For the third consecutive quarter, BF Borgers signed up the most new Securities and Exchange Commission clients in the fourth quarter of 2021, adding 13 and netting a total of eight.

Baker Tilly US came second in terms of new engagements, with seven new and six net; four of those came from its December merger with Boston-based Moody, Famiglietti & Andronico (see “

Among the larger firms, Deloitte brought on the most new clients, with seven, but netted four, while Grant Thornton added six, and netted five (see “

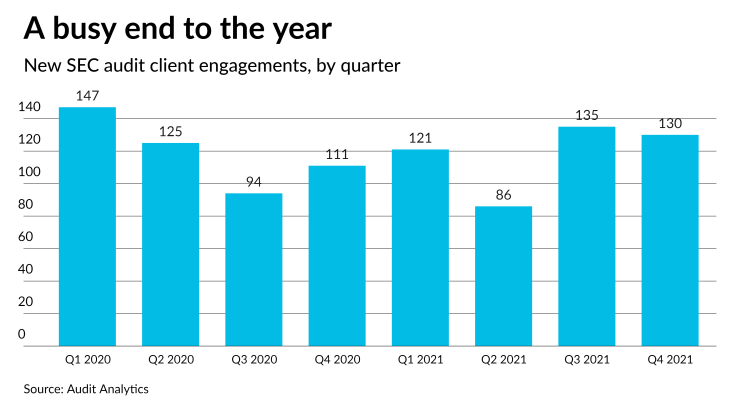

With 130 new engagements in Q4, following Q3’s 135, the year-end results suggest that the market for new audit clients may be stabilizing after more than a year of volatility.

Clients by filing status, and more

With so many more new clients than any other firm, it’s no surprise that Lakewood, Colorado-based BF Borgers led the league tables for smaller reporting companies again, as well as for non-accelerated files and non-accelerated special reporting companies (see “

Finally, Deloitte led the field in terms of new market capitalization audited, new assets audited, and new audit fees, all thanks to one client: Bermuda-based insurance holding company Athene Holding Ltd., which contributed $8.01 billion in market cap, $202.77 billion in assets, and $16 million in audit fees to the Big Four firm’s scores. (See “

BDO USA came in second in terms of new market cap audited, with most of its total made up of the $5.97 billion from “blank check” company Mercury Ecommerce Acquisition Corp. Hong Kong-based Union Power HK CPA took second for new assets audited, with $7.25 billion coming from China-based residential real estate developer Xinyuan Real Estate Co. And Grant Thornton placed second in new audits fees, with $5.07 million coming from a range of new clients.

Data for the quarterly rankings are provided by Audit Analytics, a premium online intelligence service delivering audit, regulatory and disclosure analysis. Reach them at (508) 476-7007,