Some clients have always needed more time to get in returns, but this tax season saw an avalanche of extension requests. And while the Tax Cuts and Jobs Act played a major role, it wasn’t the only factor driving more and more clients beyond April 15.

CBIZ MHM experienced a much heavier load of extensions this year, due primarily to the complexities of reform, according to Bill Smith, Bethesda, Maryland-based managing director for the Top 100 Firm’s National Tax Office. “As many more pass-through entities had to extend, that had a ripple effect on 1040s, because individuals were not receiving K-1s by April 15,” he said.

CBIZ saw 7 percent fewer returns filed as of April 15 this year versus the prior year, and 13 percent more extensions filed, according to Smith.

“Heavier than it was last year,” said Helen O’Planick, an Enrolled Agent at HELJAN Associates in Manchester, Pennsylvania. “With tax law changes, it was just not easy to get some of the more difficult returns done in a timely fashion. And the clients didn’t seem to mind that at all.”

“Record-setting,” said John Dundon, an EA at Taxpayer Advocacy Services in Englewood, Colorado. “This cowboy won’t be roping and riding on any summer vacations this year.”

“Double the extensions we typically have,” said Debra James, an EA at Genesis Accounting & Management Services, in Lorain, Ohio. “All season we found folks procrastinating and experienced a mad rush at the end, more so than usual. I think the media painted a grim picture of what refunds and balances due would look like, and people were anxious about getting the returns done, and buried their heads in the sand for as long as they were able.”

“Many more extensions than normal,” reported Chris Hardy, an EA and managing director at Georgia-based Paramount Tax and Accounting. “Many of the early filers were extremely late this year. Not sure if this was due to the government shutdown in January or if it was just people in general.”

Other issues

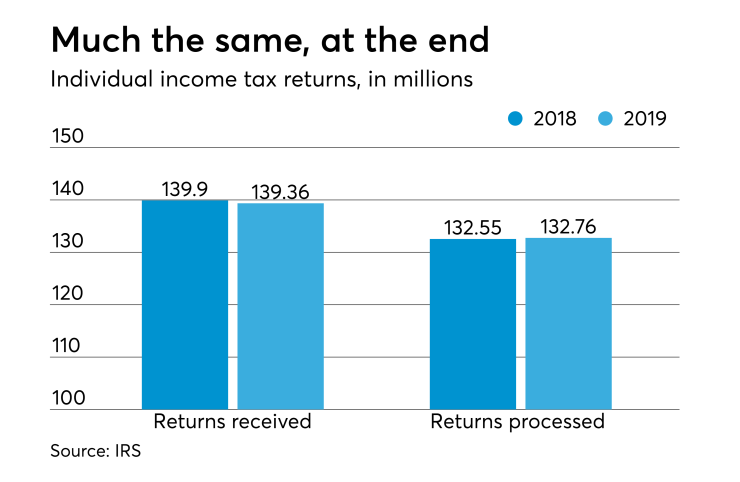

Overall this year, the IRS expected to receive about 14.6 million extension requests from taxpayers, many of them in the final days of filing season. Just hours before this year’s deadline the IRS warned that 50 million taxpayers had yet to file their returns. About 153 million individual tax returns for the 2018 tax year were expected to be filed during 2019, millions right before the deadline.

By filing’s end, the IRS later said, the

The IRS even

Not all preparers reported a backlog. “This year I had 62 extensions, last year I had 58, so not much change,” said EA Terri Ryman of Southwest Tax & Accounting in Elkhart, Kansas. “Mainly got behind because I was the bottleneck. Returns were ready but I couldn’t get them all reviewed in time.”

Aside from extensions, tax time also continues for many with communication – usually perceived as threatening – from tax authorities, according to

Blogger Jim Buttonow reports that an IRS survey found that 41 percent of taxpayers need help outside filing season: 10 percent get a notice, audit or other action initiated by the IRS, and 31 percent need information or assistance with their tax situation.

More than three out of five taxpayers also cite “fear of an audit” as a factor influencing compliance, and most taxpayers equate almost any IRS notice to an audit.