More than a third of CFOs’ time is being spent as strategic advisors as they move beyond the traditional financial management role, according to a new survey by Grant Thornton.

GT’s

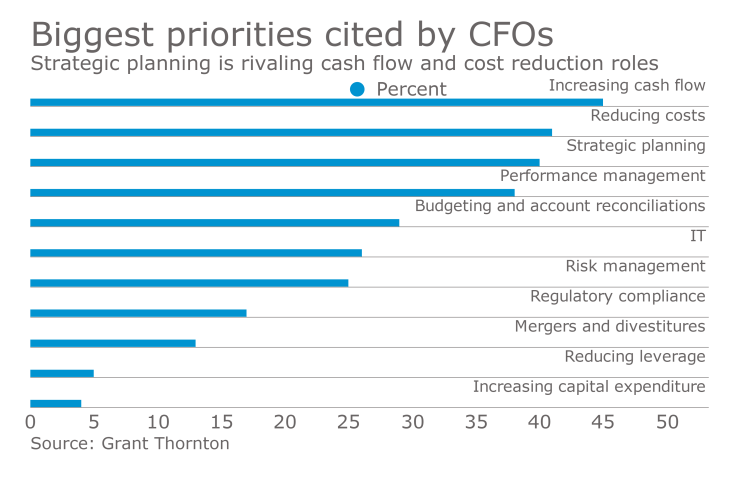

Risk management is also a major priority for CFOs, with two-thirds of the survey respondents indicating they wish to reconcile their risk management strategy with their business strategy.

CFOs would prefer to focus on digital transformation at their companies, but they’re held back by the funds they need to spend to maintain aging technology. The top three barriers for future technology growth, according to the CFOs polled, include managing costs (51 percent), maintenance of legacy systems (41 percent) and seamless business integration (40 percent).

“The simple truth is that CFOs face an uphill battle when it to comes to adopting technologies like cloud computing and advanced analytics,” said Mike Ward, national managing principal of business consulting and technology for Grant Thornton, in a statement. “And they are feeling a sense of urgency: Nearly half of survey respondents—46 percent—believe that their IT platforms lack the ability to operate effectively and require future investment.”

Seventy percent of the CFOs who responded to the survey cited operational improvement as their main area of focus. However, sales and marketing continue to be a hurdle, with only 14 percent of CFOs at larger companies anticipating they will invest in this area, while 48 percent of CFOs at small and midsize companies expect to do the same.

Twenty-two percent of the CFOs polled said their companies are considering mergers and acquisitions in the next 12 months, but the figure increases to 31 percent among middle-market respondents. However, M&A activity represents more responsibility for in-house finance departments. The top two challenges cited for successful M&A transactions were valuation (53 percent) and target identification (52 percent).