The Global Reporting Initiative released a

The proposal comes in the wake of a number of international tax-related scandals, including the release of the Panama Papers and Paradise Papers, leading to greater demand from investors, civil society, media and governments for more information on how companies approach taxes.

To address that need, GRI’s independent standard-setting body, the Global Sustainability Standards Board, began a project earlier this year to consider creating a new reporting standard to promote more transparency around a company’s approach to taxes. It published the draft standard Thursday for public comment.

“Stakeholders need and expect consistent, quality information about tax and payments to government in order to have an informed public debate around questions of equity, fairness and acceptability of tax approaches,” said Global Sustainability Standards Board chair Judy Kuszewski in a statement. “Tax revenues and their application are essential to society’s ability to deliver on the Sustainable Development Goals. Likewise, tax transparency promotes trust and credibility in the taxation system and in the tax practices of companies. It enables stakeholders to make informed judgments about whether a company’s position on tax and payments to governments reflects society’s priorities and creates a reliable basis for decision-making.”

A recent study from RobecoSAM found that only 17 percent of 830 companies polled were reporting publicly on tax payments at a country level, and most of them were only operating in a single country.

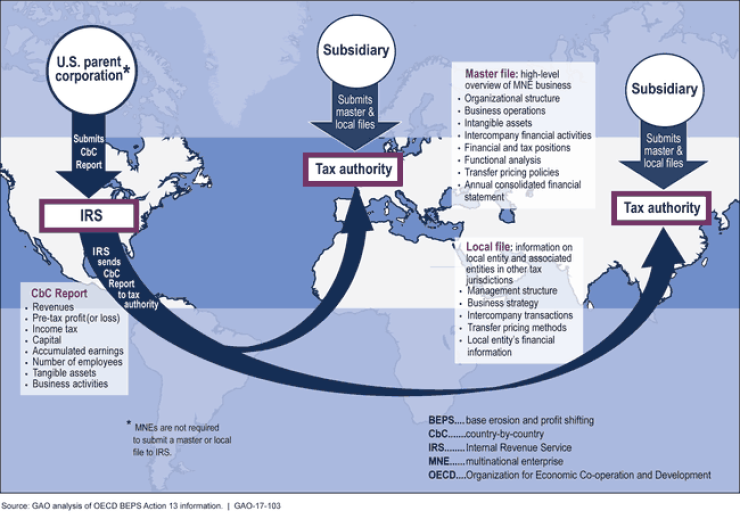

That number is expected to increase significantly, as 80 percent of respondents in a recent survey by Deloitte of multinational tax and finance managers and executives said they expect the Organization of Economic Cooperation and Development’s country-by-country reporting requirements to be adopted globally in the next few years, as more countries aim to combat base erosion and profit shifting, or BEPs, under the OECD's BEPS action plan. GRI’s proposed tax standard aims to take a significant step toward providing such reporting by laying out common, defined disclosures related to tax strategy, governance, control, risk, and stakeholder engagement, along with country-by-country reporting of income, tax and business activities.

The