A wealthy grandmother won a $19 million arbitration award against J.P. Morgan Securities and two former brokers — her grandsons — over alleged unauthorized trading in her accounts.

The ruling came 18 months and 43 hearing sessions after retail matriarch Beverley Schottenstein filed claims against the firm and her grandsons for alleged abuse of fiduciary duty, fraudulent misrepresentations and omissions and other misconduct. A panel of three FINRA arbitrators

Schottenstein’s late husband and his brothers developed a retail empire that became Schottenstein Stores Corp. and later grew to include stakes in shoe retailer DSW, clothing chain American Eagle Outfitters, American Signature Furniture, more than four dozen shopping centers, several shoe and furniture factories and grocery chain Albertson’s Companies, among other holdings, according to business data company Dun & Bradstreet.

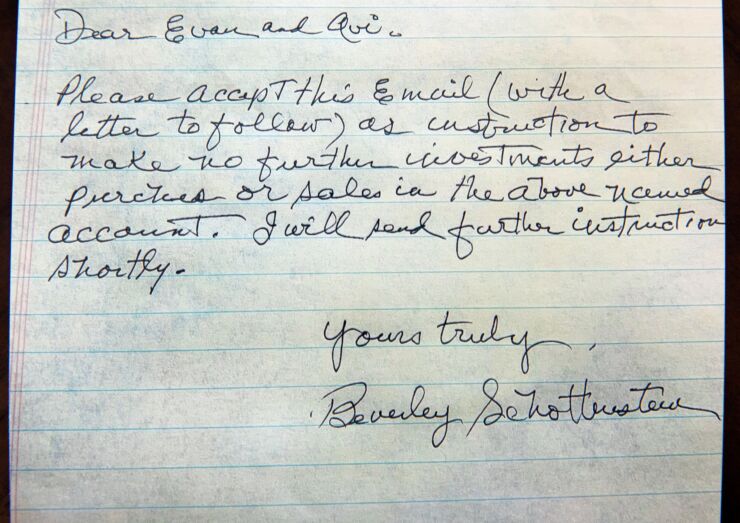

Schottenstein alleged that while working as financial advisors at J.P. Morgan Securities, her two grandsons engaged in unauthorized trading of “multiple auto-callable structured notes and various other securities” for which J.P. Morgan Securities was a market maker, “including Apple stock, as well as initial public offerings (IPOs) and follow-on offerings (FPOs),” according to the arbitration award. The alleged unauthorized trading in her account purportedly generated hefty commissions for the two grandsons, Evan Schottenstein and Avi Schottenstein.

Jonathan Brennan, a lawyer for the two grandsons at Maynard Cooper & Gale in New York, says in a statement that his clients “are deeply disappointed by the result and believe it is not justified by the facts or the law.” His statement adds that the award “is inconsistent with the substantial evidence presented at the hearing which showed that over the entire time Evan Schottenstein served as his grandmother’s financial advisor, Mrs. Schottenstein’s accounts profited by more than $30 million.”

The statement also says that “given the extensive contact between Mrs. Schottensein and her grandson (over 2,400 calls while at J.P. Morgan), the evidence overwhelmingly suggests that Mrs. Schottenstein’s account was invested in full accordance with her wishes.” It concludes by saying that the grandsons’ lawyers are “considering a motion to vacate” the FINRA ruling.

A spokesperson for J.P. Morgan Securities did not respond to requests for immediate comment.

Evan Schottenstein worked at J.P. Morgan Securities as a broker from 2014 to June 27, 2019, when he was discharged over “concerns relating to trading activity for the account of a family member,” according to a note the bank entered into his FINRA BrokerCheck record. Prior to J.P. Morgan Securities, he worked at Morgan Stanley and Citigroup. He isn’t currently registered with FINRA.

Evan’s brother Avi Schottenstein worked as a J.P. Morgan Securities broker from 2014 to July 23, 2019, according to BrokerCheck. Avi, also no longer FINRA-registered, previously worked for Morgan Stanley. Both grandsons worked out of J.P. Morgan Securities’ headquarters on Park Ave. in New York.

In all, the grandsons allegedly made more than 360 unauthorized trades, generating hefty commissions for themselves. As part of trading investments without their grandmother’s permission, the grandsons also off-loaded a “legacy position” that Schottenstein held in Big Lots, a Schottenstein empire investment, worth around $52 million, says Scott Ilgenfritz, a lawyer for the matriarch at Johnson Pope Bokor Ruppel & Burns in Tampa, Florida.

Beverley Schottenstein, 94, resides in the wealthy enclave of Bal Harbour, Florida. She inherited her late husband’s 25% stake in the family empire but later sold it to one of his brothers, Ilgenfritz says. Evan first persuaded his grandmother to become his client in 2006, when he was at Citigroup, according to her attorney.

Ilgenfritz claims the two brothers had created and used a fictitious email account for their grandmother to “receive” documents disclosing the trades in her J.P. Morgan Securities account. Only the matriarch “never got the documents, because she’s not on the computer,” the attorney says. Her account was a non-discretionary account, meaning that a broker has to get an investor’s permission before making trades.

He says his client first suspected the alleged misconduct around August 2018, when she realized she hadn’t been receiving paper statements. “She started to get suspicious,” he says.

In December 2018, a granddaughter who was visiting used Schottenstein’s J.P. Morgan Securities credit card to log in to the matriarch’s account. The granddaughter saw “very alarming” trades, including for a $150 million position in derivatives known as auto-callable structured notes, and told her grandmother, according to Ilgenfritz.

The matriarch had been revising her estate planning documents in prior months, and, after seeing the suspicious trades, she wrote a five-page amendment to her will and trust that accused her grandsons of “taking over her financial affairs and keeping her in the dark,” Ilgenfritz says. He declined to comment when asked if she had cut them out of her will.

“Evan was by far the predominant person in trading activity,” Ilgenfritz says, although “Avi got a share of the revenue” from allegedly unauthorized trades through a partnership he formed with his brother in May 2016. Through the partnership, which handled the matriarch’s account and which J.P. Morgan Securities would have known of and approved, according to Ilgenfritz, Evan got 80% of the revenues, while Avi got 20%. Overall, Schottenstein’s account generated gross revenues of $3,885,430, through commissions, selling concessions and IPO-related and other fees.

Around February 2019, the granddaughter mailed to the bank the handwritten amendment accusing the two brokers of wrongdoing, according to Ilgenfritz. That month, Schottenstein attempted to transfer the bulk of her J. P. Morgan Securities assets to an account at Goldman Sachs, but J. P. Morgan Securities put a temporary freeze on her account. The bank lifted the freeze after about two weeks passed, and the transfer was completed around the end of that month, according to Ilgenfritz.

Schottenstein’s claim, filed on July 24, 2019, was handled remotely via Zoom by a FINRA panel in Boca Raton, Florida. Fees for the 43 hearing sessions for the claim totaled $64,500; the panel ordered the bank and Evan Schottenstein to pay the fees.

The $19 million arbitration award is FINRA’s largest since October 2018, a spokesperson for the regulator said. Schottenstein had initially requested at least $10 million in compensatory damages, punitive damages of three times that amount, disgorgement by J.P. Morgan Securities of all trading revenues and commissions and reimbursement of various legal fees. She later upped her request for compensatory damages to more than $69 million.

As part of the award, the arbitration panel ordered J.P. Morgan Securities to rescind the grandsons’ investment of their grandmother’s money in a private equity fund run by Coatue Management. It also ordered the bank and Evan Schottenstein to each pay one half of the grandmother’s legal fees in the case. And the panel denied Avi Schottenstein’s request to have his FINRA records expunged.

The Schottenstein family was once on the Forbes 400 wealthiest Americans list, with a net worth of