A pair of Democratic leaders on the House’s tax-writing Ways and Means Committee have sent a

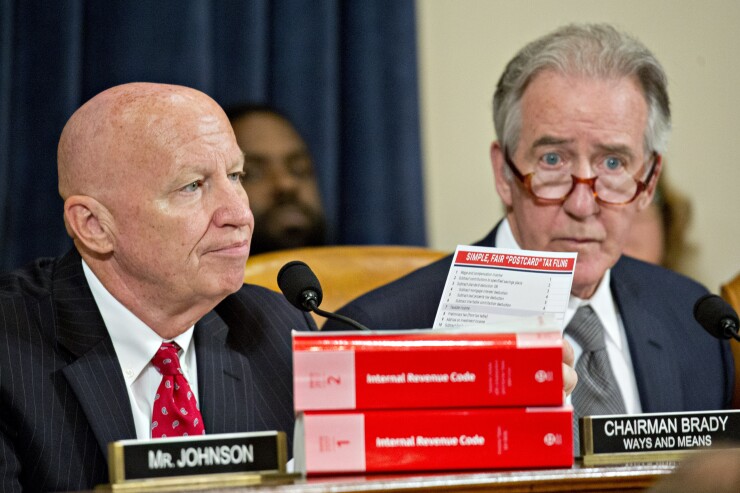

House Ways and Means Committee Chairman Richard Neal, D-Massachusetts, and Oversight Subcommittee Chairman John Lewis, D-Georgia, asked IRS Commissioner Charles Rettig in a letter last week to give them information about whether any third-party analysis had been performed on the usability of the new Form 1040, and its six schedules. The request came on the heels of National Taxpayer Advocate Nina Olson’s

“In her report, the National Taxpayer Advocate noted that the IRS shuffled resources around to meet the challenge of implementing the Republican tax bill enacted last year, the Tax Cuts and Jobs Act,” wrote Neal and Lewis. “Among the changes implemented, the IRS 'was directed to replace all the existing Individual income tax return forms — the 1040, 1040A and 1040EZ — with a single new Form 1040.’”

However, the National Taxpayer Advocate report also points to some of the potential problems with the so-called “postcard” tax form and its half-dozen related schedules: “The new schedules will force some taxpayers to cross-reference and transfer data such as credits, deductions and income, increasing the potential for errors to occur since the tax information is dispersed over many pages and needs to be tracked down and reported on different forms and schedules,” wrote Olson.

“Indeed, recent press reports have commented on the redesigned Form 1040 and missing lines that now appear on schedules,” Neal and Lewis wrote, citing a

In their letter, Neal and Lewis said they are seeking to “better understand the full extent of any due diligence done on the usability of the postcard by taxpayers,” specifically by third parties, such as the Mitre Corp., a nonprofit that operates a number of federally funded research and development centers, which they believe played a role in testing the usability of the new tax forms and schedules. Mitre has worked as a contractor for the IRS in the past, including on a

The congressmen asked for verbatim copies of notes taken by outside observers who watched taxpayers work through the new forms, along with a written description of all findings or results given to the IRS by a third party with respect to the usability of the forms; a description of what was done with the findings or results upon receipt; and an explanation for why any and all third-party results were not shared with the public.