The House Ways and Means Committee approved bipartisan legislation Wednesday to expand automatic enrollment in 401(k) plans, expand a tax credit for small-business startups and promote the Saver’s Credit.

The legislation, known as the

Passage of the bill through the committee stage comes at a time when Democrats and Republicans in Congress are negotiating with the Biden administration over the American Jobs Plan and the American Families Plan, which contain far-reaching changes in tax rates and tax credits for businesses and individuals. In a narrowly divided Congress, lawmakers are looking for ways to demonstrate that they can still work together to pass legislation, even when it involves complex tax and financial policies.

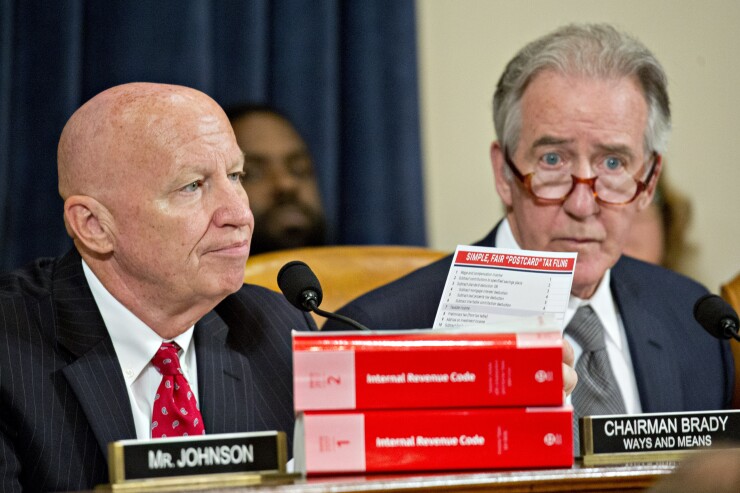

“The retirement crisis in America is real, and will only get worse without easier pathways to saving and encouraging workers to start planning for retirement earlier in life,” Neal and Brady said in a joint statement. “This legislation expands automatic enrollment, simplifies many retirement plan rules, and strengthens small businesses’ ability to offer workplace retirement plans, to make it easier for Americans to plan for their golden years. Passage of this bill is a tremendous bipartisan accomplishment and a feat for our entire committee. ... We hope to see this measure move through Congress and be signed into law in short order.”

The bill would promote savings earlier for retirement by enrolling employees automatically in their company’s 401(k) plan, when a new plan is created. It would also create a new financial incentive for small businesses to offer retirement plans. The bill also would direct the Internal Revenue Service to promote the Saver’s Credit to increase utilization. It would also expand retirement savings options for nonprofit employees by allowing groups of nonprofits to join together to offer retirement plans to their employees. In addition, it would allow individuals to save for retirement longer by increasing the required minimum distribution age to 75.

The bill would also offer individuals ages 62, 63 and 64 more flexibility to set aside savings as they approach retirement. It would allow individuals to pay down a student loan instead of contributing to a 401(k) plan and still receive an employer match in their retirement plan.

The legislation would also give individuals more flexibility to make gifts to charity through their IRAs, and permit taxpayers to avoid harsh penalties for inadvertent errors managing an IRA. It would also protect retirees who unknowingly receive retirement plan overpayments.

The bill would also modify the tax credit for small employer pension plan startup costs. The three-year small-business start-up credit is currently 50 percent of administrative costs, up to an annual cap of $5,000, but the bill would make changes to the credit by increasing the startup credit from 50 percent to 100 percent for employers with up to 50 employees.