The Internal Revenue Service is urging recipients of Supplemental Security Income and Veterans Affairs benefits to register their children and other dependents for the extra $500-per-child stimulus payments by May 5 if they haven’t already filed a tax return for 2018 or 2019, or else they may need to wait until next year to receive the extra money.

The IRS recently announced that SSI and VA benefit recipients would be able to automatically receive the economic stimulus payments for coronavirus (see our stories

Their $1,200 payments will be issued soon and, in order to add the $500 per eligible child to these payments, the IRS said it needs the dependent information before the payments are issued. Otherwise, their payment at this time will be $1,200 and, by law, the additional $500-per-eligible-child amount will be paid in association with a return filing for tax year 2020, so it won’t be received until next year.

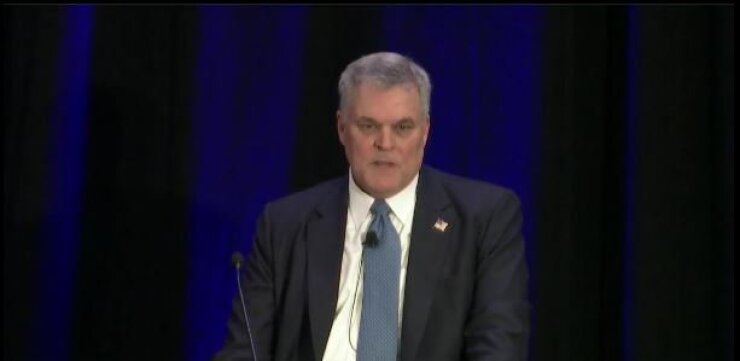

“We want to ‘Plus $500’ these groups so they can get their maximum Economic Impact Payment of $1,200 and their $500 for each eligible child as quickly as possible,” said IRS Commissioner Chuck Rettig (pictured) in a statement Friday. “They’ll get $1,200 automatically, but they need to act quickly and use the Non-Filers tool on IRS.gov to get the extra $500 per child added to their payment. Everyone should share this information widely and help others with the Plus $500 Push, so that more Americans get more money as fast as possible.”

After extensive work by the IRS and other government agencies such as the Social Security Administration and the Department of Veterans Affairs, $1,200 automatic payments will be starting soon for those receiving Social Security retirement, survivor or disability benefits, railroad retirement benefits, Supplemental Security Income and VA compensation and pension beneficiaries who didn’t file a tax return in the past two years. No action is needed by these groups, as they will automatically receive their $1,200 payment.

For VA and SSI recipients who have a qualifying child and didn’t file either a 2018 or 2019 tax return, a quick trip to a

To help get the word out to recipients with children about this special “Plus $500 Push,” the IRS has more material available on a