What many tax preparers have often suspected turns out to be true: The decision to use either DIY software or a paid professional comes down to, basically, cost versus accuracy, according to a recent study.

The researchers — Leigh Rosenthal, Bonnie Brown, Julia Higgs and Timothy Rupert — came to this conclusion after surveying 308 taxpayers. The sample was split into two groups: those who used DIY tax software to complete their 2017 federal income tax return and those who used a paid professional. From these subjects, the researchers gathered information about the taxpayer’s motivation for their preparation mode, their comfort with technology, and tax return and demographic information.

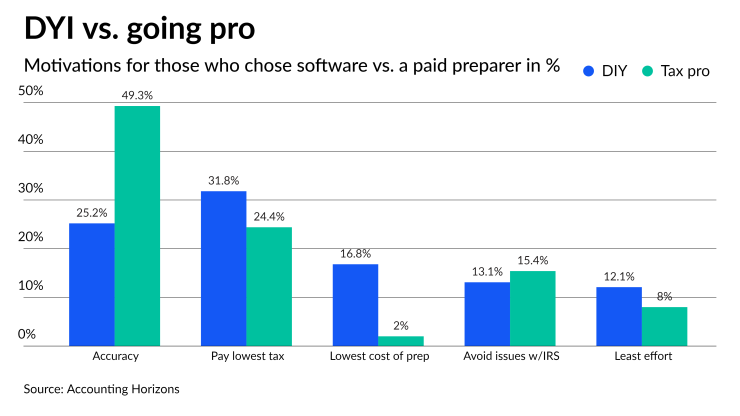

“We find that the motivations for choosing either software or a paid preparer differ between the groups. ... when asked what the single most important factor was for selecting their tax preparation mode, the software group cited minimizing the amount of taxes paid while the paid preparer group selected preparing the most accurate return possible,” the authors wrote.

The study found that 16.8% of DIY tax software users cited minimizing costs as their primary reason versus 2% of those who used a paid preparer; further, 12.1% of tax software users said their primary reason was minimizing total effort, in contrast to the 8% of paid preparer users who did so. The researchers expressed some surprise at this, saying that using tax software would seem to require more effort than paying someone.

Beyond motivation, the researchers found other factors that predict whether someone will be more likely to use DIY tax software versus a paid preparer. Age is one: The largest group of DIY tax software users are those in their 20s and 30s, and make up 29% of software users. In contrast, those who prefer paid preparers tend to be older, with 25.4% of them being 60 or up.

Income is another factor: 35.5% of those who prefer DIY tax software make between $25,000 and $50,000, versus only 15.4% of those who use a paid preparer; of those who prefer a paid preparer, 31.3% make between $75,000 and $100,000, versus only 7.5% of those who use DIY software.

Differences were also linked to what kind of return one filed. More DIY software users were single filers, 43.9%, while those who used paid professionals were more likely to be married filing jointly, 48.8%. Further, only a third of DIY software users filed a Form 1040 versus half of those who used a paid preparer. When asked what supplemental schedules were filed, 35.3% of the paid professionals group filed a Schedule A while only 21.5% of the DIY software users did so.

The study did not, however, find notable differences in terms of education level or gender.

Researchers said the findings have implications for the tax preparation industry. Given the study’s conclusions, they suggested tax software companies may wish to highlight tools to minimize tax costs, such as tools for choosing retirement contributions, selecting among educational incentives, or deciding which cost recovery incentives to use. Similarly, paid preparers looking to attract new clients may wish to emphasize their attention to detail and prioritization of accuracy.