The National Association of State Boards of Accountancy and the American Institute of CPAs have proposed a new CPA licensure model designed to "evolve newly licensed CPAs’ knowledge and skills, protect the public interest and position the CPA profession for the future," according to an announcement from the new groups.

NASBA and the AICPA wish to address the growing amount of knowledge required for modern CPAs, which includes a deeper mastery of subjects including systems, controls, SOC engagements and data analysis.

The proposal is a result of dialogue between AICPA members, firms, academia, students, tech experts and state CPA societies concerning "five guiding principles" of a new licensure model. More than 2,000 stakeholders offered feedback on these principles, hoping that a new licensure model would include:

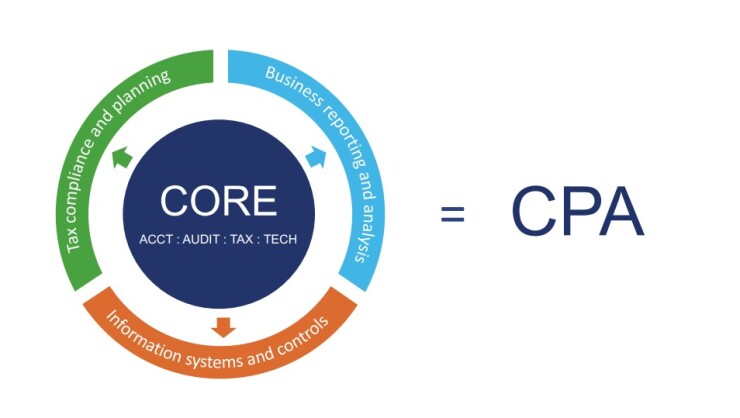

- More emphasis on technology skills and knowledge in licensure;

- Strong core competencies in accounting, auditing, tax and technology; and

- A revised model built around maintaining the relevance of the CPA license to ensure public protection.

“U.S. Boards of Accountancy, as regulators, must remain relevant to protect the public we serve,” stated NASBA chair Laurie Tish. “Today’s marketplace is shifting and CPAs need new skills to continue to serve organizations and the public. We need to ensure that CPAs continue to have the competencies needed to support an accounting profession that plays a critical role in protecting the public interest."

The proposed revised licensure model would require a strong core in accounting, auditing, tax and technology, before candidates proceed with a discipline to specialize in. The proposed model would result in a full CPA license, regardless of a candidate's specialization, with the same privileges as the modern CPA.

“The model we are proposing reflects the realities of practice today. When you look at the profession twenty or thirty years ago, it’s evident that the demands of CPAs have grown,” said Bill Reeb, chair of the AICPA, in a statement. "For example, today there are three times as many pages in the Internal Revenue Code, four times as many accounting standards and five times as many auditing standards as there were in 1980. As our body of knowledge has expanded, we’ve stretched the exam and curriculum to cover more and more material, but that approach isn’t sustainable. We need a licensure model that is flexible enough to evolve with our profession.”

NASBA and the AICPA are looking to finalize a new licensure model proposal by Summer 2020, before starting a multi-year implementation plan. Both organizations are seeking feedback on the proposed model, accepting submissions via email at

For more information, head to the CPA Evolution