The estate of late singer Michael Jackson prevailed on the valuation of the taxes owed to the Internal Revenue Service in a long-awaited ruling from the U.S. Tax Court.

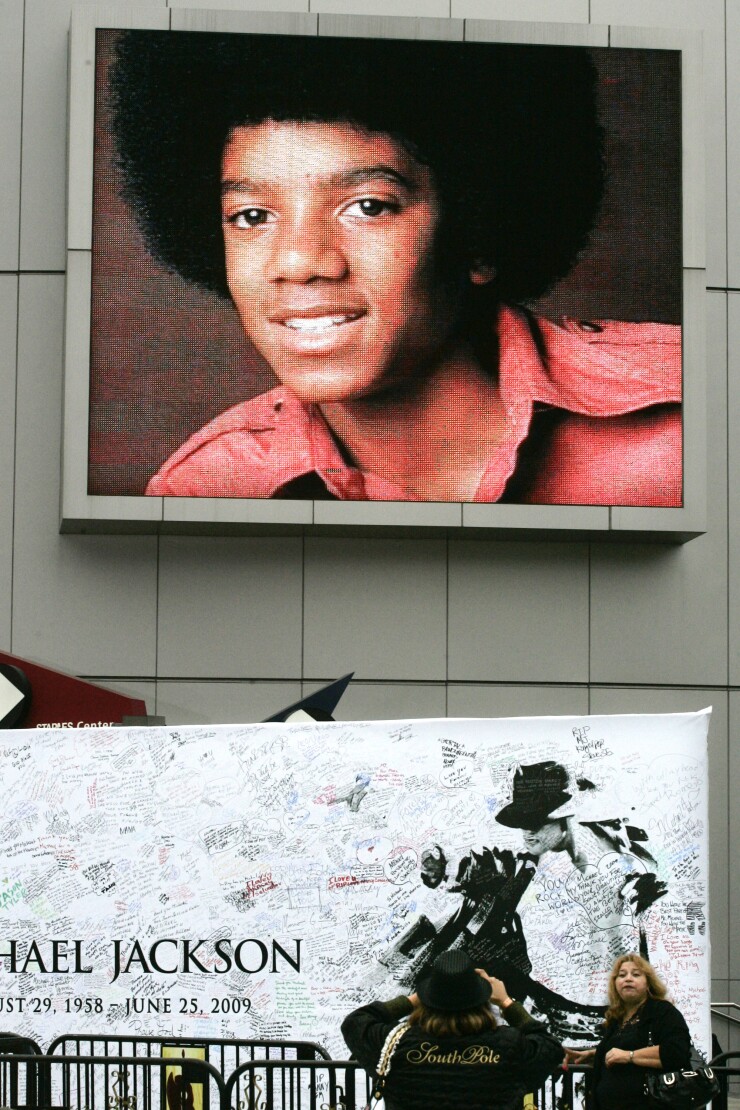

The court sided with the estate in valuing Jackson’s name and likeness at $4 million instead of the $61 million estimated by the IRS’s outside tax expert. After Jackson died in 2009 at the age of 50, the IRS had initially estimated the value was far higher and put the estate tax bill at over $500 million, including the values of two music business entities owned by Jackson, later lowering the total amount to $481.9 million, according to

The eventual outcome of the long-running case has been eagerly anticipated by estate tax observers, who had wondered at the relatively low valuation given to Jackson’s estate. The singer’s music has continued to sell strongly after his death, despite continuing controversies over his personal life fueled by accusations of child molestation, amplified by the 2019 documentary “Leaving Neverland.” However, the estate argued that the taxes should be based on the value on the date of Jackson’s death while he was trying to turn around his flagging career by readying a show that was set to premiere in Las Vegas.

The judge disagreed with the estimates of Jackson’s worth by the outside expert hired by the IRS, Weston Anson, chairman of Consor Intellectual Asset Management, an intellectual property consulting firm that specializes in trademark, patent and copyright valuation and has previously valued the intangible assets of deceased celebrities like Dr. Seuss, Andy Warhol, Audrey Hepburn, Tupac Shakur and Marlon Brando.

The judge’s opinion was scorching. “As the Commissioner’s only expert witness, Anson’s credibility was an especially important part of the case,” wrote Judge Holmes. “And it suffered greatly at trial. His problems began when he was asked about the effect on himself and his firm if the Commissioner prevailed in the case. He responded: ‘I have no idea. I’ve never worked for the Internal Revenue Service before.’ Later when asked whether he or his firm had previously been retained by the Commissioner to write an intellectual-property valuation report in Whitney Houston’s estate-tax case, Anson replied: ‘No. Absolutely not.’ That was a lie. Approximately two years before he testified, the Commissioner had retained Anson to write a valuation report titled, ‘Analysis of the Fair Market Value of the Intangible Property Rights Held by the Estate of Whitney E. Houston as of February 11, 2012 For Estate Tax Purposes.’ It was only after a recess and advice from the Commissioner’s counsel that Anson admitted to this. Anson also testified that neither he nor his firm ever advertised to promote business. This was also a lie.”

Anson did not immediately respond to a request for comment, and neither did the IRS.

The judge also had some criticism over the Jackson estate’s valuation. “Our finding reflects these facts: The Estate’s own experts used inconsistent tax rates,” Holmes wrote. “They failed to explain persuasively the assumption that a C corporation would be the buyer of the assets at issue. They failed to persuasively explain why many of the new pass-through entities that have arisen recently wouldn’t be suitable purchasers. And they were met with expert testimony from the Commissioner’s side that was, at least on this very particular point, persuasive in light of our precedent. This all leads us to find that tax affecting is inappropriate on the specific facts of this case.”

The amount of the adjusted estate tax bill has not been set, but Jackson’s estate welcomed the judge’s ruling. “This thoughtful ruling by the U.S. Tax Court is a huge, unambiguous victory for Michael Jackson’s children,” John Branca and John McClain, the estate’s co-executors, said in a joint statement Monday, according to The Wall Street Journal. “While we disagree with some portions of the decision, we believe it clearly exposes how unreasonable the IRS valuation was and provides a path forward to finally resolve this case in a fair and just manner.”

The Jackson estate was initially represented in the long-running case by a team that included Charles Rettig, who later became the IRS commissioner. Steven Toscher, managing principal of Hochman Salkin Toscher Perez P.C., who is now representing Jackson’s estate, told

The American Institute of CPAs sees lessons to be learned from the case for proper estate planning. “You may not have an estate the size of Jackson, but this is a reminder of the value of effective estate planning and assuring your assets are valued properly for tax purposes, and to keep the IRS from knocking on your heirs’ doors,” said the AICPA.