Digital transformation has become a critical business focus for accounting and finance executives, causing many organizations to emphasize hiring of technology employees in accounting and finance.

A new

“Digital transformation is affecting businesses in many areas, including staffing,” said Robert Half senior executive director Paul McDonald in a statement. “With the growing need for skilled talent in North America and the limited pool of candidates, retention is paramount. Leaders need to ensure employees are engaged, challenged and developing the skills they need to advance in the organization as the business evolves.”

Workers who are competent in data analytics are seeing the greatest demand, with 19 percent of finance leaders seeking experience with data analytics. Another 22 percent of the survey respondents are looking to hire employees with experience in enterprise resource planning systems. Nontechnical skills such as communication and collaboration are also sought by employers today, with 20 percent looking to hire candidates with strong communication skills and 12 percent seeking employees with creativity.

Organizations of all sizes are increasing their use of temporary or project professionals, including employees who can help with everyday tasks along with highly specialized consultants who can help with systems architecture and data analytics. In the U.S., 33 percent of the survey respondents report using interim staff, up from 28 percent in 2017, while 41 percent of Canadian respondents said their organizations rely on project professionals, up 9 points from 2017. Companies most commonly report using interim staff for accounts payable, accounts receivable and general accounting. Use of cloud-based solutions is continuing to rise, with 75 percent of U.S. respondents and 73 percent of Canadian respondents currently using or planning to deploy these services in the future. More than half of the U.S. and Canadian organizations surveyed still rely on manual processes for accounts reconciliation, but those percentages are declining.

“Technology continues to impact the day-to-day responsibilities of financial professionals across all levels,” said Financial Executives International and Financial Executives Research Foundation president and CEO Andrej Suskavcevic in a statement. “However, what the report indicates is that there is a continued — and in some cases rising — need for skilled strategic thinkers and communicators to manage functions that computations cannot, as well as to interpret and apply output from tech solutions.”

Most U.S. and Canadian financial executives see the cost of compliance requirements staying steady this year, although approximately one-third of executives in both countries say they are experiencing rising costs.

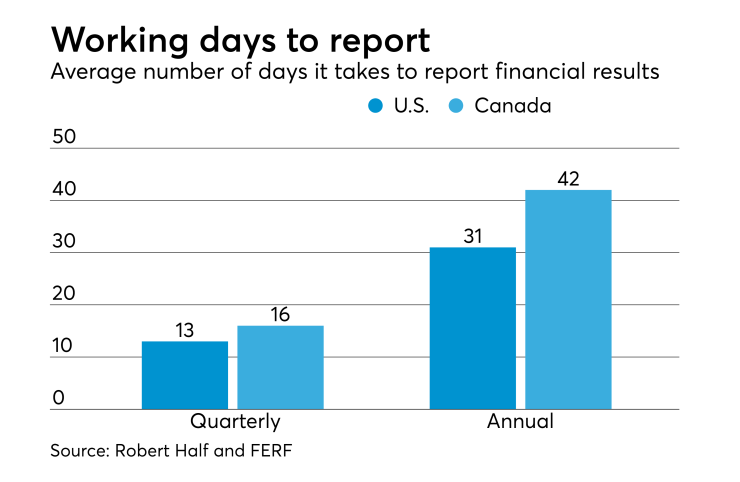

There was no change observed, year over year, in the average number of working days organizations need to close their books on an annual, quarterly or monthly basis. U.S. companies require 23 working days on average for their annual close. Canadian companies report they need 24 working days on average for this process.

U.S. companies say they typically require an average of 31 working days annually to report financial results and Canadian companies say they need an average of 42 working days annually. That finding aligns with last year’s survey results.