The Internal Revenue Service needs to do more to get ready for new reporting requirements on the Form 1099-K and 1099-DA, according to a new report.

The

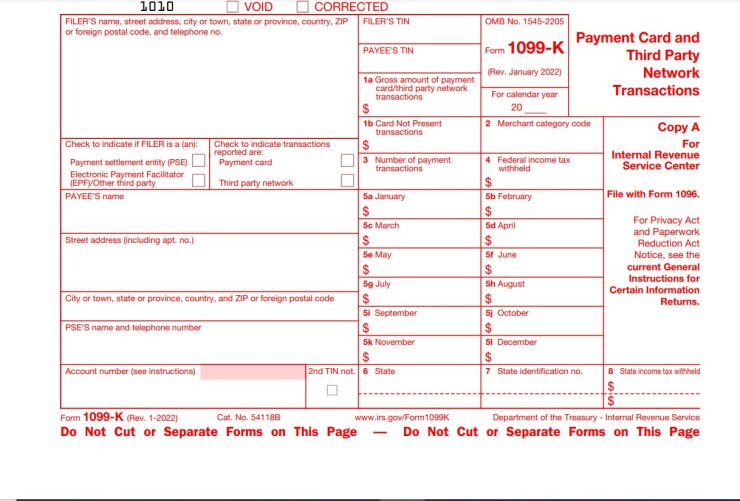

The report discussed the recently lowered Form 1099-K reporting threshold, pointing out that the American Rescue Plan Act of 2021 changed reporting requirements for Third-Party Settlement Organizations, such as some online marketplaces that connect users to goods and services. The reporting requirements will apply to many widely used payments received through services such as Venmo, PayPal, Airbnb, eBay, Etsy, StubHub, Cash App and more. Previously, TPSOs were not required to report payments on Form 1099-K unless they exceeded $20,000 and there was an aggregate of at least 200 transactions. However, under the ARPA law, TPSOs have to report payments that exceed $600 annually. In response to concerns about millions of taxpayers suddenly receiving the unfamiliar forms, the IRS decided to delay full implementation of the requirement for two years, but it didn't consistently document the risks for its decisions. Some lawmakers have questioned the IRS's decision to start phasing in the new requirement at a level of $5,000 in tax year 2024 without congressional authorization.

"Documenting risks will help ensure IRS has a sound rationale for decisions and is prepared for the reporting threshold change," said the report.

For Form 1099-DA for reporting on digital assets, which was also the result of another recent law, the Infrastructure Investment and Jobs Act of 2021, the IRS has begun planning its outreach and education efforts for new cryptocurrency reporting in its communication strategy. "But the IRS is missing an opportunity to apply lessons learned from its Form 1099-K implementation efforts, such as what did and did not work well," said the report.

The GAO noted the IRS did not have plans to evaluate its communication efforts. "Incorporating lessons learned and evaluating outreach and education efforts could help IRS more effectively prepare for the new reporting and adjust communication efforts, if needed," said the report.

Information returns provide benefits, but also create burdens, the report pointed out. For example, Congress's Joint Committee on Taxation estimated that digital asset reporting will increase revenue by $28 billion over 10 years after implementation. But third-party filers will still face costs and challenges in tracking such information for reporting.

The GAO made four recommendations in the report to the IRS, including updating its policies and procedures to require documentation of risk; incorporating lessons learned into its Form 1099-DA communication strategy; and evaluating its outreach and education efforts. The IRS agreed with and intends to implement all four recommendations.

An IRS official said the agency is "working judiciously" to implement both the 1099-K and 1099-DA requirements. "We acknowledge the benefits and burdens of expanding third party information reporting and share GAO's goal of continuously evaluating and improving information reporting administration to improve voluntary compliance," wrote IRS chief tax compliance officer Heather Maloy in response to the report. "We will continue to use information return data to improve our compliance efforts."