With the effective date for the new lease accounting standard taking effect at the end of the year for public companies, many are finding themselves unprepared and their accounting systems in need of an upgrade.

“The approach for implementing this lease accounting pronouncement really needs to be holistic for a company,” said CohnReznick partner Rebecca McDonald. “It can’t be siloed with just the accounting department. It has a broad reach across the organization and impacts a lot of different departments.”

The new standard requires putting many leases on the balance sheet for the first time, and she believes the accounting and finance department needs to take the lead role to drive the implementation. But the effort also should heavily involve the operations, IT, treasury, tax and facilities groups.

“It just has a broad reach,” said McDonald. “You have to work across the organization to really be able to gather all the information needed to implement the standard as far as the leases go, and to have that holistic team approach to make sure you leave no stone unturned when analyzing whether any of your contracts or any of your leases that haven’t been on the balance sheet are reported that way will be impacted, just to make sure that you have a complete inventory of all the contracts and leases that are in the organization. It’s just a lot heavier lift than it has been historically.”

Her colleague, Matthew Derba, a senior manager at CohnReznick, agrees that many companies are unprepared for the wide-ranging effort involved with the leasing standard, especially after they have just needed to get ready for the revenue recognition that took effect at the end of last year for public companies.

“I would say that from just talking to people internally about their clients, and having external conversations with other CPAs and other people in the profession, outside of the large public companies, a lot of entities are not necessarily as prepared for this as at least we think that they should be,” he said. “It’s easy to underestimate this because it’s following the revenue standard change, which is a major overhaul of revenue accounting.”

Survey Results

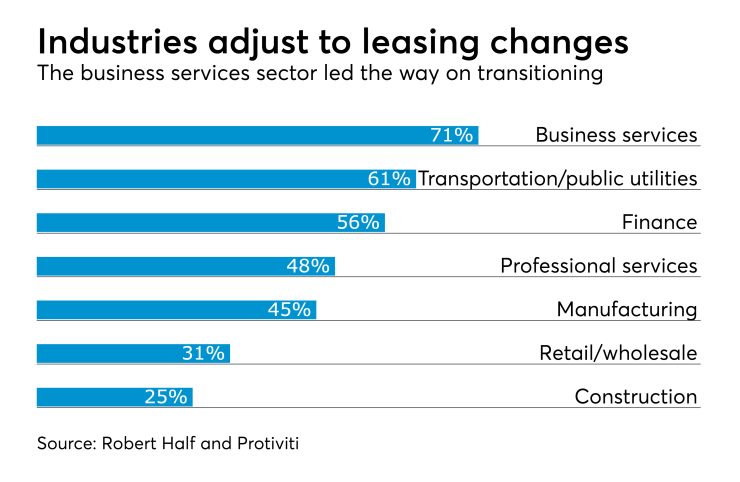

A survey released last week by the staffing company Robert Half and the consulting firm Protiviti found only 44 percent of companies have begun the transition to the new lease accounting standard. Among companies that have moved to adopt the standard, only 48 percent of the respondents at these organizations reported completing an assessment of how much needs to be done. Only 37 percent of the smallest companies in the survey, with between 20 and 49 employees, have begun the lease accounting adoption process. On the other hand, 69 percent of companies with 1,000 or more employees have begun the transition. Companies with 100 to 249 and 1,000 or more employees said that finding employees with the needed skills was their top challenge with the transition to the new standard. That also ranks among the top three issues for the smallest companies.

Business services companies were the most likely to have begun the transition, at 71 percent, according to the survey respondents. Only 31 percent of executives in the retail and wholesale industry and 25 percent in construction said their organizations are currently working on adopting the new standard.

The Robert Half and Protiviti survey also uncovered some differences among various cities in the U.S. The cities with the largest percentages of companies that have started the lease accounting transition were Atlanta (81 percent) and Cleveland (72 percent), while the smallest percentages were in Salt Lake City (19 percent) and Boston (22 percent). Finance leaders in Chicago (48 percent) and St. Louis (45 percent) most frequently reported being able to apply what they learned from the revenue recognition transition to lease accounting.

A separate poll by Deloitte of attendees at a lease accounting conference this month found that 61 percent of respondents have not even started automation yet on the leasing standard, while 0 percent said they are fully automated from end-to-end. Approximately half (49 percent) of the respondents reported that cost of implementation is their largest concern.

Balance Sheet Impact

Companies believe their investors and banks already know they have leases, but they might not understand the true impact on the balance sheet now.

“A big part of this is that this requires new math and a new way of performing the calculations,” said Derba. “That’s a hurdle that I believe accounting departments are going to have to deal with.”

One way to address the challenges is to create cross-functional teams. “The first step is to identify the project’s sponsor and then create a change management group and that’s where you identify a representative from each department, like operations, facilities and the IT group,” said McDonald. “Even when you have sites at different locations across the U.S., or even internationally where your contracts and your leases may be decentralized, you need to have folks from those locations to be on this team, and to then train them to understand what they need to know from the lease pronouncement and what’s going to impact the boots on the ground. They then need to create this team and to help identify where the organizational risks are, and then how you’re going to proceed with the implementation. It can’t be just done in a vacuum with accounting. It has to be an organizationally wide implementation.”

Implementing the new standard isn’t a one-time process. “These are processes that must be ongoing as new leases are written in the future after the standard becomes effective as well as how modifications are handled, because the way we look at lease modifications is changing,” said Derba. “There need to be processes in place to support that, and to identify triggering events that will result in actions being taken that by those individuals who are part of the overall process.”

Maintenance of the standard is going to be a much heavier lift than historically has been seen with lease accounting, according to McDonald, but it helps to set priorities.

“The number one priority is to get a complete and accurate inventory of all of the leases and contracts and even service agreements,” she said. “For the companies to consider whether they are a lease or not, this is going to be a big area, especially if companies are audited. The auditors are going to focus on the completeness of their inventory. That’s really going to drive what software you may want to consider to help with this implementation and then maintenance, or what your disclosures are going to look like, and what kind of impact it’s going to have on the balance sheet. That would be the first step out of the gates.”

Once companies have an inventory of their leases, they need to pull out information to produce disclosures, such as the weighted average remaining term of leases or the weighted average discount rate used on the lease liabilities, according to Derba. They also need to identify whether a contract is a lease or not. “The land easements will have to be evaluated to determine whether they are themselves leases, that they meet the definition of a lease, and a part of a contract can lead to the definition of a lease,” he noted. “It doesn’t have to be the entire contract.”

FASB recently issued an accounting standards update for land easements. “It provides a practical expedient that says that if you’ve got a land easement, under Topic 840, it may or may not have been accounted for as a lease,” said Derba. “Topic 840 is the previous GAAP. If that practical expedient is taken, it’s grandfathering in the treatment of those existing land easements. It specifically says that if those easements are modified and you’ve got a new land easement that is granted subsequent to the effective date of the new standard, then those would have to go through the analysis of whether it is a lease or not, if it meets that definition of a lease.”

The new leasing standard will have a bigger impact on lessees than lessors, but lessors will still need to pay attention.

“By and large lessor accounting is not really changing [much],” said Derba. “The thing about lessors is that their leases were already on the balance sheet. Just to use an example, if I’m a lessor and I put equipment on lease to my customers, I have that equipment on my balance sheet already. So lessors shouldn’t see a wholesale change in their financial statement presentation, and their income statement recognition, although there’s always the risk that theoretically there is the new specialized asset lease classification criterion, which is new. That could have an effect if you get a lessor that has operating leases of very specialized equipment. Right now, in theory that could be something that I would suggest a lessor would look at, but I think by and large a lessor shouldn’t see a wholesale change as a result of the new standard. Although with that said, if I were a lessor, I would want to understand what the impacts would be for my lessee clients because for a lot of leasing businesses, part of their service is the structure of a lease. This on balance sheet, off balance sheet consideration is sort of going away, so if virtually all leases are on the balance sheet now, what does that do to lease structuring? I think it will be interesting to see if and how lease structures evolve.”

Data Integrity

Data integrity and quality will be a big concern for both lessors and lessees.

“Data integrity is a really large issue,” said McDonald. “There are several software programs out there that start with lease administration and take you all the way through the accounting disclosures. Historically companies haven’t had that. They may have the data administration piece, but it’s separate software from their accounting system or their ERP. Just ensuring that the data they have that’s on the leases, and the data that they had in their accounting system is still accurate, getting all that information if they are going to a new software platform to assist with this new pronouncement, making sure that all that information is correct and accurate, and how you maintain it is a huge issue. Even while you’re just implementing that, leases could be changing or there could be modifications or leases are dropping off. How do you keep that data fresh and current for your financials? It’s a huge issue, and a lot of these leases are decentralized, in different languages, in different currencies. We’ve had clients where the leases are handwritten. It runs the gamut. It’s like a huge unearthing project to gather this information and make sure your data is correct.”

Keeping the data accurate will be just as necessary in the future. “While you’re implementing you need to be thinking about maintaining this pronouncement going forward,” said McDonald. “That’s going to be key. Just don’t focus on implementation. Think forward to how you’re going to maintain this.”

Despite all the recent accounting standards taking effect, along with the new tax law, accountants will need to stay alert for any new wrinkles. “Try not to get too fatigued,” said Derba. “The new revenue standard was a big change. A lot of work went into it just learning the standard itself. Having read it, or read most of it, that was a large undertaking, and then to go out and apply it. Then you think you’re done, and when you lift your head up to take a breath of fresh air, here comes the leasing standard. From a technical, straight accounting guidance standpoint, I don’t think it’s so different that it’s like this brand new way of thinking of things. I think a lot of the concepts that we’re familiar with from the older standard will translate well. Although there are a lot of new things to learn, now we’re going from something that might have been completely or substantially off balance sheet to the whole thing being on balance sheet for lessees. That just raises risks and other potential issues that could come about from applying the new standard.”