The largest auditing firms have seen a very slight erosion in their share of the market for audits of Securities and Exchange Commission-registered businesses over the past year, thanks in no small part to the flood of SPACs into the client pool.

Over the past decade, the share of SEC-registrant audits conducted by the 10 largest firms had climbed from 56.9% in 2014 to 68.8% in 2022, but according to Audit Analytics' recently released "

Much of this can be attributed to the significant number of special-purpose acquisition companies that have sprung up over the past two years: While the 10 top auditing firms account for 64% of all non-SPAC SEC audits, they handle only 49% of SPAC audits. And while SPACs make up only 10% of SEC registrants (707 out of 6,950), it was still enough to pause to halt (or at least pause) the previously inexorable rise.

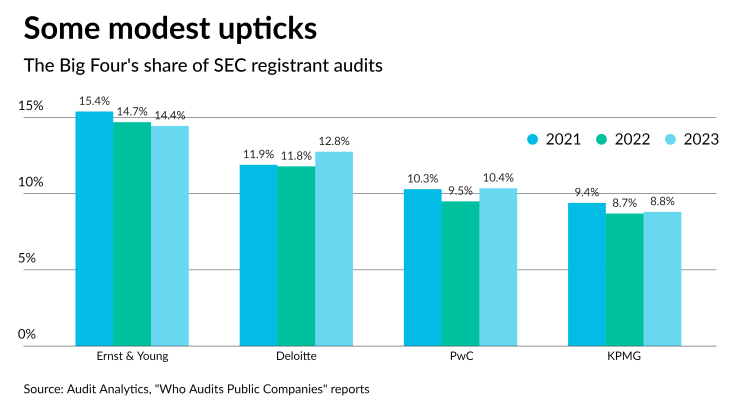

Meanwhile, the Big Four continue to dominate, both among the top 10 firms and overall, with 46.38% of the market, up from 44.7% last year.

And among the Big Four, Ernst & Young continues to audit the most SEC registrants, with 1,004 clients and 14.45% of the market. It's worth noting, though, that its share fell very slightly, from 14.7% last year. Closely following it were:

- Deloitte & Touche with 887 — at 12.76% (up from 11.8% last year);

- PricewaterhouseCoopers with 720 — at 10.36% (up from 9.5% last year); and,

- KPMG with 612 — at 8.81% (up from 8.7% year).