over challenges facing the IRS in her Annual Report to Congress in January. Her report noted that the reduction in IRS funding since FY 2010, approximately 20 percent in inflation-adjusted terms, has challenged the agency’s ability to perform the basic tasks of administering the tax system.

“As the National Taxpayer Advocate, I see daily the consequences of reduced funding of the IRS and the choices made by the agency in the face of these funding constraints,” she stated. “These impacts are real and affect everything the IRS does. Funding cuts have rendered the IRS unable to provide acceptable levels of taxpayer service, unable to update its technology to improve its efficiency and effectiveness, and unable to maintain compliance programs that both promote compliance and protect taxpayer rights. ‘Shortcuts’ have become the norm, and ‘shortcuts’ are incompatible with high-quality tax administration.”

In her report, Olson noted that the implementation of major tax legislation is always a “heavy lift” for the agency. For example, following enactment of the last major tax reform, back in 1986, the IRS made changes to 162 existing forms, developed 48 new forms, and created 13 new publications.

Counting the cost

While the IRS has not yet developed a final cost estimate for implementing H.R. 1, the Tax Cuts and Jobs Act, a preliminary estimate from earlier in 2017 projected that it would require additional funding of $495 million in fiscal years 2018 and 2019. The necessary tasks include programming and systems updates, answering taxpayer phone calls, drafting and publishing new forms and publications, revising regulations and issuing other guidance, training employees, and developing systems capacity to verify compliance with new eligibility and documentation requirements.

“The IRS will have its hands full in implementing the new law,” Olson reported. “We have already seen confusion about withholding changes, confusion about the deductibility of prepaid property taxes, and confusion about whether states can allow taxpayers to make charitable contributions in lieu of taxes as a way of permitting their residents to claim larger tax deductions than would otherwise be allowed because of the new $10,000 cap on the state and local tax deduction. The IRS will have a lot of issues to work through, and taxpayers will have a lot of questions. But with more funding, strong leadership, and a closer working relationship with Congress, I am convinced the IRS can do the job well.”

The American Institute of CPAs voiced similar concerns. “Whether addressed within or outside of tax reform, we urge Congress to address IRS taxpayer services,” the institute stated in a letter to Congress. “The legislative and executive branches should work together to determine the appropriate level of service and compliance they want the IRS accountable for and then dedicate appropriate resources for the service to meet those goals.”

Former IRS Commissioner Mark Everson believes the agency will get the funding it needs. “Everyone recognizes that the IRS needs to have extra funding,” said Everson, who is currently vice chairman of alliantgroup. “I don’t think they will have a tough time getting those funds. Congress should understand. They know that failure to execute correctly on the part of the IRS will come back to haunt them, so I think Congress will give them the money.”

“The practitioner community will have a lot of challenges,” he added. “When people go in with their paperwork for their annual conversation with their accountant, they will ask, ‘What about next year?’ But the IRS and practitioners did catch a break as to the timing of the legislation since, for the most part, it doesn’t affect the current filing season.”

Everson noted that the IRS will have to be very careful about prioritizing the guidance they will need to promulgate. “Taxpayers will try to figure out what is most beneficial and still be within the law,” he explained. “The IRS has to clarify what the proper interpretation of the law is. There will be litigation on top of that, and many challenges will go to court. It will take a long time to get these new issues resolved.”

“Anytime you have a tax bill of this magnitude, a lot of people will be waiting for the IRS take on how the bill will work,” agreed Roger Harris, president of Padgett Business Services. “Most tax professionals are concerned about IRS funding because whether you like them or not, they are a reality and they need to do their job properly.”

A junkyard dog

The IRS is overloaded and underfunded, but they will do what is absolutely necessary to administer the new law, according to Marty Davidoff, CPA, Esq., of E. Martin Davidoff & Associates CPAs. “The IRS is going to do what it has to do, minimally, to make sure the new law is enforced,” he said. “They’re not going to help people learn it or answer questions about it, because they don’t have enough personnel to answer questions on the existing law. Their dramatically reduced budget and dramatically reduced personnel over the last seven years has caused a diminution in services, and a diminution in enforcement.”

Davidoff cited a recent phone call from an Appeals officer as evidence of the degree to which the service is constrained: “We had already agreed on the adjustment, had agreed on the numbers, and all we needed was a conversation regarding the wording in the report they asked us to sign, because the wording was unclear. I wanted clarification of the wording, and she basically told me, ‘Marty, accept the wording as is or I’m going to close the case as unagreed.’ She was going to take the deal off the table, which would have meant dozens of hours to start over. It wasn’t normal for this Appeals officer to act this way. She just seemed under intense pressure.”

“What’s happening to the IRS is that they’re so pressured by a shortage of staff, and the work doesn’t go away, that they’re not allowing processes to happen the way they’re designed,” Davidoff continued. “Imagine a dog that’s well-cared for and which the owner likes. It’s a friendly, happy dog. But take the exact same dog, don’t feed it regularly, and the owner says, ‘You’re a bad dog.’ It ends up as a nasty dog in a junkyard. That’s what is happening. Congress — the owner — is turning the IRS into a junkyard dog.”

“The bottom line is they’re short personnel and they need more money,” he said.