The Financial Accounting Standards Board issued a proposed accounting standards update that would grant private companies, not-for-profit organizations, and certain small public companies extra time to implement the new standards on current expected credit losses (also known as CECL), leases and hedging.

The proposal comes after FASB voted earlier this month to give private companies, nonprofits and smaller reporting companies an additional year to implement the standards (see

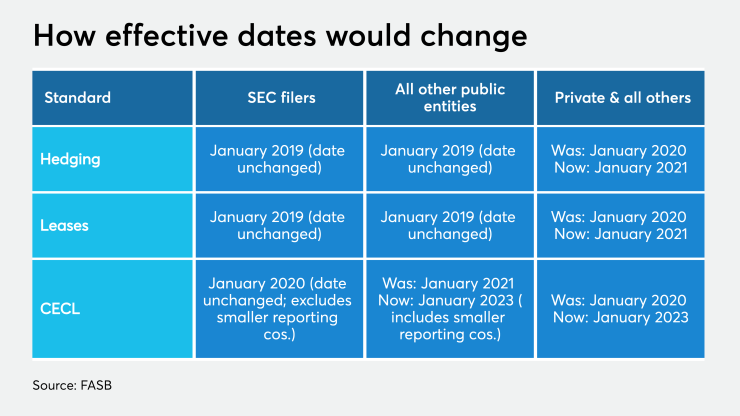

In the proposed update, FASB outlines a new philosophy for the effective dates for major standards between larger public companies and all other entities, including private companies, smaller public companies, not-for-profits, and employee benefit plans. Under this philosophy, a major standard would first take effect for larger public companies, and then, for all other entities, FASB would consider requiring an effective date staggered at least two years later. Generally, it’s expected that early application would continue to be permitted for all entities.

The move comes in response to complaints from many companies and accountants about the dfficulties of implementing the new standards, especially so soon after implementation of the revenue recognition standard.

“Based on what we’ve learned from our stakeholders, including the Private Company Council and the Small Business Advisory Committee, private companies, not-for-profit organizations, and some small public companies would benefit from additional time to apply major standards,” said FASB Chairman Russell Golden in a statement. “This represents an important shift in the FASB’s philosophy around effective dates, one we believe will support better overall implementation of these standards.”

Based on that philosophy, the FASB proposes to amend the effective dates for CECL, leases, and hedging according to the following chart, which assumes a calendar-year end:

FASB also voted this month to propose a deferral for its long-term insurance contracts, and that will be described in an upcoming accounting standards update.

The