The Securities and Exchange Commission approved a number of rule changes from the Public Company Accounting Oversight Board, including one that would toughen the ethics rules around the liability of those who contribute to audit firm violations.

The changes to Rule 3502, "Responsibility Not to Knowingly or Recklessly Contribute to Violations," would crucially change the standard for an associated person's contributory liability for a firm violation from "recklessness" to "negligence" — though it would maintain the requirement that the person have "directly and substantially" contributed to the violation.

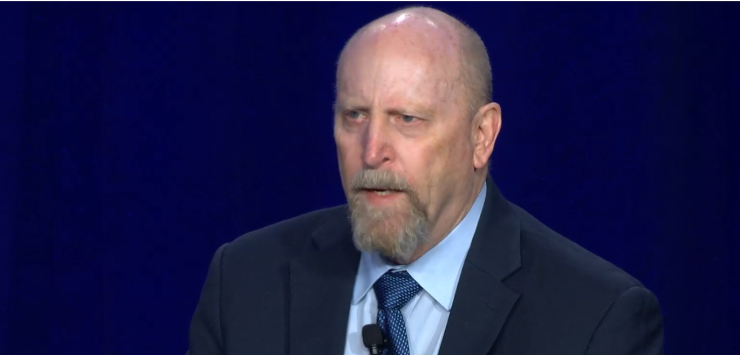

"The amendments to Rule 3502 are critical because moving the PCAOB contributory liability standard from recklessness to negligence aligns the rule with other negligence-based professional conduct standards, including the standard for sanctions by the commission for individuals negligently contributing to firm violations as well as certain state professional licensing requirements, that have long governed the accounting profession," the SEC's chief accountant, Paul Munter, said in a statement. "It also aligns the rule with the same standard of reasonable care that auditors are required to exercise when executing their professional duties."

SEC Commissioner Hester Pierce, who opposed the amendment as unnecessary, said in a statement, "It could have the unintended consequence of lowering audit quality and could worsen the trend toward fewer talented individuals entering the auditing profession."

"With this rulemaking, which updates a rule that is nearly 20 years old, the board has aligned PCAOB rules to what investors expect: that when an associated person's negligence directly and substantially contributes to firm violations, the PCAOB has tools to hold them accountable," said board chair Erica Williams, in a statement.

AS 1000, 1105 and 2301

The commission also approved the board's new AS 1000, "General Responsibilities of the Auditor in Conducting an Audit," along with related amendments to other standards, to "reaffirm, consolidate, and modernize the general principles and responsibilities of the auditor when conducting an audit."

Finally, it approved the PCAOB's amendments to AS 1105, "Audit Evidence," and AS 2301, "The Auditor's Response to the Risks of Material Misstatement," and conforming amendments, to address the use of technology-assisted data analysis in audit procedures. The changes specify and clarify auditors' responsibilities when they use such analytical tools in conducting audits.

"We thank our SEC colleagues for their review and approval of the PCAOB's standard-setting and rulemaking … . These changes are all wins for investors," Williams said in a statement. "One of the board's top strategic goals is to modernize our standards and rules to ensure they are best fit to protect investors from today's risks. Our markets are evolving every day. To keep investors protected in an era of rapid change, our standards and rules must keep up."

The amendments to Rule 3502 will become effective in 60 days, and do not apply to conduct before the effective date. AS 1000 will take effect for audits beginning on or after Dec. 15, 2024 (with a few specific exceptions). For AS 1105 and AS 2301, the amendments will take effect for audits for fiscal years beginning on or after Dec. 15, 2025.