The Internal Revenue Service issued a warning Tuesday to tax professionals to be on guard against the identity thieves who are targeting them and their clients, fresh on the heels of a report from the National Taxpayer Advocate about long delays at the IRS in helping identity theft victims.

The IRS is joining once again this summer with its Security Summit partners in the tax industry and state tax authorities on its annual "

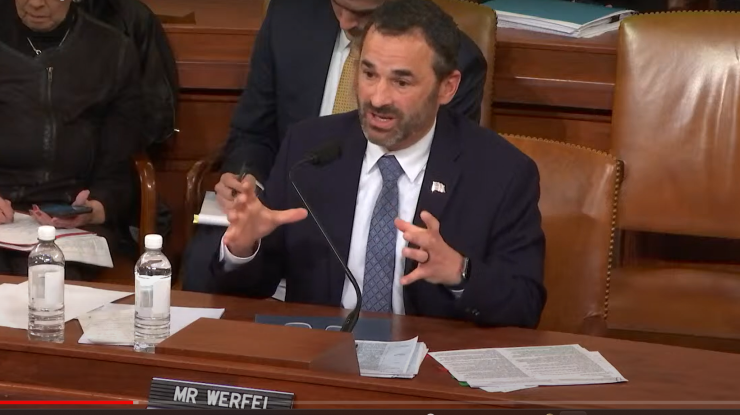

"Security threats against tax professionals and their sensitive taxpayer information continue to evolve, and it's critical to stay on top of the latest developments to protect their business and their clients," said IRS Commissioner Danny Werfel in a statement. "The Security Summit effort between the IRS, states and the nation's tax industry has worked to protect taxpayers and tax returns from identity thieves, and tax professionals form a key part of these security defenses. It's critical that everyone in the tax professional community, including smaller practices, stay current on the latest developments to keep their systems safe and protect their clients."

Last week, National Taxpayer Advocate Erin Collins released a

The effort by the IRS and its Security Summit to raise awareness about the identity theft problem aims to head off the problem before cybercriminals can access tax clients' information. The "

The IRS pointed out that security threats against tax pros remain a daily threat. Through the spring, the agency's stakeholder liaisons have received reports of nearly 200 tax professional data incidents potentially affecting up to 180,000 clients.

This summer, the IRS and its Security Summit partners hope to raise awareness among tax pros about the importance of maintaining strong security, and what to do if a security incident occurs. The effort comes just ahead of the IRS's

"There are special steps that tax professionals need to take to protect themselves from scammers trying to obtain sensitive information in attempts to file fraudulent state and federal tax returns," said Sharonne Bonardi, executive director of the Federation of Tax Administrators representing state tax agencies and a co-chair of the Summit's communications team, in a statement. "Continued vigilance by tax professionals is a critical part of the larger effort needed to protect tax information at the state and federal level."