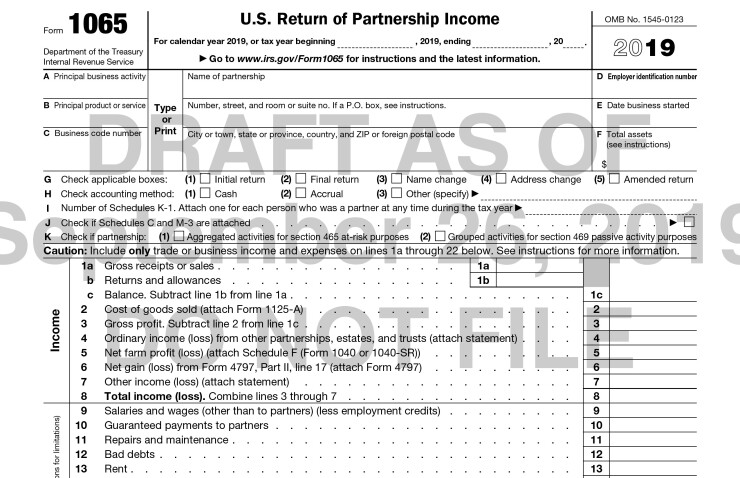

The Internal Revenue Service released drafts of the two critical partnership forms for 2019.

The proposed versions of

The forms request some additional information to “aid the IRS in assessing compliance risk and identifying potential noncompliance, while ensuring that compliance taxpayers are less likely to be examined.”

Some of the changes also reflect the requirements of the Tax Cuts and Jobs Act.

Partnership filings have increased significantly in the last 15 years, according to the IRS, rising 59 percent from approximately 2.5 million Form 1065s in 2004 to more than 4 million in 2017. That was a “considerably” larger increase than in the number of C corp and S corp filings, which only rose about 14 percent over the same period.

The IRS also released drafts of the 2019

All four forms are considered “near-final” and are meant to give tax practitioners and software providers a preview of what’s coming before the final version are released in December.

Comments are being accepted for 30 days at