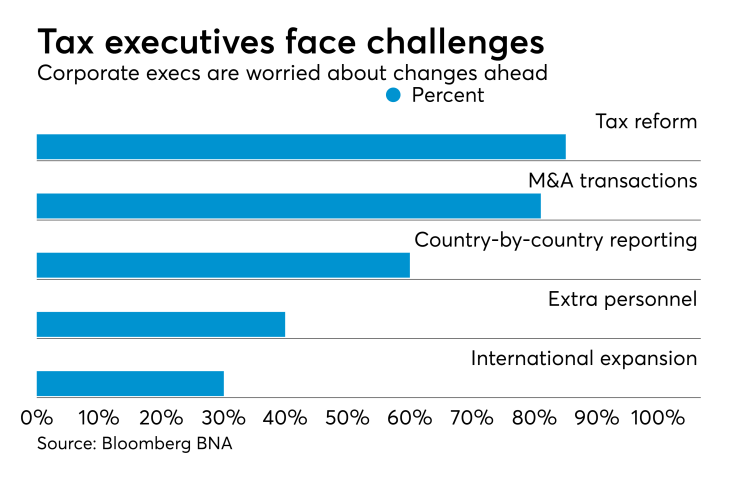

An 85 percent majority of corporate tax executives perceive tax reform as the biggest challenge they’re facing in the months ahead, according to a new survey.

The

Corporate tax executives are also worried about international tax changes, including country-by-country reporting requirements, cited as a challenge by over six out of 10 tax practitioners. Almost three out of 10 of them expect their companies will operate in more international jurisdictions in the year ahead.

Tax executives are also dealing with challenges at their companies, especially the absence of alignment between their accounting systems and their tax compliance or provision processes. Despite the expected tax reform overhaul, 52 percent of the tax managers polled anticipate no change in staffing levels while 40 percent are looking to add more employees. Mergers and acquisitions are on the horizon, with 81 percent of the respondents expecting their companies to pursue such deals in the year ahead.

“As highlighted by the survey’s findings, corporate tax professionals are facing a wealth of challenges as they look to prepare their businesses for what could be seismic changes,” said George Farrah, editorial director of Bloomberg BNA’s Tax & Accounting division, in a statement.