The Internal Revenue Service posted a Spanish version of its Form 1040 and instructions Tuesday and made available publications and online information in other languages.

For the first time ever, the IRS posted a

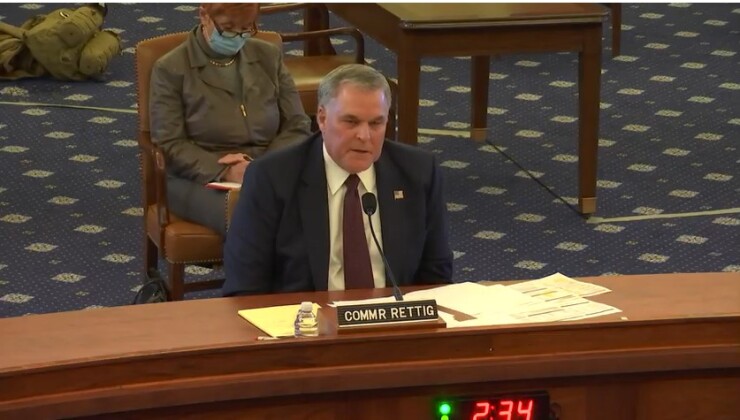

The move is part of IRS Commissioner Chuck Rettig’s goal of making the IRS more multilingual. Rettig has talked at tax and accounting conferences and congressional hearings about how his wife is an immigrant for whom English wasn’t her first language, so he understands the need to make tax forms and information more widely available (

The IRS is also introducing a new Form 1040 Schedule LEP, “Request for Change in Language Preference,” in

“When it comes to filing taxes, being able to ask questions and read forms and instructions is crucial,” stated Ken Corbin, who is the first to fill the new role of IRS Taxpayer Experience Officer, while continuing to be commissioner of the IRS’s Wage and Investment Division. “We take that very seriously and continue to work toward ensuring all taxpayers have what they need without obstacles.”

The IRS is also making available some other materials and services in multiple languages:

Publication 1 , "Your Rights as a Taxpayer," and other basic tax information are now available in20 languages on IRS.gov.- Taxpayers who interact with an IRS representative have access to

over the phone interpreter services in more than 350 languages. - The Earned Income Tax Assistant tool is now available in

Spanish . - The IRS is continuing to post multilingual information in its

social media channels , including Twitter and Instagram. Key messages are going out in six languages, includingSpanish ,Vietnamese ,Russian ,Korean ,Haitian Creole andChinese , using both Twitter Moments and Instagram Highlights. - The recent Form 1040-SR for seniors, in

English andSpanish , offers larger print and a standard deduction chart to make it simpler to use for older Americans. - Form W-4 allows taxpayers to correctly adjust their withholding during 2021. The

English language version as well as theSpanish language version are available.

The IRS is also adding information about translation services and other multilingual options in the top notices it sends out to taxpayers. For more information, see the “