The Internal Revenue Service's Criminal Investigation unit issued a warning Tuesday about the use of "money mule networks," criminals who exploit networks of innocent people to move illicit funds between bank accounts, currencies and blockchains in an effort to evade law enforcement.

The people who are exploited are referred to as "money mules," and they often don't even realize they're part of a criminal scheme. They may believe they're helping a friend, doing a favor for a love interest or performing job duties. However, IRS CI warned the consequences, which can come in the form of criminal charges, are the same for both willing and unwitting participants.

This month, IRS CI is teaming up with partners in the federal government and law enforcement to take part in an effort they call the Money Mule Initiative to identify and prosecute facilitators of money mule schemes. Participating agencies include the Department of Justice, the FBI, the U.S. Postal Inspection Service, the Department of Labor Office of Inspector General, Homeland Security Investigations, the Small Business Administration Office of Inspector General, the U.S. Secret Service, and the Commodity Futures Trading Commission.

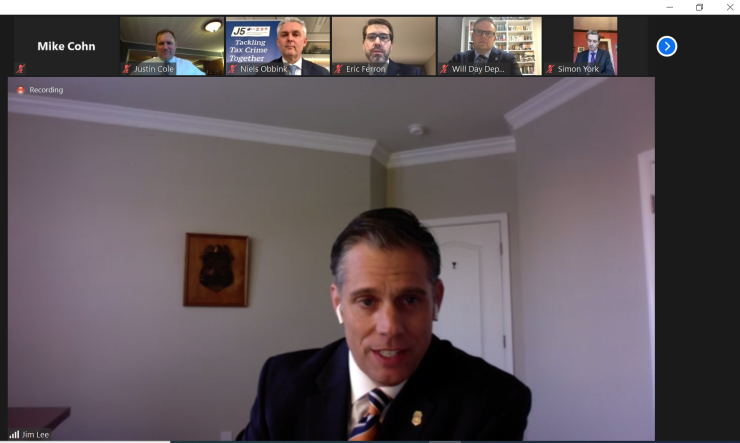

"Fraudsters prey on people's vulnerabilities — whether that's the need for friendship or the need for a job — and that can result in devastating financial and legal consequences for a person recruited as a money mule," said IRS CI Chief Jim Lee in a statement Tuesday ahead of his

Money mule networks use social media, employment and dating websites, email spam, classified ads and dark web forums to recruit unwitting participants. They send unsolicited email and social media messages promising easy money with little to no effort. They can also pose as a prospective employer who asks a job candidate to open a bank account to receive and transfer company funds as a condition of employment. They may strike up an online relationship and ask their romantic partner to transfer funds on their behalf using a money services business, a wire transfer or the U.S. Postal Service. Sometimes the "mule" is told to keep part of the funds for themselves, making them a recipient of illicit money.

IRS CI advised anyone who believes they're part of a money mule network to immediately stop all communication with the suspected criminals and not to transfer money or any other items of value. Potential victims should maintain any receipts, contact information and relevant communication like emails, chats and text messages. They should also notify their local IRS CI field office and report suspicious activity to