The 20 percent pass-through deduction in the new tax law could provide a major benefit for freelancers and gig economy workers, but there are also some important caveats for the self-employed.

“Getting a 20 percent reduction off your business income for individuals who are either sole proprietors, or if they are self-incorporated and have business income that is below the threshold of the specified service of $157,500, or $315,000 if they’re married, is going to be quite an incentive for people to want to be independent contractors and freelancers,” said MBO Partners CEO Gene Zaino, whose firm provides technology for self-employed professionals.

Today there are over 40 million independent workers in the U.S., according to MBO’s research, and the number has been growing as more companies rely on contractors rather than employees. Many workers are affiliating themselves with gig economy apps like Uber, Lyft, TaskRabbit, Handy and others to earn extra money. The Tax Cuts and Jobs Act offers some incentives for the self-employed.

“It’s a pretty significant part of our economy, and it’s been growing quite fast,” said Zaino. “It’s actually growing five times faster than traditional employment. We think the new tax law and the benefit to the small business and independent sole proprietor is only going to be further motivation to accelerate the shift in the workforce from full time to having more and more people launch their own independent career.”

But there’s a great deal of risk to going freelance, particularly the loss of employer-provided health insurance and other employee benefits like a 401(k).

“That remains probably the single biggest job lock: benefits,” said Zaino. “But what’s happening is many independent workers are either covered through a spousal program, or there’s a lot of baby boomers who are pre-retirement or they have COBRA or are getting onto the Medicare program. They generally have other ways of getting health benefits.”

In January, the Department of Labor proposed to expand access to Small Business Health Plans, also known as “association health plans,” which don’t provide the full range of benefits required under the Affordable Care Act for plans offered by the state-run health insurance exchanges. Sole proprietors would be able to join the Small Business Health Plans. The proposal came not long after Congress eliminated the Affordable Care Act’s individual mandate requiring people to buy health insurance when it passed the Tax Cuts and Jobs Act last December.

“We think there’s going to be some dramatic innovation in that area that’s also going to have better health benefits available through the private exchanges, through the private insurance companies, now that the individual mandate is no longer in place,” said Zaino. “In other words, people can buy health insurance now that isn’t ACA compliant for their own individual purpose, and there’s not a penalty for doing that. I think you’ll see insurance companies also looking at products that could be attractive to this independent worker community. But that still is a big problem. What we see in our world today is most of these people have insurance through their spouse or through some other avenue.”

The Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through businesses such as sole proprietorships and partnerships, but there are limits, particularly when it comes to professional services firms such as accounting firms and law firms.

“Our understanding is that everyone would get it up until the threshold of $157,500,” said Zaino. “Once you break past that threshold, there are ‘specified services,’ which is basically just about every service industry other than architects and engineers that won’t be entitled to it any longer. But for the independent freelancer, $157,500 in pass-through profit is quite attractive for a one-person company, and certainly if they’re married, it can be up to $315,000. We think it’s going to be absolutely an accelerator for that segment of the market.”

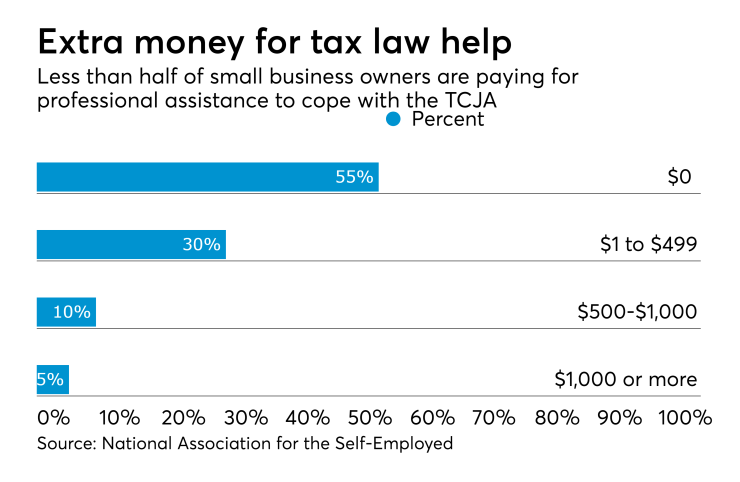

Many of the self-employed have little understanding of the new tax law, which is probably true of most taxpayers. A recent

A separate

Despite the dramatic changes in the tax code in recent months, the IRS is likely to still keep a close watch on employee versus independent contractor classification and misclassification issues.

“The law has not changed in terms of what is an employee and what is an independent contractor,” Zaino pointed out. “There are rules about that, regarding the level of control that your client has over the work that you do, and your real ability to have profit or loss and have entrepreneurial opportunity, what’s the nature of the arrangement, and are you really set up as a business. If you’re going to become an independent contractor, you have to really understand what that means. You have to set yourself up properly and know that you are taking on risk. You have to get your own benefits and your own business insurance. You have to market yourself and hold yourself out to be a true business.”

One thing companies should not do is pressure their employees to become independent contractors.

“I do believe you’re going to see people and companies push the envelope to probably convert employees into independent contractors, which is illegal, and that’s going to cause a lot of conflict,” said Zaino. “One of the biggest issues is to raise awareness and give people a better understanding of the difference between an employee and an independent contractor. Companies that are going to be using these people are at risk of potentially misclassifying the worker as their employee, and they should really understand those rules. For the actual freelancers and contractors who want to take advantage of this tax deduction, they should make sure they really understand how to set themselves up properly to be a qualified independent contractor. If they’re set up properly, I think there’s a great opportunity for them. But this is not a matter of just calling yourself an independent contractor and getting a 20 percent benefit.”