Filing season 2017 has swung sharply from a trickle to a deluge of returns filed, according to John Hewitt, founder and president of Liberty Tax Service: “It’s been the worst January in history, followed by the best February in history. This is the result of the PATH Act.”

To combat fraudulent returns, the Protecting Americans against Tax Hikes Act of 2015 mandated that refunds on returns involving the Earned Income Tax Credit or the Additional Child Tax Credit be held until Feb. 15, 2017. “There was a mistaken feeling among the populace that because the IRS would not release their refunds until February 15, they could not e-file until then,” said Hewitt. “That’s close to $50 billion in refunds that normally gets spent within the first week that taxpayers receive it. The economy is hurt by lower-income Americans not being able to spend.”

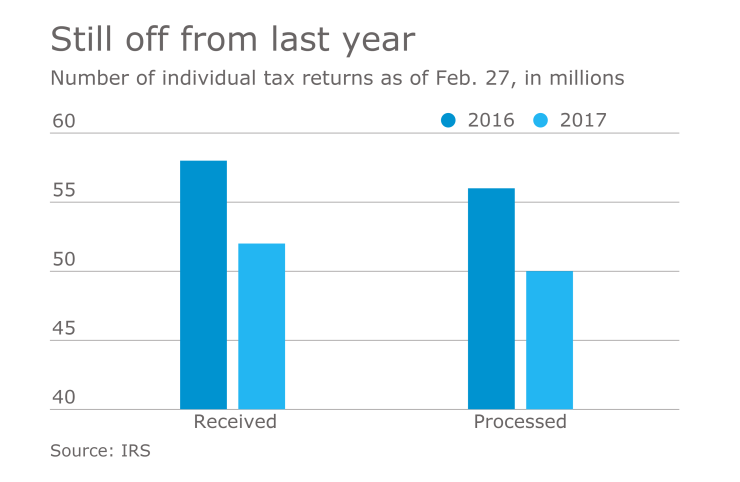

IRS filing season statistics for the week ending Feb. 10, 2017, showed a 17.2 percent decline in the total number of returns received and a 16.9 percent decline in e-filing receipts compared to the same time period last year. However, the IRS noted that calendar year-to-year comparisons are difficult at this early point in the season, since four additional days of tax return processing are included in the 2016 totals, and just a few weeks later the gap was closing (see chart below).

The PATH Act’s delay in refunds is not the only factor affecting the slower-than-usual start, according to Annie Schwab, tax manager at Padgett Business Services. “Yes, the number of returns is down in part due to the IRS holding refunds for the EITC and the ACC,” she agreed, “But people are also still hopeful that something will come from the Trump administration affecting their 2016 return, especially with regard to the Affordable Care Act.”

MAKING NIGHTMARES

Among other ACA issues is whether the IRS would reject “silent returns.” The agency had said it would reject any 2016 Form 1040s that were silent as to information related to the ACA’s individual mandate — that is, one where Box 61 is not checked, indicating full-year coverage; or one that does not include Forms 8965 or 8962, indicating that an exemption applies or that a premium tax credit was reconciled or a penalty payment was made.

“In February, the IRS reversed itself, saying that it would begin accepting such returns. However, the law is still in effect,” noted tax attorney Barbara Weltman, author of J.K. Lassers’ Small Business Taxes 2017.

This could cause problems, according to Beanna Whitlock, a Reno, Nev.-based practitioner and educator, and former director of National Public Liaison for the IRS. “The IRS doesn’t have the ability to go out and collect the penalty from a taxpayer for not having health insurance,” she explained. “Suppose a taxpayer qualifies for the Earned Income Tax Credit and is entitled to a $6,000 refund on the return. If they checked the box that they had no health insurance, the penalty on those children would reduce the refund from $6,000 to $4,000. If they file without disclosing that, what will the IRS do?”

“If a taxpayer doesn’t have health insurance, the only way the IRS can collect the penalty is by deducting it from their refund,” she noted. “The IRS can’t overtly go after the penalty, but I believe they will go after it based on the taxpayer receiving too much refund. They said in the notice that the law is still in effect. Just when we thought the ACA had left the building, it turns out it hasn’t. This is setting itself up to be an after-filing-season nightmare.”

To lessen the nightmare, Whitlock recommends practitioners have the taxpayer sign a “Disclosure of Taxpayer Refusal to Report Penalty for Not Having Health Insurance,” acknowledging that the taxpayer has voluntarily chosen not to report “whether there are individuals on the return for which the individual shared responsibility payment (penalty for not having health insurance) would apply or that no one had health insurance for which the penalty may apply.”

Her disclosure goes on to state that the taxpayer understands that they may receive a communication from the IRS, experience delayed refunds, and face subsequent collection activity. It states: “Although my return preparer has thoroughly explained the issue to me, I have made the decision not to complete Line 61 on the tax form and have so instructed my return preparer. I further understand that should I request my preparer’s additional assistance in this matter the fee paid for the preparation of the return does not include representing me in this matter should the need arise. Should I engage my preparer to represent me in this matter, I understand an additional fee will be required and determined at that time.”

NEW DEADLINES

The flip in the due dates for partnerships and corporations may not have impacted clients that much, but it has put pressure on practitioners, according to Schwab. “They need to get the partnerships done so the partners can file their returns,” she said. “If the flow-through return is extended, the owners have to extend their personal return.”

It was anticipated that the change in due dates would cause aggravation, observed Carl Giardino, managing director at Top 100 Firm CBIZ MHM. “We extended the partnership returns and communicated this to the partners. We may still get them filed by the historic deadline, and will in most cases file the partners’ personal returns by April 18 [this year’s deadline].”

“The real challenge has been that, although the federal return due dates have been reversed, in some cases the states did not change,” he continued. “Many states’ corporate returns are still due in March, so we might as well get everything done for March. For corporations, the change is more a formality than reality, but for partnerships, it was significant because those were entities that were not historically extended. When you talk extensions to clients that historically were not familiar with doing extensions, it becomes stressful. We assured them that if they filed on time in April in the past, we will still file on time for them.”

“If you’re not going to meet the March 15 deadline, start working with your client now,” advised Salim Omar, president of Morganville, N.J.-based Straight Talk CPAs. You want to avoid surprises to the client as well as your own team. “As practitioners, we knew about it, so it’s just a question of making sure you get the work done in a shorter amount of time. If you can’t get it done by the deadline, go on extension but keep the client in the loop. Let them know their return will still be filed by the April due date, if possible.”

Padgett’s Schwab noted that 2016 is the last year for filers age 65 or older to get the benefit of the 7.5 percent threshold to claim medical deductions. “Beginning in 2017, anyone of any age must clear the 10 percent of AGI hurdle to claim medical deductions,” she said.

Even if you have all your information and would otherwise file without an extension, this might be a year to extend, according to Paul Gevertzman, partner at Top 100 Firm Anchin, Block & Anchin. “That could give you the ability to file with some hindsight if there are tax law changes as are proposed,” he said. “Most things are in the books, but there still may be a few options that would shift income, such as whether to take accelerated depreciation or not, or whether to make certain automatic accounting method changes.”

DON’T LEAVE TOWN

Preparers with clients that owe a significant amount to the IRS should inform their clients that new Code Section 7345 gives the IRS the power to take away their right to travel overseas, according to David Shuster, director of international tax controversy services at Top 100 Firm Friedman LLP. The section was part of the Fixing America’s Suburban Transportation, or FAST, Act.

“The act passed in December 2015, but the IRS delayed implementation until very recently,” Shuster said. “It leads to the denial or revocation of a taxpayer’s passport if the taxpayer has a ‘seriously delinquent’ [$50,000 or greater] tax debt.”??Although it is a severe measure, it is not something that happens lightly, Shuster indicated. “Every taxpayer is entitled to a collection due process hearing,” he said. “If the taxpayer works out a payment plan with the government, that is good enough to prevent their passport from being denied. It would be prudent for practitioners to notify clients that may be affected that they may be at risk if they don’t work out a payment plan.”